The charts that matter: the tug of war continues

As the US Federal Reserve backs off, John Stepek looks at how quantitative tightening is affecting the global economy’s most important charts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In this week's podcast, Merryn talks to Bernard Connolly, economist and author of The Rotten Heart of Europe, the 1995 book that got him fired from his job at the European Commission. He warned then that the euro would turn domestic economic problems into international political conflicts. And it's hard to argue that he was wrong. You may not always agree with him but this one is a must-listen.

As always, if you have any questions that you'd like Merryn and I to address, please do send them in to editor@moneyweek.com. Put "Questions for the podcast" in the subject line and we'll see what we can do.

If you missed any of this week's Money Mornings, here are the links you need.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: The oil price has soared this year and it's nothing to do with supply or demand

Tuesday: Is enough of your money invested in overseas stocks?

Wednesday: Wages are picking up but the market still can't believe it

Thursday: Gold here's why it just might be different this time

Friday: What the end of quantitative tightening means for markets

And subscribe to MoneyWeek magazine it's even better than Money Morning.

And now, over to the charts.

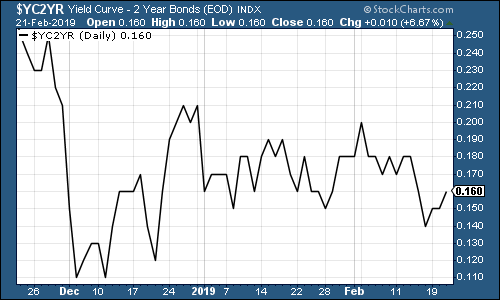

The yield curve (here's a reminder of what it is) still hasn't shifted much, although it perked up a little on news that the latest Federal Reserve minutes indicate that the central bank is aiming to end quantitative tightening later this year.

The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

We're not there yet. But you'd be hoping to see this spread start to increase if investors are convinced that the Fed is going to back off.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

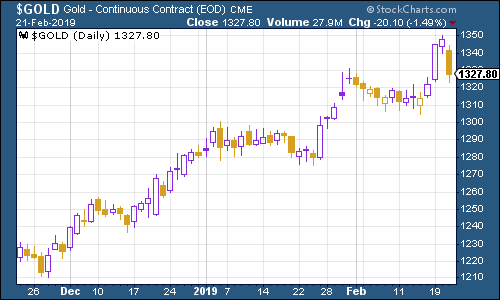

Gold (measured in dollar terms) spiked higher on the Fed news, although it ticked back as other US economic data later in the week turned out to be disappointing. What gold probably really needs to head higher now is a belief that inflation is going to break higher despite the Fed's weak efforts to thwart it. Until fear of recession passes, that won't happen.

(Gold: three months)

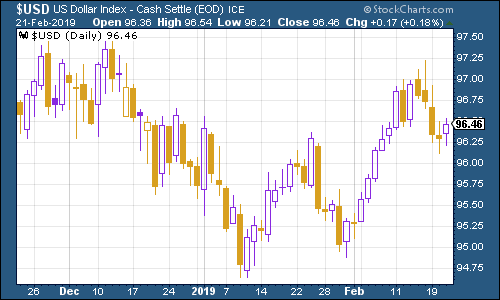

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners slipped a little this week on the Fed news.

(DXY: three months)

