The charts that matter: a big bounceback – but can it last?

John Stepek looks at the global economy’s most important charts to find out what’s behind the market’s latest rally, and how long it can last.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back. Quick thing to highlight before we get started I'm hosting an event in London on 12 February. I'll be talking to MoneyWeek regular and dedicated value investor Tim Price, and to Netwealth's Iain Barnes about the outlook for 2019. We'll cover everything from inflation and interest rates to political risks and investing in global equity markets. Tickets are selling fast, so book your place now.

We'll have a new podcast for you next week meanwhile if you missed the one on Gift Aid at the end of last year you can catch it here.

If you missed any of this week's Money Mornings, here are the links you need.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: The US booms and China starts spending again: is the bear market over?

Tuesday: Buy Brazil and watch out for solar flares some of 2019's most interesting calls

Wednesday: Here are my ten big predictions for 2019

Thursday: Three questions to ask before you buy shares in any UK high street retailer

Friday: Will the market rally last?

If you've made a New Year's resolution to get on top of your finances, but you haven't yet subscribed to MoneyWeek I mean, you are missing an open goal there. Subscribe now, get your first six issues free, and give yourself a head start on your 2019 "to-do" list. (And if you are more of a guidelines than goals person well, subscribe anyway if you're enjoying Money Morning, you'll definitely enjoy the mag).

And now... over to the charts.

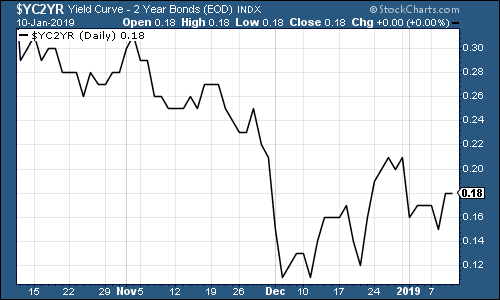

The yield curve (here's a reminder of what it is) still isn't pointing to a recession but it's still dangerously close to doing so. The chart shows the difference (the "spread") between what it costs the US government to borrow money over ten years rather than two. Once this number turns negative , the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

The spread has remained stubbornly above the zero mark and does show some sign of making a comeback, helped by the combination of strong jobs data and the Federal Reserve sounding a bit more dovish than previously (which reduces the market's fears of a "monetary mistake").

(The gap between the yield on the ten-year US Treasury and that on the two-year: going back three months)

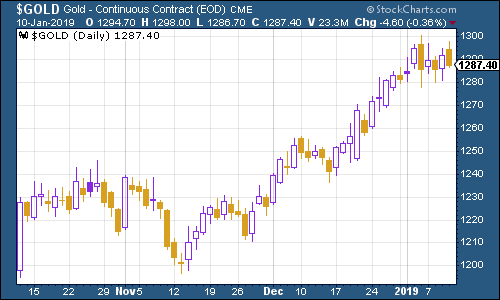

Gold (measured in dollar terms) has been more subdued this week as the panic gripping stockmarkets calmed down somewhat. However, I don't think the rally is over.

If the Fed grows more dovish and it allows inflation to pick up and the dollar to weaken, that should at the very least sustain gold at these levels. But if the Fed is more hawkish than the market expects, then the "safe haven" rush will continue to buoy gold. So for now the metal's immediate prospects still look pretty healthy.

(Gold: three months)

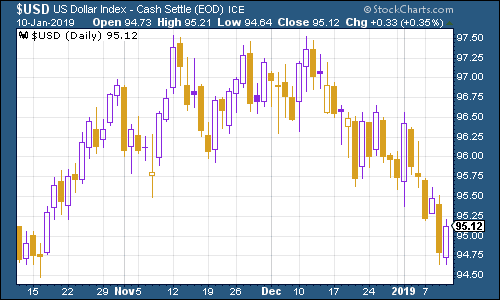

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners drifted lower as the market starts to adapt to the idea of the Fed no longer being quite as aggressive as expected.

(DXY: three months)

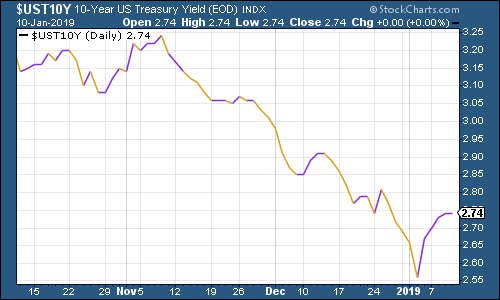

The ten-year US Treasury bond yield remained well below 3%, but it had a strong bounce higher this week as fears of recession retreated at least a little.

(Ten-year US Treasury yield: three months)

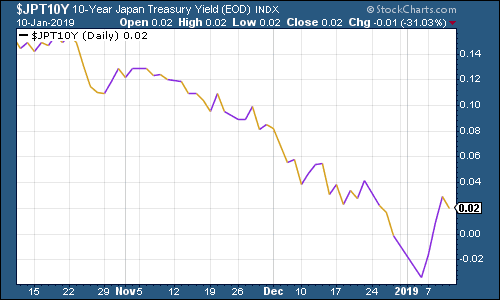

The Japanese government bond (JGB) yield followed the US yield higher.

(Ten-year Japanese government bond yield: three months)

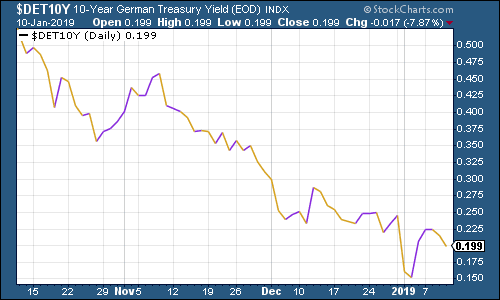

Ten-year German bund yields (the borrowing cost of Germany's government, Europe's "risk-free" rate) were a bit of an exception. They did rebound but drifted lower towards the end of the week as fears grow about the strength of the German economy and the car industry in particular.

(Ten-year bund yield: three months)

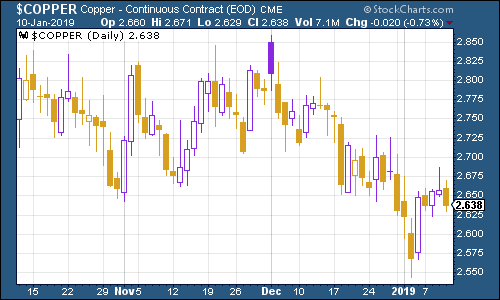

Copper rebounded this week it could be that investors grew that bit more confident about economic growth, but it's probably more an inverse move to the US dollar.

(Copper: three months)

Meanwhile the Aussie dollar rallied sharply after a brief New Year "flash crash". The rally in the Aussie does speak of recovering confidence in China and has likely been influenced by optimism over a US-China trade deal. It is, of course, also a reaction to a weakening dollar.

Cryptocurrency bitcoin had a tough end to the week, but it's still meandering in the same $3,000 to $4,000 or so trading band that it has been stuck in since early December.

(Bitcoin: ten days)

The four-week moving average of weekly US jobless claims it edged higher this week to 221,750, although weekly claims came in at a lower-than-expected 216,000. The next few weeks will probably be distorted by the government shutdown, although it doesn't appear to have shown up yet.

Gluskin Sheff's David Rosenberg has noted in the past that US stocks typically don't peak until after jobless claims (as measured by the four-week moving average) have hit their lowest point for a cycle. On average, the peak follows about 14 weeks from the trough. A recession follows about a year later. (As always, a reminder that this is taken from a small sample size with a lot of variation).

You can see the most recent trough in the chart below it was on September 15th, at 206,000. That would suggest that the stock market may already have peaked, and it would imply a recession late this year or in 2020. That said, if the jobless claims keep trending lower, who knows there may yet be one final trough (or more) left in this particular cycle.

(US jobless claims, four-week moving average: since January 2016)

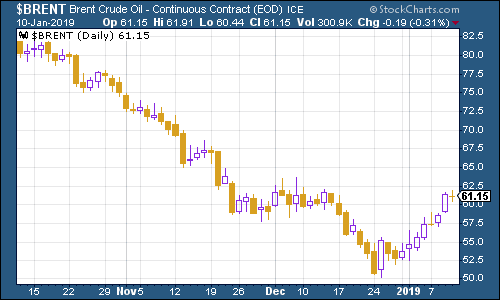

The oil price (as measured by Brent crude, the international/European benchmark) has had a spectacular rally to start the year. This is a good omen for risk appetite. You see reports talking about possible production cuts, or optimism about trade talks, but the reality is that oil fell too fast and too hard, and markets are now bouncing from that.

Whether it will be sustained or not is another matter, but at the end of November I said I couldn't see Brent getting a lot lower than $55 a barrel, and for now I think that view still stands.

(Brent crude oil: three months)

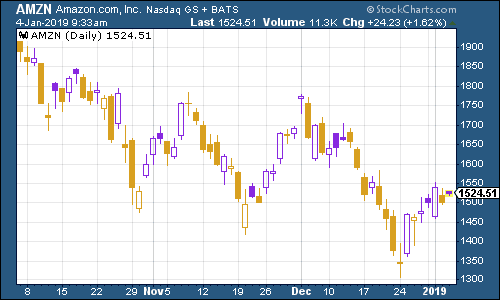

Internet giant Amazon has rallied this week. I'm interested to see if it can break back above $1,800 and thus clearly escape its current downtrend. Analysts are still keen on the stock JPMorgan has it down as one of its best investment ideas for the year ahead, with a focus on advertising and Amazon Web Services.

(Amazon: three months)

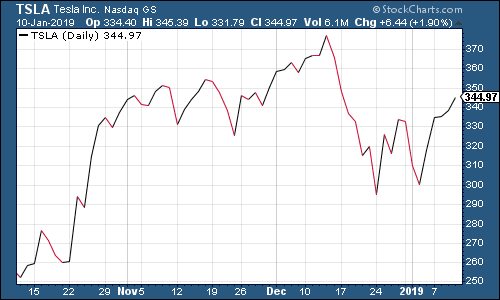

Electric car group Tesla rebounded from recent falls, helped by news that Oracle founder Larry Ellison, who was appointed to its board last month, owns more than $1bn worth of the company.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge