Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"When Roger Williams got his turn at the microphone earlier this month, his question for the bank CEOs lined up before the House committee on financial services seemed an unusual one to put to seven sharp-suited financiers. "Are you a socialist or are you a capitalist ?" the Texas Republican asked each of them, from Citigroup's Mike Corbat to David Solomon of Goldman Sachs."

From "Capitalism keeps CEOs awake at night" by Andrew Edgecliffe-Johnson in The Financial Times, 23 April 2019.

To answer Congressman Williams' question, it depends on whether those banks are making healthy profits (in which case: "capitalists, hell yeah") or requiring bailouts from US taxpayers ("socialists, please because we're all in this together"). Or perhaps the most honest answer, to which Eamonn Butler alludes in our most recent podcast, is "crony capitalists, or corporatists".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

To paraphrase Marx, free market capitalism won the fight against all comers, notably socialism, and yet mysteriously almost everywhere man is in chains. This is largely because free market capitalism throughout the developed world is today more honoured in the breach than in the observance. This holds whether the "free market" in question is in the US, where Jamie Dimon can earn $30 million a year as chairman and CEO of JP Morgan Chase (it helps bankers to earn effortless profits when their organisation's borrowing costs are effectively zero), or in the UK, where the so-called Conservative Party, when it isn't botching Brexit, is engaged in some kind of race to introduce as much intrusive regulation as parliamentarily possible, or in France, where a Jupiterian' President Macron has managed to alienate growing numbers of gilets jaunes with an imprudent mix of tax rises for fuel consumers but tax breaks for the wealthiest see Jeremy Harding's excellent long form piece for the LRB.

The screenwriter William Goldman famously began his autobiography, Adventures in the Screen Trade, with the words "Nobody knows anything". And nobody seems to learn anything from history, governments least of all. This is the central message of Eamonn Butler and Robert Schuettinger's Forty Centuries of Wage and Price Controls: how not to fight inflation. You can download a free PDF copy from the excellent Mises website.

As the title of Forty Centuriesshould make abundantly clear, the first instinct of government is always to try and control prices. It never works. Even when it appears to work, it alwaysleads to second-order effects which require further intervention, which gives rise to further effects, in a death-spiral of illogic and footling bureaucratic interference.

As David Meiselman asks in his introduction to Forty Centuries,

"What, then, have price controls achieved in the recurrent struggle to restrain inflation and overcome shortages ? The historical record is a grimly uniform sequence of repeated failure. Indeed, there is not a single episode where price controls have worked to stop inflation or cure shortages. Instead of curbing inflation, price controls add other complications to the inflation disease, such as black markets and shortages that reflect the waste and misallocation of resources caused by the price controls themselves. Instead of eliminating shortages, price controls cause or worsen shortages. By giving producers and consumers the wrong signals because "low" prices to producers limit supply and "low" prices to consumers stimulate demand, price controls widen the gap between supply and demand.

"Despite the clear lessons of history, many governments and public officials still hold the erroneous belief that price controls can and do control inflation. They thereby pursue monetary and fiscal policies that cause inflation, convinced that the inevitable cannot happen. When the inevitable does happen, public policy fails and hopes are dashed. Blunders mount, and faith in governments and government officials whose policies caused the mess declines. Political and economic freedoms are impaired and general civility suffers."

"General civility suffers" might be the perfect summary of our dysfunctional politics in 2019. Whether in the form of Brexit, President Trump (or Ukraine's newly elected President Volodymyr Zelensky) or the gilets jaunes, traditional political parties are struggling to remain relevant to an increasingly cynical and angry electorate. As LRB reader Jon Harry writes in response to Jeremy Harding's piece, what's remarkable in France is

"the complete failure of both the extreme right (the recently renamed Rassemblement National) and the extreme left (Mlenchon's France Insoumise) in their attempts to infiltrate and recuperate the gilets jaunes. Not unlike much of the support for Brexit, the movement is a massive and simultaneous rejection of all current political offerings."

As for us, we trace this widespread disenchantment amongst electorates back to already socially divisive economic policies that were then supercharged by monetary authorities' emergency' response to the Global Financial Crisis. The financial reckoning has been almost Biblical. Matthew 13:12:

"For whosoever hath, to him shall be given, and he shall have more abundance: but whosoever hath not, from him shall be taken away even that he hath."

QE [quantitative easing] and ZIRP [zero-interest-rate policy] have turned out to be potent wealth generators for the already asset-rich. For those without any assets to speak of, good luck saving your way into prosperity now.

It has taken a decade, but the shock waves from the collapse of Lehman Brothers and all those arbitrary bailouts for crony capitalists bound up within the GFC [great financial crisis] and its central bank-sponsored aftermath have finally reached the shore. Turns out socialism for the rich doesn't play well with electorates who have failed to experience any meaningful upswing in their own standard of living for several decades.