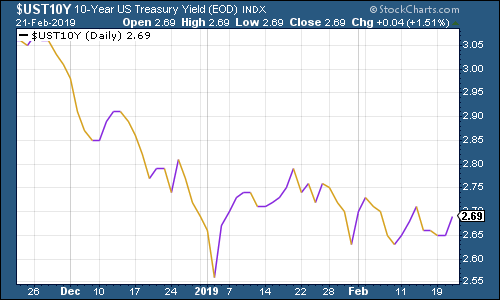

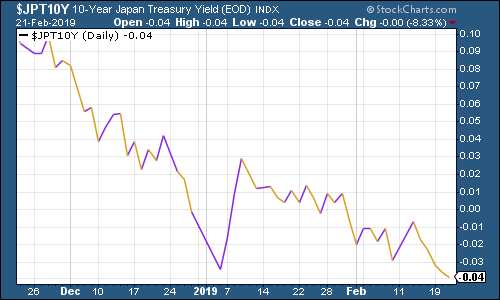

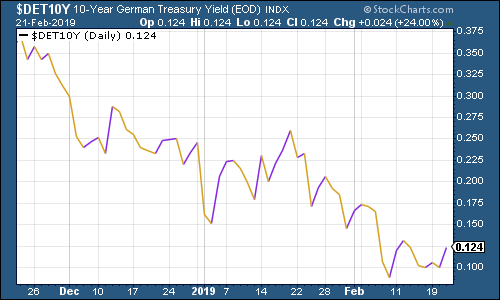

The ten-year yields on the world's major developed market bonds were little changed, as readings from the US, Japan and Germany show.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

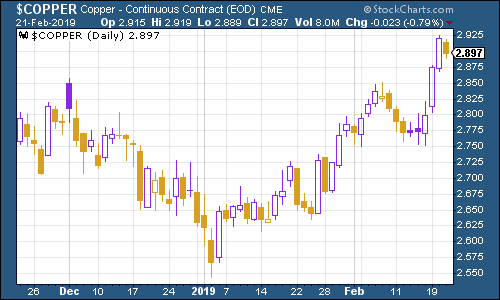

Copper is surging higher this week, which is odd given fears of a downturn. It's partly because copper has now been recast as the ultimate metal for investing in the renewables and electric car sectors.

(Copper: three months)

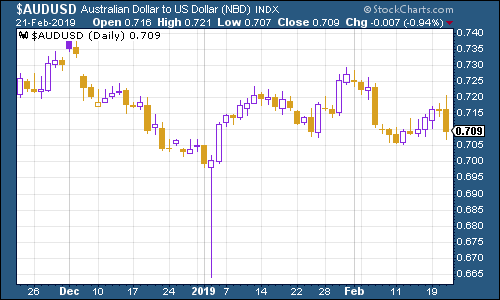

The Aussie dollar our favourite indicator of the state of the Chinese economy took a hit this week (although it rebounded on Friday) amid confusion over a story that suggested China had banned coal imports.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin rallied this week after a long period in the doldrums. Some suggest it's because of the news last week that JP Morgan will be issuing its own cryptocurrency. The delayed reaction seems odd but let's see if it has legs.

(Bitcoin: ten days)

