The charts that matter: is the tide starting to turn?

The yield curve has perked up ever so slightly. John Stepek looks at what this and the global economy’s other most important charts mean for the markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We'll have a new podcast (maybe even more than one) for you next week, but in the meantime if you missed last week's, you should listen to it now Merryn talks to Bernard Connolly, economist and author of The Rotten Heart of Europe, the 1995 book that got him fired from his job at the European Commission. It might not do your blood pressure any good (regardless of the side of the Brexit divide on which you fall), but you will find it fascinating.

As always, if you have any questions that you'd like Merryn and I to address, please do send them in to editor@moneyweek.com. Put "Questions for the podcast" in the subject line and we'll see what we can do.

If you missed any of this week's Money Mornings, catch up now.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: What the trade war truce means for your money

Tuesday: Watch the copper price if it keeps rising, this bull market could have legs

Wednesday: It looks as though Brexit has been kicked into the long grass

Thursday: Why this obscure central bank debate matters for your money

Friday: A long stagnation could kill off Britain's obsession with house prices

And subscribe to MoneyWeek magazine it's even better than Money Morning.

This week I've written a cover story on the slow demise of the US dollar. Could the dollar lose its place as reserve currency? What would have to happen first? What could replace it? And what would it mean for your portfolio? For the answers, you'll have to subscribe but you get your first six issues free, so what are you waiting for?

And now, over to the charts.

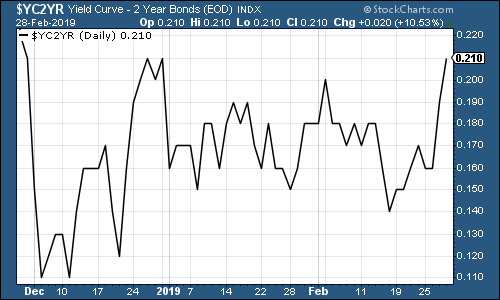

The yield curve (here's a reminder of what it is) perked up ever so slightly this week, which is probably because of two things - firstly, hopes for a deal between the US and China picked up a little, but secondly and probably more importantly, US GDP data came in better than expected.

The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

The further this line moves away from zero, the less nervous investors are feeling and the more keen they'll be to take on more risk (ie drive asset prices higher). This is only one week, but the Fed will be keen to see this keep moving in this direction.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

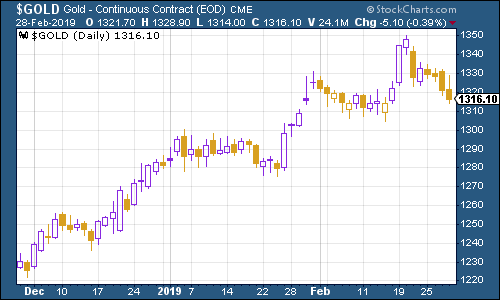

Gold (measured in dollar terms) had a tougher week this week. That's partly because investors have been getting excited about it again, which with gold, tends to be a warning sign. But it's also a sign that investor risk appetite is returning. When that happens, they don't want to be in something boring and "safe" like gold - they want to invest in exciting things like stocks.

(Gold: three months)

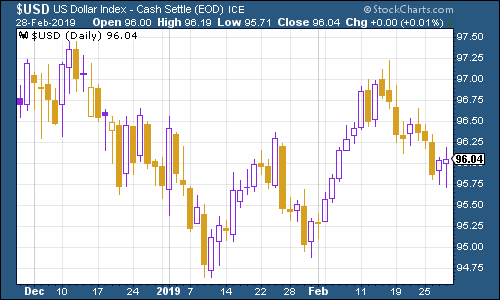

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners slipped a fraction this week before rebounding on the GDP data.

(DXY: three months)

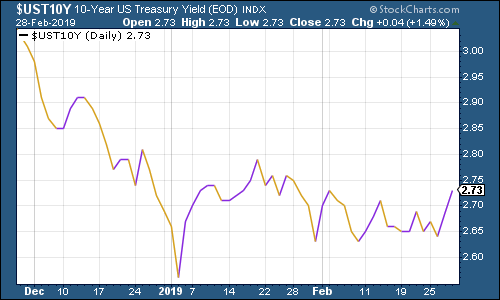

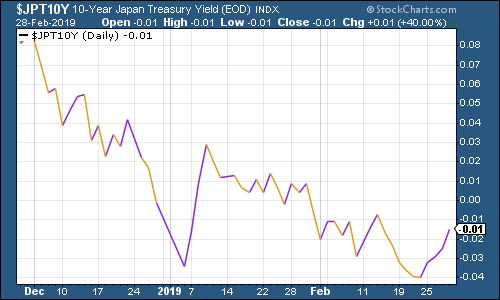

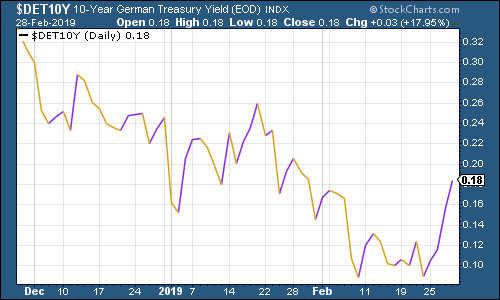

The ten-year yields on the world's major developed market bonds were all slightly higher, as readings below from the US, Japan and Germany show (Japanese yields are almost in positive territory again!).

It'll be very interesting to see if and when US yields can get back above 3% this year. I suspect the headline story on recession fears would start to change then.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

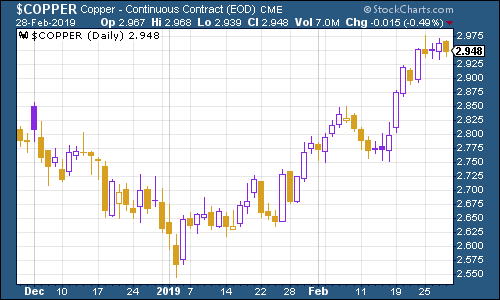

Copper maintained its recent winning streak. Again, when you look at the action of emerging markets, Chinese stocks, and the copper price, you have to question whether investors are really right to fear a slowdown.

(Copper: three months)

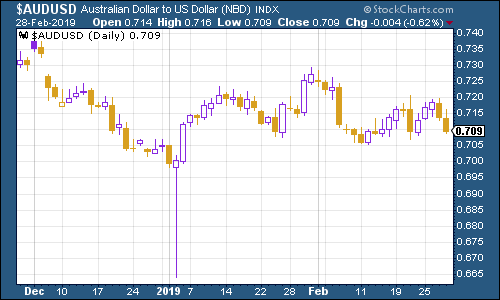

The Aussie dollar our favourite indicator of the state of the Chinese economy rallied, but then fell back to where it ended last week, as Aussie construction activity missed hopes, while the dollar was given a boost by the aforementioned GDP data.

Cryptocurrency bitcoin couldn't maintain its recent surge, and has slipped back into a range.

(Bitcoin: ten days)

