Profit from Renishaw’s precision

Few people have heard of Renishaw, but its products and prospects are excellent, says Mike Tubbs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Some companies tend to keep a low profile because they sell to other businesses rather than the general public. That means investors sometimes overlook them too. In the case of Britain's Renishaw (LSE: RSW), that would be a great shame.

The company makes high-precision measuring and calibration equipment. One of its laser precision-measuring systems used in the manufacture of machine tools, for instance, is accurate to one-half of a millionth of a metre in length and boasts a measuring distance of up to 80 metres.

A wide range of industries

Machine-tool manufacture is just one of the industries served by Renishaw. Others include aerospace, automotive, energy, electronics, construction, resources, healthcare and scientific research.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In aerospace, Rolls-Royce is a long-standing customer. Renishaw systems are used both in the manufacture of high-precision fan blades and in refurbishing fan-blade tips. In healthcare, products range from dental frameworks to robotic surgical systems for treating neurological conditions.

Renishaw invests heavily in research and development (R&D). It spends around 13% of sales on this, compared with a global average for its sector (electronics and electrical) of approximately 5%. Renishaw is an innovative company, taking out patents to cover all novel aspects of its products, while it has demonstrated that it will take legal action against infringers.

Its combination of patented technology, a high rate of innovation, high-quality reliable products, excellent customer support and a high market share in its global niche makes it extremely difficult to compete against.

The company's major sales are to countries with substantial precision- manufacturing industries. In 2018, 46% of its sales were made in the Far East and Australasia (with China comprising just over half of them). Europe and the Americas comprised 30% and 21% of sales respectively.

2018 sales were up 14% over 2017. Renishaw's growth is mainly organic, with small, bolt-on acquisitions made to acquire new technologies and accelerate expansion into target markets. For instance, Renishaw scooped up Detroit-based Advanced Consulting & Engineering in 2014 to support sales of measuring and gauging products in America.

Customer interaction and support is an important part of Renishaw's business and it exhibits at all the major machine tool and manufacturing events. The company also has high-quality demonstration and training facilities located near where there are clusters of major customers. In 2018 the Turin facility was refurbished and a new one opened near Shanghai.

China is an eager customer

In addition to precision measurement systems, Renishaw makes manufacturing systems, including 3D metal printing. However, the metrology division accounts for 94% of revenue and almost all the profits. Precision healthcare is a small but fast-growing segment that recorded a small profit of £0.3m last year.

The trading statement for 2018/2019's first quarter was released in October and said that metrology revenue was up 7% over last year; healthcare sales, meanwhile, increased by a quarter.

The outlook statement said that the company expects growth in both revenue and profit for this financial year. The major uncertainty is President Donald Trump's trade dispute with China, since China accounts for nearly one quarter of Renishaw's revenue.

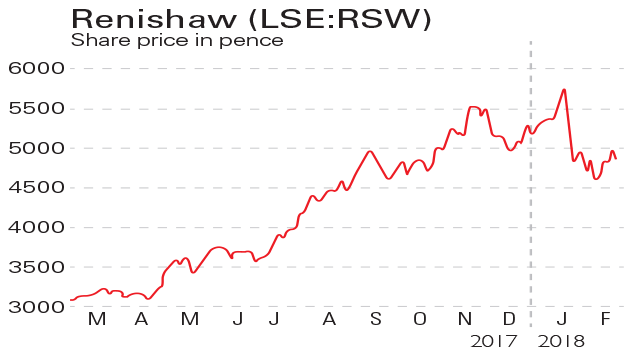

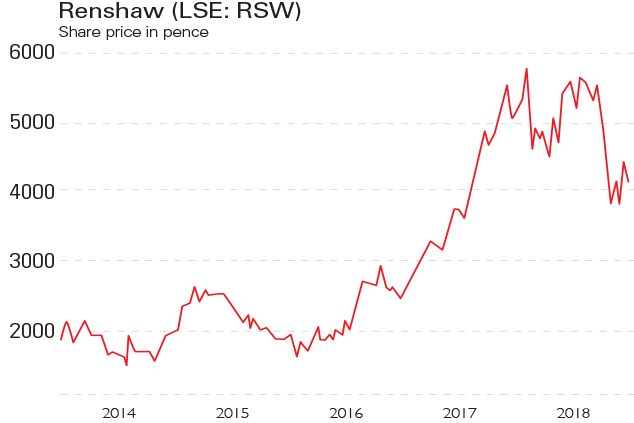

This has led to a fall in the share price since September. However, China is determined to develop its higher value-added manufacturing sector and will need Renishaw's products to achieve this.So the medium- to long-term outlook remains healthy.

Good entry point for a first-class stock

Renishaw is a profitable firm with 2018 operating profits of £153m on turnover of £611m, giving a high operating margin of 25%. It has always retained a healthy cash pile. The earnings-per-share (EPS) for 2018 of 182p and the recent share price of 4,182p produce a trailing price-earnings (p/e) ratio of 23. With the firm predicting growth in profits for 2019 and healthcare at last contributing to profits, the forward p/e is likely to be below 20.

It also pays a dividend that has been increased every year since 2009; a total dividend of 60p was declared for 2018, giving a yield of 1.4%. Its markets tend to be cyclical, as the share-price chart shows and it pays to buy in a dip. Investors who bought at the lows in early 2014 and early or late 2016 have done well. But buying at October 2016's peak still gives a 43% gain in two years. The wider market decline and concern over the trade stand-off between the US and China caused a fall in the stock to 3,600p in October 2018. It is still 26% below last year's highs, offering a very reasonable entry point to a first-class company that will prove a sound long-term investment. I have owned shares in Renishaw for many years.

| Data table for Renishaw (LSE: RSW) | |||

| Investment measure | Investment ratio | ||

| Share price (7/12/18) | 4182p | p/e (for 2018 EPS) | 23 |

| Market cap (7/12/18) | £3.04bn | Net cash | £115.3m |

| Next results (H1) due | Late Jan 2019 | Yield (7/12/18) | 1.43% |

| Recent results | 2017 | 2018 | Change % |

| Turnover | £536.8m | £611.5m | +13.9% |

| Operating profit | £116.8m | £153.2m | +31.2% |

| EPS | 141.3p | 181.8p | +28.7% |

| DPS | 52p | 60p | +15.4% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how