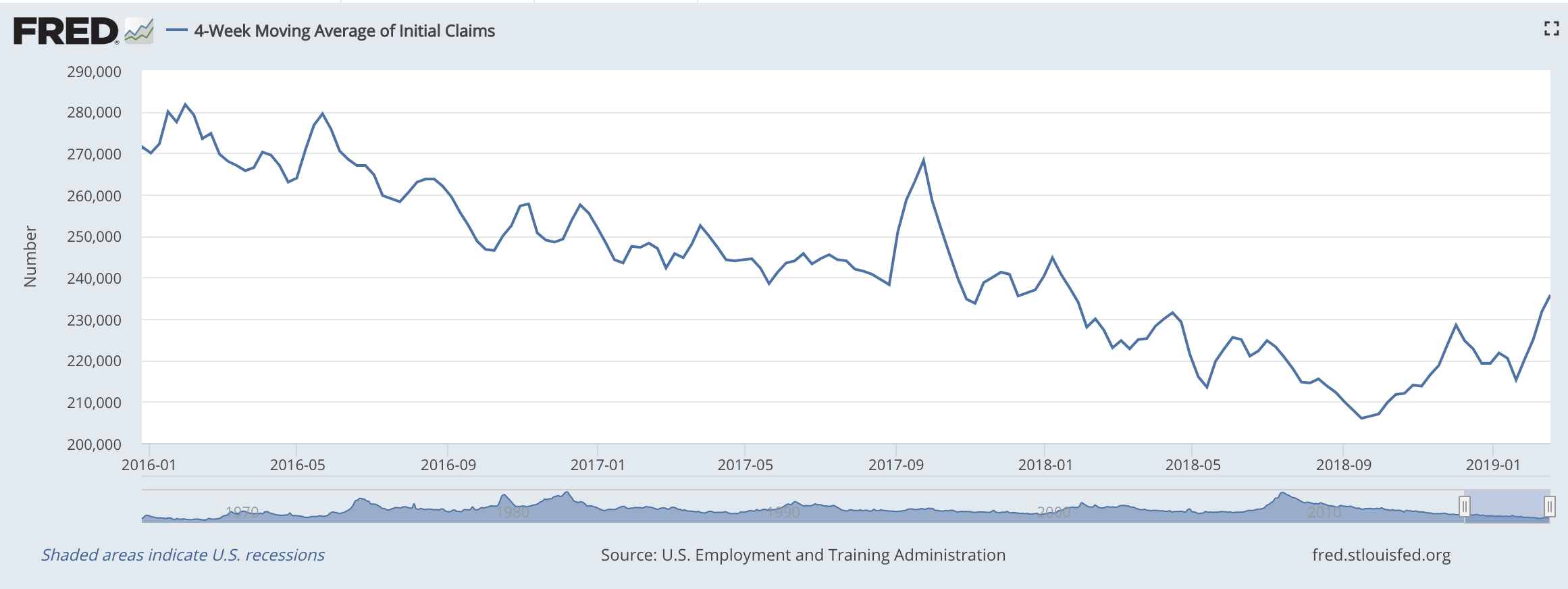

The four-week moving average of weekly US jobless claims rose again this week, to 235,750, the highest level in more than a year, although weekly claims fell to 216,000, a better result than expected.

US stocks typically don't peak until after the moving average of jobless claims has hit a low for the cycle, as David Rosenberg of Gluskin Sheff has pointed out. We don't have many past recessions to go on. But as long as you accept the limitations of the sample size, then on average, the stockmarket typically peaks about 14 weeks after the trough in claims, with a recession following about a year later.

The most recent trough came on 15 September, at 206,000. If that was the bottom, it implies that the market has already peaked (in early October, at around 2,950 for the S&P 500), and that a recession may follow this year or in 2020. Let's keep an eye on the chart. But jobless claims will have to fall pretty hard over the next few months to take us to a new trough.

(US jobless claims, four-week moving average: since January 2016)

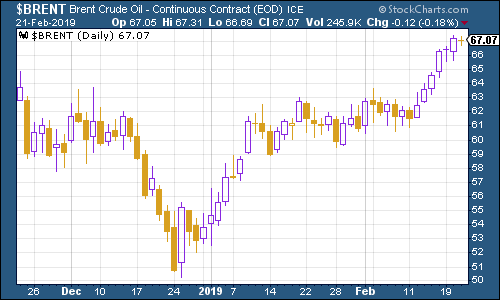

The oil price (as measured by Brent crude, the international/European benchmark) is back in full-on bull market mode. Investors are paying more attention to the effect of supply cuts than to concerns about demand.

(Brent crude oil: three months)

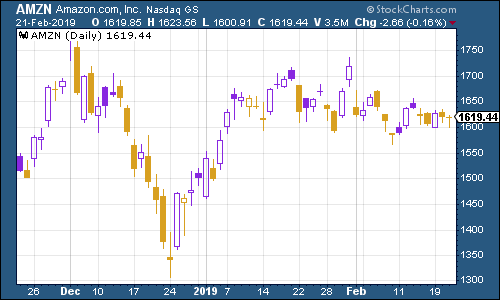

Internet giant Amazon moved very little this week. The whiff of politics surrounding the stock isn't enough to deter those who wonder if now is the time to "buy the dips".

(Amazon: three months)

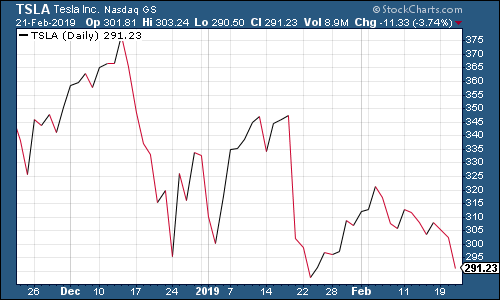

Electric car group Tesla saw its shares continue to fall hard as another key member of staff quit. The company's top lawyer jacked in the job after just two months. I don't think it takes a genius to figure out that Elon Musk might be challenging to work with. But being unable to hang on to senior staff is not ideal when a company is trying to prove both its competence and its ability to survive for the long term.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge