Watch the copper price – if it keeps rising, this bull market could have legs

The price of copper, one of the most important metals in the world, is climbing. Dominic Frisby looks at what’s behind the rise, and picks the best ways to invest.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This week I want to take a look at copper.

It's a subject I haven't looked at in a long, long time far too long, in fact, given its importance to the world economy.

The monetary purists might tell you gold is the most important metal, but far greater investment minds than my own will shake their heads quietly and say: "No. Copper is."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Both China and copper are breaking higher here's why that matters

Here's why I was drawn to copper this week. First, one of the newsletters I follow issued a "buy" recommendation on Chinese equities. Almost in tandem, another issued a "buy" on copper. Copper and China will often trade in lockstep, so it is no great coincidence that the recommendations should have come so close to one another. Both are staging break-outs.

Copper is the third most-used industrial metal in the world, after iron and aluminium. Its main use is in wiring, which accounts for about 60% of demand. Piping and roofing make up another 20%, and machinery about 10%. (The final 10% we can file under "other"). Broken down by sector, copper demand is 65% electrical, 25% industrial and 10% transportation.

Because it has so many uses all over the economy homebuilding, construction, manufacturing, power generation, electronics and transportation it has proven an effective barometer of economic health. Hence the nickname you have no doubt heard many times before, Dr Copper the metal with a PhD in economics.

That it is currently breaking out, is both significant and bullish.

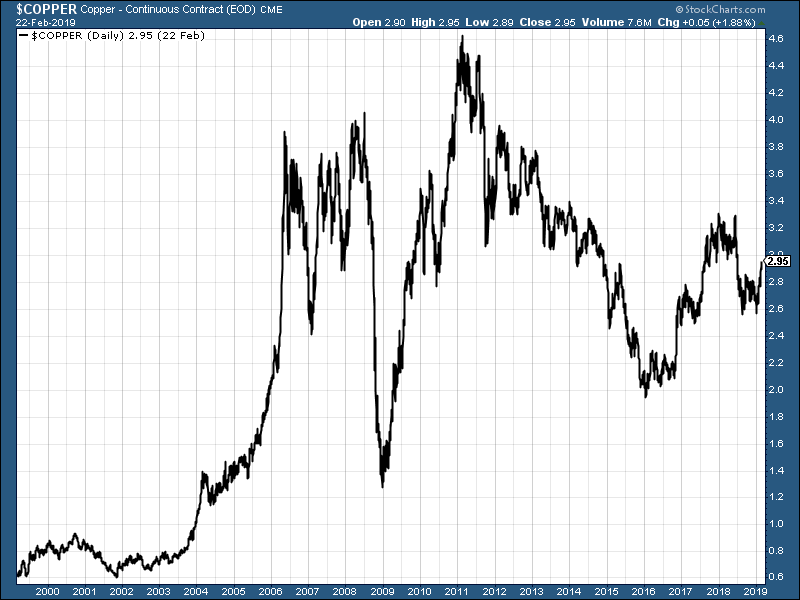

The current copper price is about $2.90/lb. Below we see the price action over the last 20 years, by way of perspective.

You can see: the lows around the turn of the century at 60c/lb; the huge run up through the noughties into 2008, when it hit $4/lb; the crash of 2008 followed by the rebound and eventual all-time high in 2011 at $4.60/lb; and the subsequent bear market which took copper back to $2 by early 2016.

Copper then had a decent enough couple of years until things got ugly again in the second half of last year.