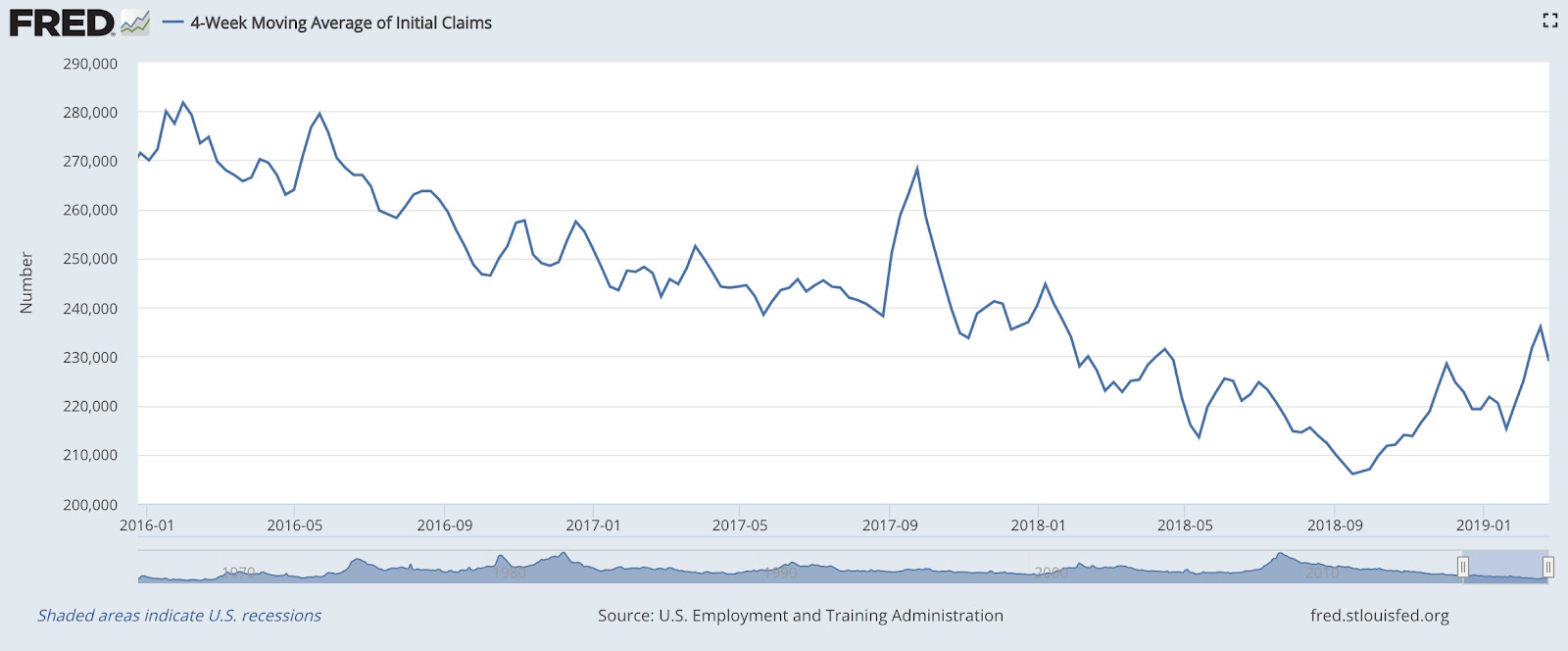

The four-week moving average of weekly US jobless claims fell back this week, to 229,000, although weekly claims rose to 225,000, higher than expected.

Based on a limited sample of data (recessions are relatively rare), David Rosenberg of Gluskin Sheff has pointed out that US stocks typically don't peak until after the moving average of jobless claims has hit a low for the cycle. On average, a recession follows about a year later.

The most recent trough came on 15 September, at 206,000. If that was the bottom, it implies that the market has already peaked (in early October, at around 2,950 for the S&P 500), and that a recession may follow this year or in 2020.

It's looking more and more likely. But let's not judge too quickly.

(US jobless claims, four-week moving average: since January 2016)

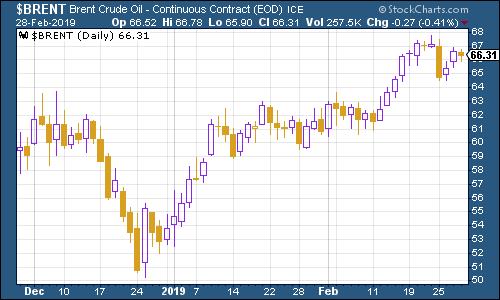

The oil price (as measured by Brent crude, the international/European benchmark) slipped earlier this week as Donald Trump took it upon himself to warn Opec and markets in general that the price was climbing too high. However, while the president might be able to throw the occasional spanner into the works, his influence is limited. By the end of the week, the price was climbing back towards its most recent high.

(Brent crude oil: three months)

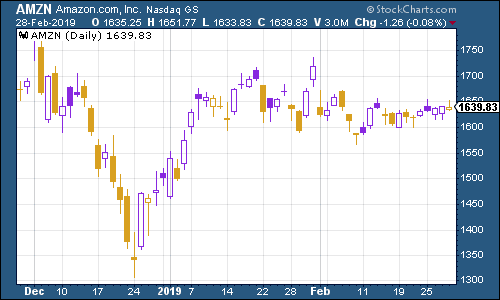

Internet giant Amazon edged higher this week - it's still not back in full-blown bullish mode yet though.

(Amazon: three months)

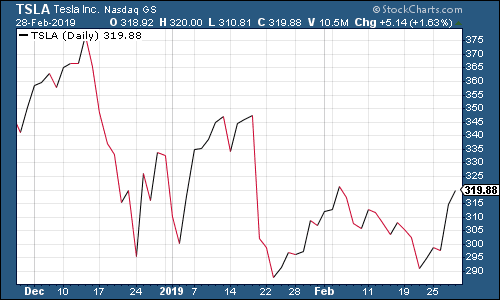

Electric car group Tesla rallied sharply this week, partly because Elon Musk (who seems to revel in annoying the US regulator, the SEC) tweeted that the company would have a big announcement to make on Thursday.

It then declared that it would finally be selling its Model 3 car in the US for $35,000, a long-time target which is seen as the key to making the car truly mass-market. It's also moved to selling the cars online only, shutting its showrooms, while offering an effective week-long test drive period, after which you can return the car for a refund.

It's a pretty compelling sales technique although the fact that Tesla will now not make a profit in the first quarter also suggest it may be an expensive one.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.