Bitcoin has been bouncing – but is the bear market really behind us?

Bitcoin has been on the up over the past few months. So, is that it for the bear market, and what does the future hold for the cryptocurrency? Dominic Frisby investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It might not have escaped your notice that bitcoin has had something of a rally over the past few months.

From its low in late December at $3,200, bitcoin has rallied 65% to $5,200.

The altcoins have followed, and the crypto world is happy again.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The questions we ask today: is that it?

Is the bear market over? Is the next bull market underway?

Is it time to buy bitcoin again?

The two components of a big bear market: price and time

Bitcoin's high came on 18 December 2017 at $20,000. The low came on 15 December 2018, almost a year to the day later, at $3,200.

That's an 85% correction.

Markets correct in price and time.

In terms of price, is an 85% correction enough, given what preceded it? I'd say, yes, just about.

Look at some of the great manias over the past 20 years: whether it's dotcom in 2000; uranium in 2006; junior gold mining in 2011; or 3D printing in 2013/14; an 85% correction in the fundamental underlying asset is probably enough.

Of course, gold did not have an 85% correction, but the companies that were mining it did. In fact, their corrections were mostly over 85%. In many cases the correction was 100% and they went to zero.

The same goes for bitcoin. Many of the ICOs (initial coin offerings), smaller-cap coins and so-called sh*tcoins have corrected by much more.

Within bitcoin, 85% corrections are nothing new, by the way. You get one, on average, every two years. In the ten years bitcoin has existed it has had five corrections of 85% two in 2011, one in 2013, one from 2013-2015, and this one in 2018.

So I think it's reasonable to conclude that 85% is enough to purge the system.

However, you also need time. I'm not convinced at all that one year is enough. Here we are, 13 years after uranium mania and it is still in the doldrums. Gold languishes eight years on. It took the Nasdaq some 15 years to get back to its 2000 high.

The comparison with commodities is perhaps not valid, as mines take so long to bring into production. Bitcoin is much more dynamic and fast-moving. It's a new and exciting tech. Most of the people who work in the sector are young. It's bound to move more quickly.

Perhaps, then, the comparison with dotcom is more valid. From peak to trough in the Nasdaq took 31 months from 2000 to 2003. The overall correction, by the way, was 83.5% (from 4,800 to 795) concomitant with bitcoin.

If you bought the Nasdaq in 2003, you might have had to wait 12 years to reclaim the 2000 high, but it was still a great buy of the once-in-a-generation variety.

Is this bitcoin's 2003 moment?

Bitcoin looks good, but I think it has another correction ahead of it

I'm director of a Canadian bitcoin company and we have been buying, partly because of the trend and partly because we are new and need to establish a position.The long-term inevitably starts with the short-term and the short-term action has been good.

But I still can't get away from the feeling that this market needs more time to purge before we can declare the bear market over.

So this is the scenario I am looking at.

Unless the market proves me wrong and bitcoin has a habit of humiating its commentators I rather think this is a relief rally than the start of a new bull market.

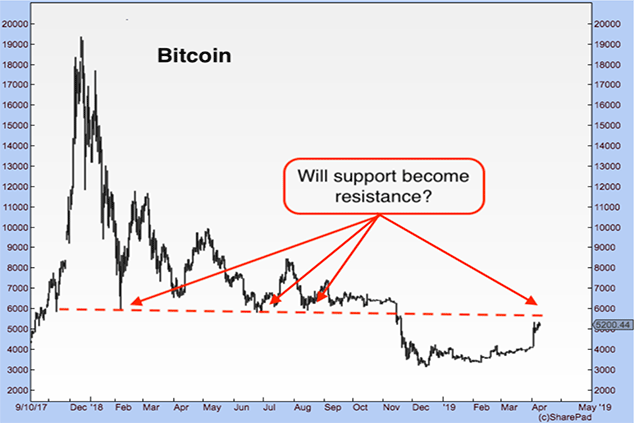

This rally probably take us to the $6,000 area, perhaps by early summer. However in the $5,800-$6,500 zone there is a lot of resistance. That was the old low. Bitcoin held up there for about ten months before it proved to be the "breakdown point".

Bitcoin will try a few times and fail to get through the resistance zone (where I have drawn the dashed red line on the chart below and just above), but it won't get through. Then it comes back down to re-test its lows at $3,200 perhaps in the autumn. Then we will have a nice double-bottom in place, a nice technical base on which to stage our next bull market run.

In that scenario, we will have had enough of a purge in both price and time to lay the foundations for a new bull market.

It's just a theory. I'm long bitcoin. I sell a lot more books when the price is going up than when it's going down. I'm happy for the market to prove me wrong.

But a likely outcome would be a little more rally before a re-test of the lows. Now let's see if I am right. Over to you, Mr Market.

And by the way, if you don't own any bitcoin you really should, even if it's only ten quid's worth. Get with the kids, Grandad! And read our guide on how to do it.

Dominic Frisby is author of the first (and best, obviously) book on Bitcoin from a recognised publisher, Bitcoin: the Future of Money?, available from all good bookshops (and a couple of rubbish ones too). He is also director of Cypherpunk Holdings (CSE: HODL), a company set up to invest in privacy-related technologies. Follow Dominic @dominicfrisby

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both