The charts that matter – the yield curve is dangerously close to inverting

The Federal Reserve's renewed dovishness has had a dramatic effect on the yield curve. John Stepek explains what that means, and looks at the rest of the charts that matter most to the global economy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Happy Saturday to all our readers my apologies again for the lack of MoneyWeek podcast again this week we will aim to get back to normal service next week, hopefully with a podcast interview with one of our favourite analysts.

Meanwhile, this week, our sister magazine The Week very kindly invited me to appear on their podcast, The Week Unwrapped. It's a lot slicker than what listeners to the MoneyWeek podcast are used to but don't let that put you off. We talk about employment, adulthood, and the threat of a digital dark age. Check it out here.

A quick reminder that my book on contrarian investing, The Sceptical Investor, is still available at a knock-down price for Money Morning and MoneyWeek readers get a whopping 25% discount when you pick up your copy here. (And if you've already read it, and you enjoyed it, please do leave a review on the Amazon page if you have five minutes).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you missed any of this week's Money Mornings, here's your chance to catch up.

Monday: The most important event for markets this week

Tuesday: The latest Brexit twist means a long delay seems ever more likely

Wednesday: Uranium looks a good long-term bet here's how to play it

Thursday: The Federal Reserve is doing what markets want so why aren't they going up?

Friday: The most important number to look at before you buy any fund

And subscribe to MoneyWeek, if you haven't already (you get your first six issues free, so you really do have nothing to lose).

As per usual, the big market news this week was not Brexit or any other political goings on, it was the Federal Reserve's latest decision on interest rates. This was as you'd expect very dovish indeed. The Fed is almost certainly not going to raise rates this year, and it's also going to end quantitative tightening more quickly than expected. Markets are still not quite sure what to make of it as the charts reveal.

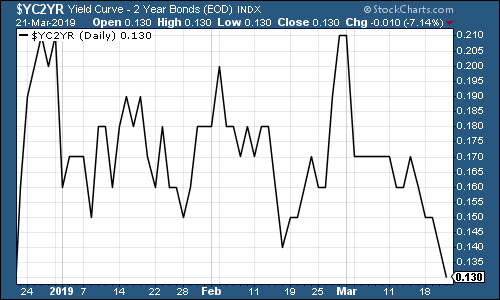

The yield curve (here's a reminder of what it is) took a dive this week, which won't be welcomed by the Fed, although it's certainly happened as a result of the central bank's caution.

The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

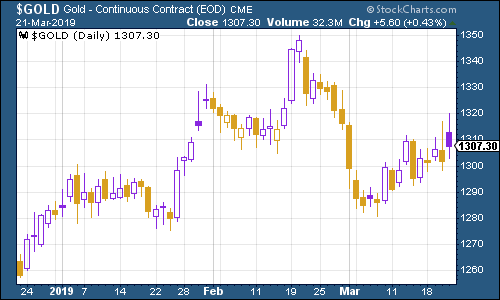

Gold (measured in dollar terms) rallied this week, partly as a result of the Fed but also as the US dollar weakened more broadly.

(Gold: three months)

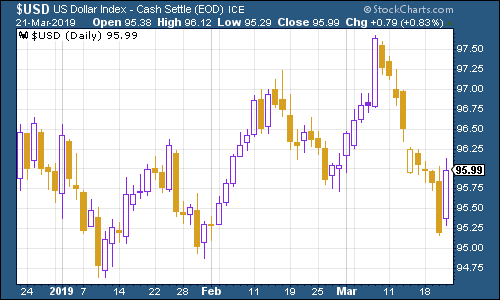

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners continued to slip, helped by the Fed's dovish turn.

(DXY: three months)

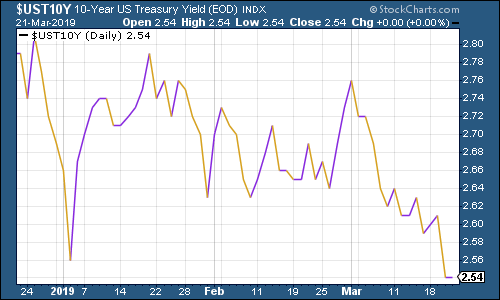

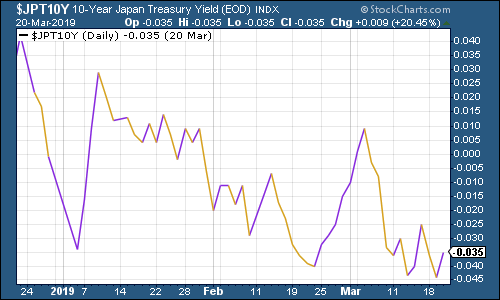

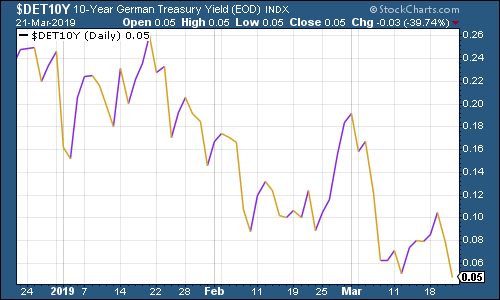

Looking at ten-year yields on the world's major developed market bonds the US slid sharply as the market started to price in lower interest rates. Japan was flattish (although it was already heavily negative), and the yield on German bunds fell towards the 0% mark.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

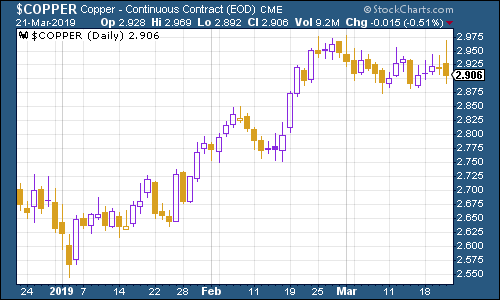

Copper continued to trade sideways. If recession fears spread, it's hard to see how copper can hang on to its winning trend.

(Copper: three months)

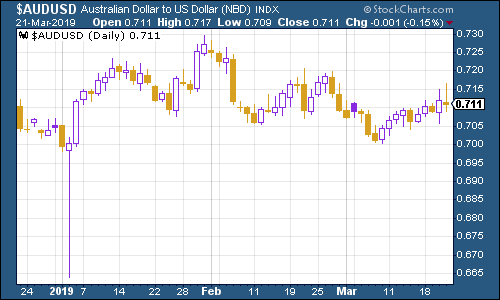

The Aussie dollar our favourite indicator of the state of the Chinese economy bounced back somewhat. Australia's economy is in trouble but the US dollar fell back this week, giving the Aussie a boost.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin appears to be drawing more attention once again, bouncing above the $4,000 mark at one point.

(Bitcoin: ten days)

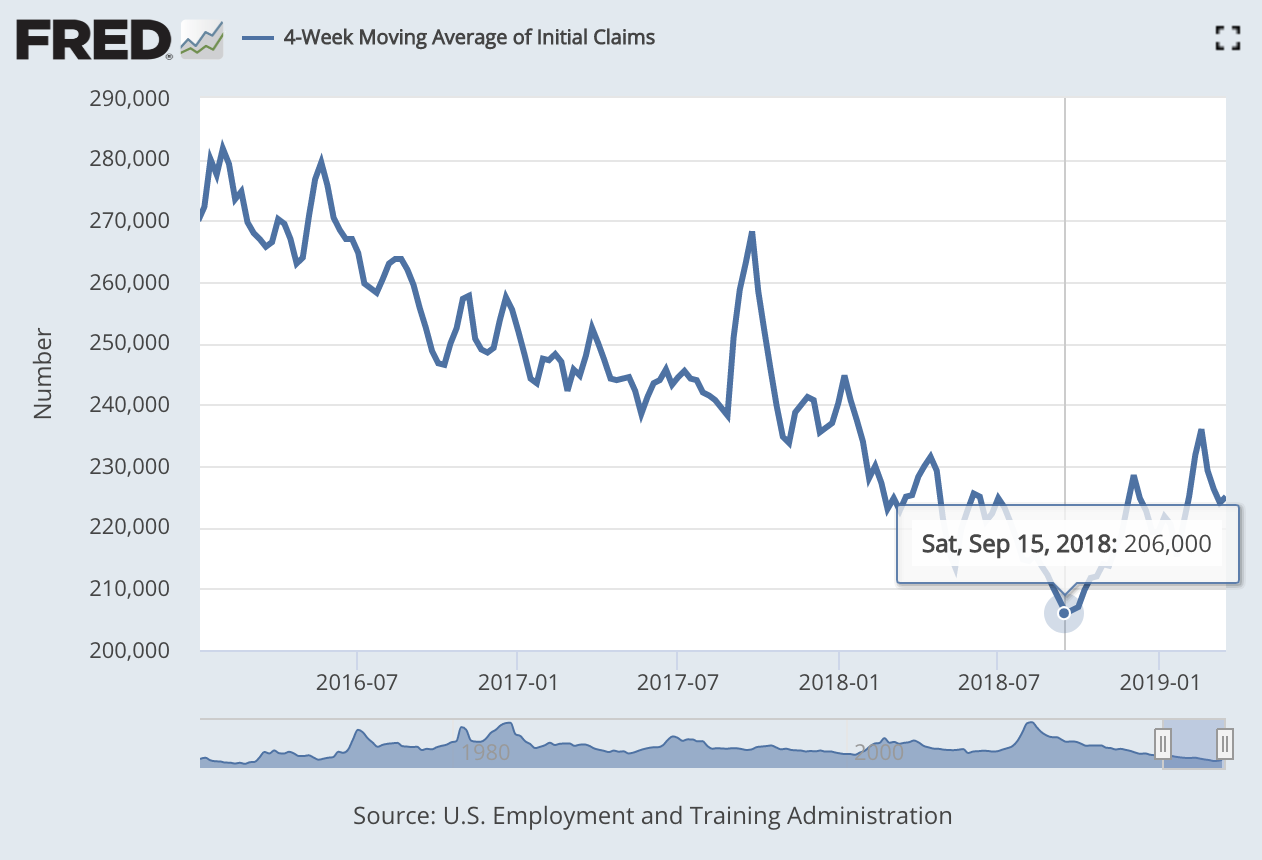

The four-week moving average of weekly US jobless claims rose this week, to 225,000, although weekly claims fell by more than expected to 221,000.

Based on looking at historical recessions, David Rosenberg of Gluskin Sheff has observed that US stocks typically don't peak until after the four-week moving average has hit a low for the cycle. On average, a recession follows about a year later.

The most recent trough came on 15 September, at 206,000 (as shown on the chart below). If that was the bottom, the market may have already peaked (the S&P 500 hit around 2,950 for the S&P 500 in October), and a recession may follow this year or in 2020. Judging by this indicator at least, that seems increasingly likely but do bear in mind that a surge in hiring over the next few months could yet see another trough come along.

(US jobless claims, four-week moving average: since January 2016)

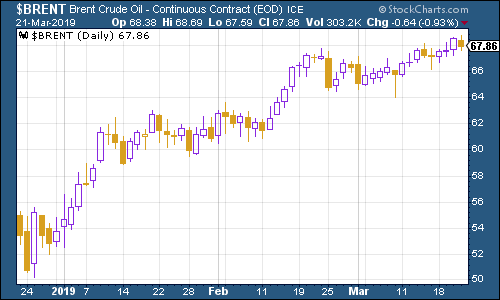

The oil price (as measured by Brent crude, the international/European benchmark) keeps pushing higher. So far Opec production cuts and a slide in US oil inventories are keeping sentiment bullish. Will that continue if fears over a recession continue to rise? I doubt it but then maybe the oil price is also telling us that recession fears are overplayed.

(Brent crude oil: three months)

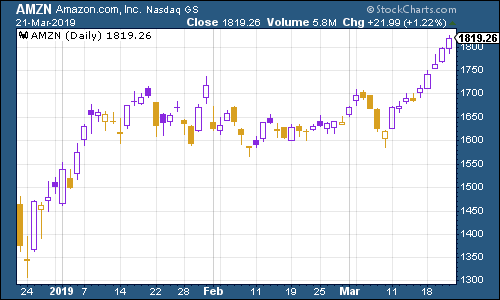

Internet giant Amazon this week climbed back above the $1,800 mark. To my mind, this suggests that you shouldn't write off the idea of the S&P 500 climbing back above its October peak. Amazon was a former leader, it's the stock that's safe to own (you won't get fired for owning Amazon) while it's going up or retesting old highs, it shows that there's demand for stocks out there.

(Amazon: three months)

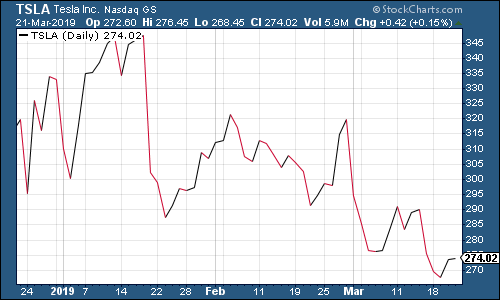

Electric-car group Tesla remains in the doldrums.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King