Could things have gone differently? Those in the West, or at least its politicians, have forgotten the lesson of Hong Kong where Sir John James Cowperthwaite was Financial Secretary between 1961 and 1971. Wikipedia takes up the story:

"He arrived in Hong Kong in 1945 and was assigned to the Department of Supplies, Trade and Industry. He was asked to find ways in which the government could boost post-war economic outlook but found the economy was recovering swiftly without any government intervention. He took the lesson to heart and positive non-interventionism became the focus of his economic policy as Financial Secretary. Cowperthwaite built on the economic policies of his predecessors, Arthur Clark and Geoffrey Follows, promoting free trade, low taxation, budget surpluses, limited state intervention in the economy, a distrust of industrial planning, and sound money. It was a policy mix that drew more on Adam Smith and Gladstone than on Keynes and Attlee. However, Cowperthwaite was a pragmatic civil servant rather than a theoretician and he based his policies on his experience, empirical data and what he believed would work in practice.

"He refused to compile GDP statistics arguing that such data was not useful to managing an economy and would lead to officials meddling in the economy. He was once asked what the key thing that poor countries could do to improve their growth. He replied: "they should abolish the office of national statistics." According to Catherine R. Schenk, Cowperthwaite's policies helped it to develop from one of the poorest places on earth to one of the wealthiest and most prosperous: "Low taxes, lax employment laws, absence of government debt, and free trade are all pillars of the Hong Kong experience of economic development." The Economic Freedom of the World 2015 Report ranks Hong Kong as both the freest economy in the world, a distinction it has held since this index began ranking countries in 1975, and among the most prosperous."

The allure of Asia as an investment destination has not dimmed during the past half century. Indeed, the slow relative decline of the West over the same period coincident, for example, with Britain's membership of the EU makes Asia an even more compelling platform for wealth generation today.

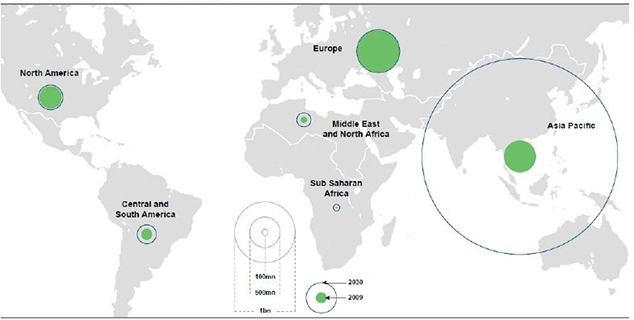

The map below a recurrent favourite of ours shows in solid green the size of middle class populations by geographic region. Around each circle there is a wider blue circumference, which represents the forecast size of that region's middle class population by 2030, as forecast by the OECD.

Growth of middle class populations by 2030

Source: OECD forecasts.

To summarise: the size of the US middle class doesn't grow much, because the US is already a mature economy. Neither does that of Europe (though in the case of Europe, one is also advised to be sceptical as to likely economic growth the region now feels like it is tipping back into recession). South America and Africa's middle classes grow a reasonable amount. Then look at Asia, where the size of the middle class is forecast to grow from 500 million to three billion people by 2030. If this comes to pass it will be the greatest creation of wealth in human history.

And yet much of Asia remains, to a stock investor, inexpensive. Our core Asian fund investment, Samarang Asian Prosperity Fund, sports the following metrics:

Average price/earnings ratio: nine times Price/book ratio: 0.9 times Historic return on equity: 16% Average dividend yield: 4.4%.

Since inception in November 2012, Samarang Asian Prosperity Fund has generated (in US dollars) a return of 102.7%. That is more than double the return of MSCI Asia ex-Japan over the same period (46.7%).

Westerners may have forgotten the lessons of Hong Kong. Their counterparts in Asia, and especially Japan and Vietnam, don't appear to have done.

www.pricevaluepartners.com @timfprice

Tim Price is co-manager of the VT Price Value Portfolio and author of Investing through the Looking Glass: a rational guide to irrational financial markets'. You can access a full archive of these weekly investment commentaries here. You can access the archive of our regular State of the Markets' podcasts, with Paul Rodriguez of ThinkTrading.com, here.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

Beat the cost of living crisis – go on holiday

Beat the cost of living crisis – go on holidayEditor's letter As inflation rages, energy bills soar and the pound tanks, what’s a good way to save money this winter? Go on holiday, says Merryn Somerset Webb.

-

An era of high inflation has arrived

An era of high inflation has arrivedNews In recent weeks investors had started to bet on signs that inflation may be peaking – but we’re in a new economic age. Expect high inflation to be here for some time to come.

-

China’s property woes are spreading beyond Evergrande

China’s property woes are spreading beyond EvergrandeNews Instability sparked by the troubles of Evergrande, China’s heavily-indebted property giant, is spreading to the wider property market, and it could affect the country’s growth for years to come.

-

“Zombie companies” may do little harm to the US economy

News Fears that the US is being overrun by corporate zombies may be exaggerated.

-

China’s economy to shrink for the first time since 1976

China’s economy to shrink for the first time since 1976News China may now be on course for its first quarterly contraction since 1976, with Goldman Sachs predicting a 9% plunge in first-quarter economic activity.

-

Boom times for gold miners

Editor's letter One despised asset class that MoneyWeek has long been bullish on has done rather well. John Stepek explains why he's sticking with gold miners.