Sterling might struggle as we approach Brexit Day – but long term it’s a buy

The uncertainty surrounding Brexit has left sterling undervalued. And while it remains vulnerable for now, it’s a solid buy in the long run. Dominic Frisby explains why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In today's missive we consider the fate of the oldest currency in the world still in use today. I'm talking, of course, about the Great British pound. Currently a pound buys you US$1.29 or €1.14. As 29 March, Brexit day, comes into view, is the end of the forex turmoil finally in sight? Or is there worse to come?

What Frisby's Flux says about the outlook for the pound

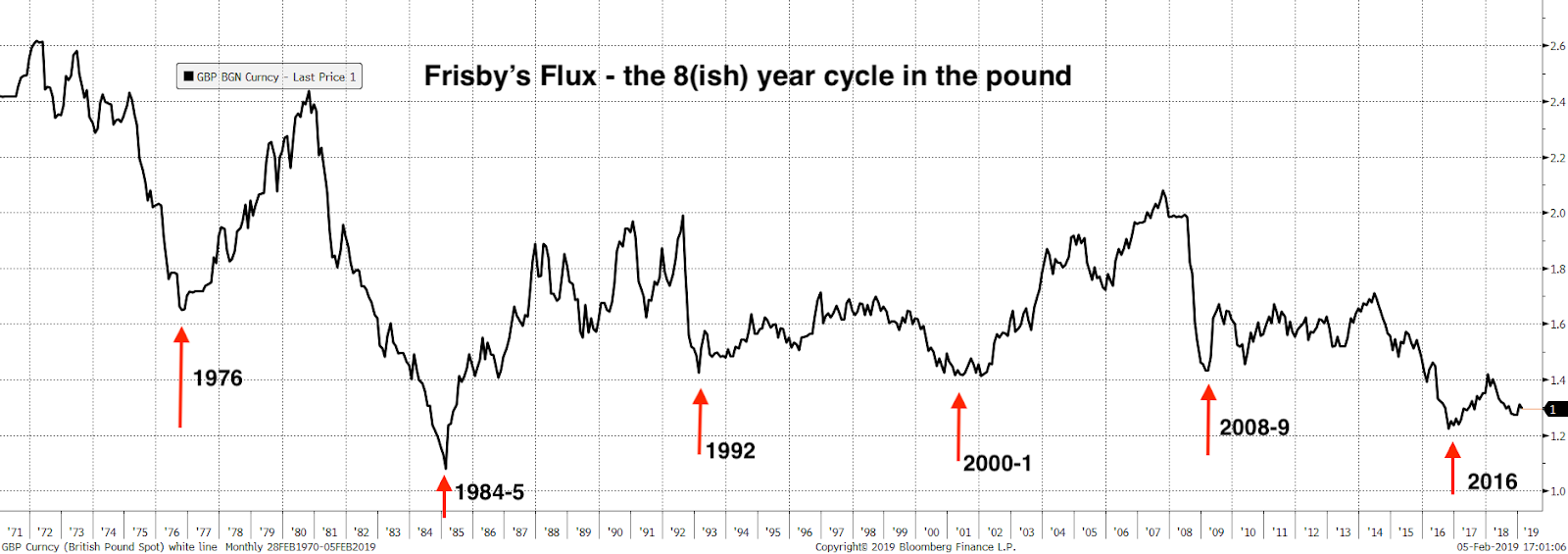

The long-term theory I have been espousing on these pages is that there is something of an eight-year cycle in the pound. This goes all the way back to the 1970s. I have not looked back any further because 1971, when the US dollar came off the gold standard, is such an obvious starting point.

As regular readers will know, I am somewhat dubious about the value of cycle theories. They often only seem to work retrospectively, when one arbitrarily imposes some kind of pattern on past events. If one starts operating in the present time, believing there to be some greater cycle at work which only you and a few others know about, you can end up with egg on your face fast.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Perhaps the most famous cycle of all is the Kondratiev wave, which hypothesises a 60-year cycle in the global economy. I notice a lot of revisionism going on among its believers at present, with dubious theorists projecting that we are just going into Kondratiev winter (aka depression) now.

But they were saying the same thing ten years ago, and anyone who paid too much heed to the idea became fixated on the fact that we were falling into a great depression and invested accordingly, missed out on numerous epic bull markets.

Yet, at the same time, as an investor it can pay to think at least a little in cycles. Things go around and come around. There are bull markets and bear markets, particularly in cyclical industries such as mining.

So, with that rather damning caveat, here we return to a long-term chart of what I have dubbed "Frisby's Flux" the eight(ish) year cycle in the pound. It might be pure coincidence of course, but sterling does seem to do this odd thing where it puts in a low every eight years.

There was 1976, when chancellor Denis Healey had to go begging to the IMF; in 1984-1985, there was the miners' strike, and (more importantly) the Plaza Accord; in 1992, there was Black Wednesday, when George Soros so famously shorted the pound and the UK had to exit the European Exchange Rate Mechanism; in 2000, the pound sank with the dotcom crash; in 2008 it fell with the global financial crisis; and in 2016 we got the "flash crash" after Theresa May's disastrous speech at the Conservative Party Conference (and we suggested that might be the low). In the chart below I have visualised the cycle.

On a purchasing power parity (PPP) basis today the pound is certainly undervalued. Some see $1.60 as fair value. Others have it at $1.40. I have it somewhere between those two figures. But, in any case, at $1.29 it is certainly cheap.

Against the euro, fair value is probably somewhere in the mid-to-high €1.20s.

The pound is vulnerable in the short term, but a solid buy for the long run

The reason for the low valuation is, of course, all the uncertainty surrounding Brexit. Yet, bizarrely, even as 29 March looms, and with no clear withdrawal agreement yet in place, the pound is behaving somewhat better than it was two years ago.

The dominant narrative in in the forex markets is still that a weak Brexit or no Brexit is good for the pound, while no withdrawal agreement is bad. We saw this in play over the last few weeks. From a December low at $1.25, the pound rallied to $1.32 last week, as various Remainer amendments looked as though they had a chance of getting through Parliament. Since they were voted down last week, the pound has slid to today's price of $1.29. But this anti-Brexit narrative in forex is not as strong as it was two years ago.

I still can't believe that Parliament will allow the UK to leave without a withdrawal agreement, and I don't think the forex markets do either, but bizarrely this might be the best outcome, because at least there is certainty: we go straight to WTO rules and everyone knows where they stand. The eternal Brexit limbo will be over. However, the initial reaction to this in the forex markets would be one of considerable turmoil, even if they eventually come round to the idea.

May goes to Brussels this week and I think the pound goes lower in the immediate short-term as fears of no deal grow, but I remain of the view that 2016 was the long-term low, and that over the next few years the pound goes higher.

Of course, much of that will depend on the how the economy fares after Brexit and thus on the types of deals secured. Trading the pound has become speculating on political machination, which is a dangerous game. It is hard to know, politically, exactly what is going to happen. But somehow it will be muddled through.

So there we go short-term volatility, but not as bad as in 2016. Longer term, sterling is a buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge