Zoopla: House prices slows to 1.4% in May as rate of sales at four year high

The average UK property now costs £268,400, Zoopla says, but some areas of the country are experiencing much higher price growth than others.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

House price growth slowed to 1.4% in May, down from 1.6% in April, as the number of properties up for sale increased by 6% in the last 12 months, according to Zoopla’s House Price Index.

The average home in the UK now costs £268,400, representing year-on-year growth of £3,960.

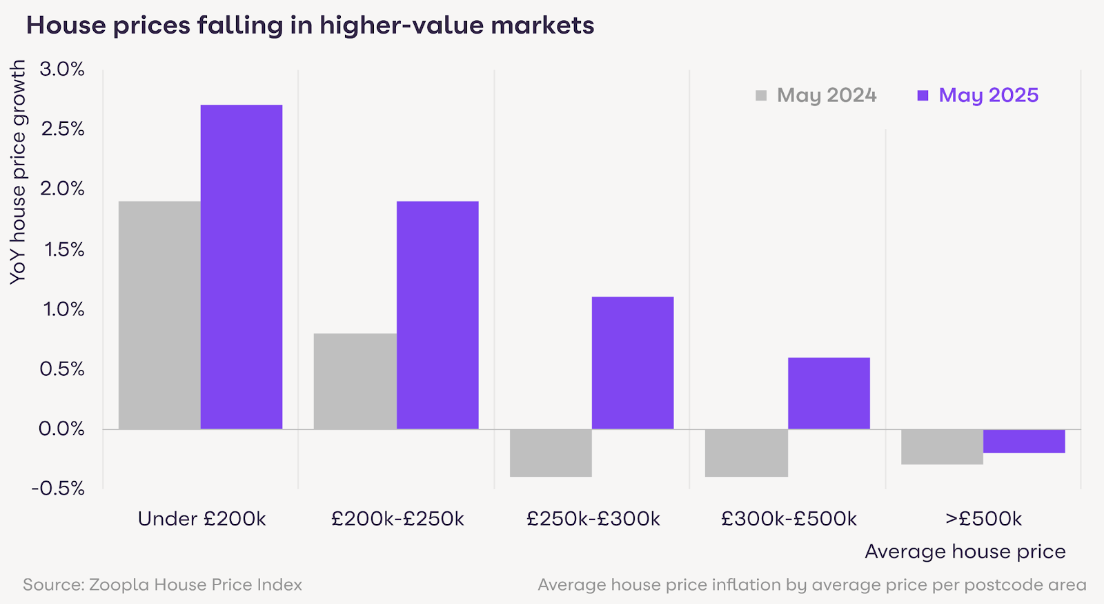

However, growth in house prices has been unequal across different price ranges in the market. The data shows that house price falls have persisted in higher value markets, while more affordable areas have seen faster growth.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Areas where the average value of a property is over £500,000 saw a modest fall in prices in May of -0.2%, whereas areas where average properties cost below £200,000 have seen price growth of 2.7%, well above the national average.

The reason for this will largely be affordability factors, as more people can afford to buy a property of less than £200,000 than one over £500,000 so the laws of supply and demand will increase prices.

Outside of this, though, Zoopla says tax and policy changes aimed at second homeowners and landlords (such as the stamp duty increase in April 2025) are leading to weaker demand and prompting more sales by these owners.

Richard Donnell, executive director at Zoopla, said the number of sales increasing year-on-year “demonstrates a continued desire of more households to move home in 2025”.

However, 22% of all homes on the market have been up for sale for over six months.

While many sellers will have a price in mind that they want to secure when they sell their home, they may have to wait a long time before they achieve it.

Zoopla has urged sellers to seek advice on how to price their home correctly and achieve a timely sale, to avoid being stuck waiting months for a buyer.

Donnell at Zoopla says buyers remain “price-sensitive,” especially in higher-value markets, but notes that “serious sellers need to be realistic on where they set their asking price in order to achieve a sale and secure a home move in 2025”.

Sarah Cartlidge, branch manager at estate agent Fraser Reeves, echoes this, saying “property price remains key to agreeing a sale”.

She suggests prospective sellers “need to price positively and realistically from the get-go, in order to secure a good buyer in good time, and to make the best first impression possible when their property hits the market”.

Where are house prices growing fastest?

House price growth has continued to outpace the nationwide average in parts of Scotland and north west England where property prices have grown by 3.5% per annum.

The local area where house prices are growing the fastest is Wigan, a town just to the north of Manchester, where homes in the area have grown by 4.3% in the last year.

Meanwhile, Failkirk in Scotland’s central lowlands has seen property prices surge by 3.8% in the last year, and Blackburn, also north of Manchester, has seen prices rise by 3.6%.

On the other hand, London and the south of England have experienced much slower growth, with some areas even seeing house prices fall in the past year.

Property prices in west central London have fallen by 4.3% in the past year, while homes in west London have also fallen by 1.3%.

In some areas of the south west, house prices are also falling. The past year has seen properties in Torquay decline in value by 1.7%, while the average price of a home in Truro has fallen by 1.3%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Daniel is a financial journalist at MoneyWeek, writing about personal finance, economics, property, politics, and investing.

He covers savings, political news and enjoys translating economic data into simple English, and explaining what it means for your wallet.

Daniel joined MoneyWeek in January 2025. He previously worked at The Economist in their Audience team and read history at Emmanuel College, Cambridge, specialising in the history of political thought.

In his free time, he likes reading, walking around Hampstead Heath, and cooking overambitious meals.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how