Diploma qualifies for your portfolio

This British mid-cap is a successful global player with plenty of room for expansion, says Dr Mike Tubbs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

This British mid-cap is a successful global player with plenty of room for expansion.

Few investors have heard of Diploma. Yet it is well worth a look. This global provider of specialised technical products and services is a member of the FTSE 250 index. It boasts sales of nearly £500m following a 60% increase in sales between 2014 and 2018, and a market capitalisation of £1.7bn.It has three divisions producing essential components for industrial companies worldwide.

A finger in three tasty pies

The Seals business comprises 43% of revenue and supplies a wide range of seals, gaskets, filters, cylinders, components and kits used in heavy mobile machinery and specialised industrial equipment. North America contributes 60% of seals' revenue. Finally, the controls division accounts for 29% of revenue and supplies specialised wiring, cable, connectors and fasteners to a range of technically demanding products, such as the KC-46 air-to-air refuelling aircraft, and the Ajax fighting vehicle.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Diploma's business model has several key features. One is to encourage an entrepreneurial culture through a decentralised management structure. Another is to acquire related companies that fit within the existing three divisions a well-proven acquire/build/grow strategy.Diploma typically spends £20m-£40m on acquisitions each year. For example, there were 11 acquisitions in 2015 to 2018 with two in life sciences, five in seals and four in controls, totalling £111m. This strategy has delivered great returns for shareholders, with total shareholder returns of 33.5% per year over the last ten years and dividend growth of 13% per year over that period.

Diploma also makes a point of attempting to gain market-leading positions in niche markets wherever possible, while its businesses work with closely with customers by blending high-quality service, technical support and value-adding activities useful little extras that strengthen the brand. An example of Diploma's service is its US aftermarket own-branded seals business for heavy machinery such as bulldozers, excavators, tractors and forklifts, where seal failure can be costly for the customer. Diploma offers US delivery from its Florida warehouse by 10.30am for orders received by 8pm the previous day.

An illustration of a value-added niche in the controls business is the company's strong relationships with key vending-machine operators through its supply of a range of spare parts for Wurlitzer vending machines. Another is the supply of aerospace-quality fasteners for niche markets such as motor sport and supercars.

Ample scope for growth

A fast and profitable grower

The company's operating margin (operating profit as a percentage of revenue, another key measure of profitability) is large and steady. It increased from 17.2% in 2016 to 17.5%in 2018.Diploma's results for the year to the end of September 2018 show sales rising by 7% to £485.1m, profit before tax gaining 9% to £84.8m, free cash flow of £60.5m (up 9%), earnings-per-share (EPS) of 47.5p (up 13%) and a dividend per share of 25.5p (up 11%). The dividend has increased every year since 2008.

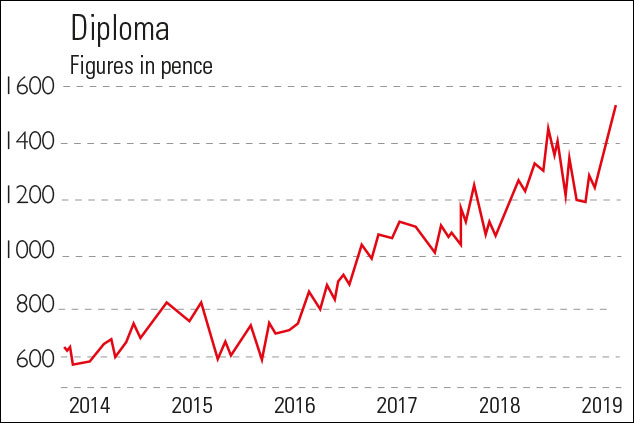

Looking ahead to the 2019 results, the consensus view is for sales to increase by 7.7%, EPS by 11% and the dividend by 14%. The share price is currently around 1,550p, giving a forward p/e for 2020 of 23.6. The trading update on 27 March was in line with expectations. The share-price chart above shows a steady rise from 608p in November 2015 to over 1,550p recently, with 400p added since late December 2018. Diploma is a long-term buy, but it may be worth waiting for a lower price in the next few months.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.