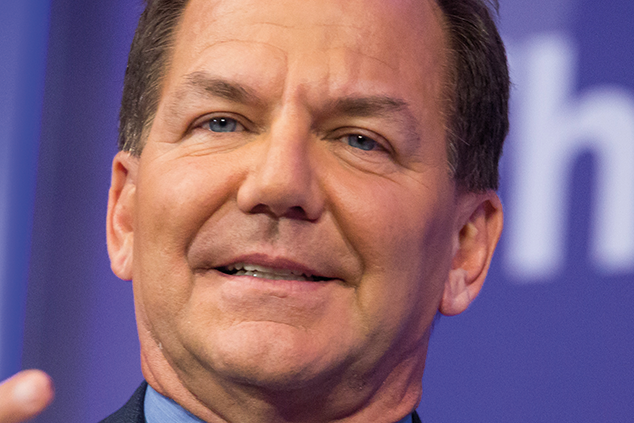

Paul Tudor Jones: stockmarket could go "crazy"

Hedge fund manager Paul Tudor Jones, who predicted the October 1987 crash, believes the stockmarket will rally later this year, even in the face of tightening monetary policy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Hedge fund manager Paul Tudor Jones, who predicted the October 1987 crash, believes the stockmarket will rally later this year, even in the face of tightening monetary policy. "I think we'll see rates move significantly higher beginning some time late third quarter, early fourth quarter," Jones told CNBC, but "the stockmarket also has the ability to go a lot higher at the end of the year... I can see things getting crazy, particularly at year-end after the mid-term elections... to the upside." The move higher, however, will not be sustainable eventually, rising inflation and interest rates will lead to a recession.

Moreover, the state of America's balance sheet means that President Donald Trump's stimulative fiscal policy isn't sustainable either, Jones said during a conversation with Goldman Sachs CEO Lloyd Blankfein, notes Yahoo Finance. "We're going to have to mean revert to a normal real rate of interest with a normal term premium that's existed for 250 years... That probably means the price of assets goes down in the very long run." The danger is that, come the next recession, there will be little left in the pot to enable the government or central banks to offset the downturn. "We'll have monetary policy, which will exhaust really quickly, but we don't have any fiscal stabilisers."

That's all further down the line. For now, though, Jones doesn't have significant exposure to the financial markets, mainly because he sees a quiet period ahead. "We're getting ready to go into a summer lull... I like to have significant leveraged positions when I think there is an imminent price move directly ahead."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Robert Rubin: The 'Teflon Don' of Wall Street

Profiles Robert Rubin was widely feted for America's impressive economic expansion during the Clinton years. But did the former US Treasury Secretary sow the seeds of the financial crisis?

-

Lex Van Dam: From reality TV to investment training

Features Lex Van Dam, a former Goldman Sachs trader turned hedge-fund manager turned reality TV impresario, has just launched his online trading academy.