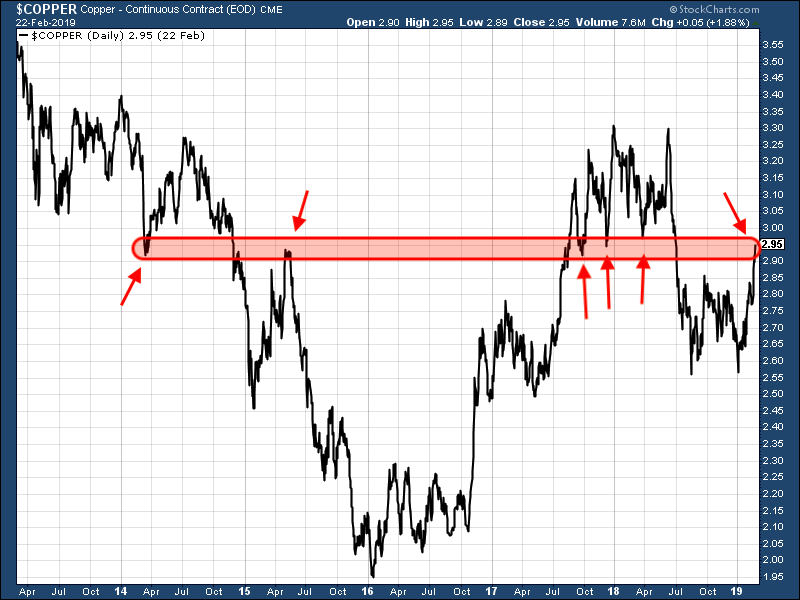

Zooming in on the last five years, you can see by the red band and the arrows I have drawn in the next chart, that the area just below $3/lb has been something of a pivotal price point.

We are right in the red zone at the moment. If copper goes through, things start to look bullish not just for copper but, as stated above, for the economy generally, especially emerging markets. If it bounces back down, however, things look rather more stagnant.

You never know, of course. But to me it looks like copper had made a bottom at $2.55 and wants to go higher. The current trend is up.

How to invest in copper

The copper market has several main drivers. Perhaps first and foremost is the US dollar itself. A weak dollar and a more inflationary environment suits copper best.

Next there is the oil price. The supposition is that, as copper extraction is an energy-intensive process, a low oil price is good for copper. But in fact, in general, the tendency is for both commodities to rise and fall together. High demand and rising prices are symptomatic of economic expansion. Low demand (and falling prices) implies contraction.

Third we have China. China is the world's largest consumer of copper (as it is for most metals) and so Chinese demand is one of the metal's main price drivers.

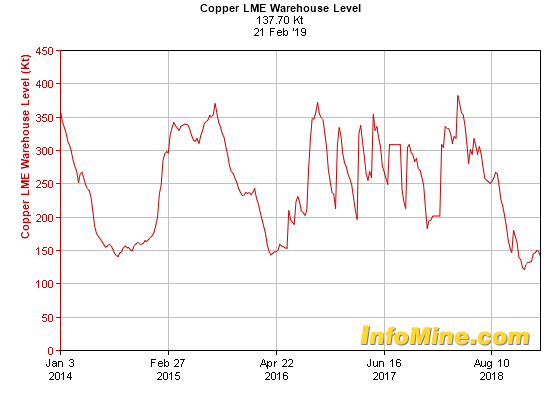

When stocks on the London Metal Exchange (LME) are low, as they are now, the set-up is bullish. It suggests demand is greater than supply. LME stocks are near five-year lows.

Then there is the longer-term price driver that is projected future demand versus projected future production. Production is generally forecast to be constant over the next five years. The outlier, however, is discoveries.

Exploration budgets soared in the years to 2012, but the number of discoveries made did not. Today exploration budgets are about a third of what they were in 2012, and the number of new discoveries remains historically low.

Given the lack of success finding new deposits, companies are instead focusing on expanding existing projects. We are not at the stage where we need worry about this just yet. But in a decade, perhaps, the scene will be set for another major shortage of copper and a subsequent boom in price such as that which began in 2001.

Of the new discoveries that are made, over half are in South America. Chile remains the world's largest copper producer. It produced 5.3 million tons last year, more than twice as much as the second-largest producer, Peru (2.4 million tons). Then it is China (1.9 million tons), the US (1.3 million tons) and Australia (920,000 tons).

There are myriad ways to speculate in copper. You can buy the copper ETF (LSE:COPA). You can spreadbet it (high risk; as ever, not recommended). The NYSE has a copper miners ETF (NYSE:COPX), but London has so many large producers listed, there seems to be very little need for this.

There's BHP Billiton (LSE:BLT), Glencore (LSE:GLEN), Anglo American (LSE:AAL), Rio Tinto (LSE:RIO), and Antofagasta (LSE:ANTO). US-listed Freeport-McMoran (NYSE:FCX), as the world's second-largest producer (after Chilean state-owned Codelco), also deserves a mention.

My own largest copper position, since you ask, is in a exploration-development play by the name of Regulus Resources, which trades on the Canadian Venture Exchange (the ticker is REG.V). It has a market cap of around C$150m.

Its main focus is developing its share of the AntaKori project in northern Peru, where the drill results have been extraordinary. It looks as though they are onto something unusually big. Given the above-mentioned lack of discoveries, it could be worth a few bob a few years down the line (I hope).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how