The charts that matter: the cracks in the market are showing

Gold has had a reasonable week, but most other assets are selling off. John Stepek looks at the charts that matter to see where the global economy might be going next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

We have not one, but two podcasts this week! Merryn talks to demographics and chemicals expert Paul Hodges about globalisation, the EU's biggest mistake (abetted by Tony Blair and Gordon Brown), and the slide in the London housing market in our bonus podcast. And Merryn and I discuss China and globalisation further in the latest weekly podcast here.

And if you missed any of this week's Money Mornings, here are the links you need.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday: I can't see why you'd ever use an active fund to invest in big US stocks

Tuesday: Apple's fall is just a symptom here's what's really troubling the market

Wednesday: How bitcoin and blockchain could solve our crisis of trust

Thursday: What Pulp Fiction can tell us about the next stage of Brexit

Friday: The best way for investors to prepare for Brexit

Don't miss Merryn's piece on rising UK wages, and don't miss this week's issue of MoneyWeek magazine if you're not already a subscriber, sign up here now.

And now over to the charts.

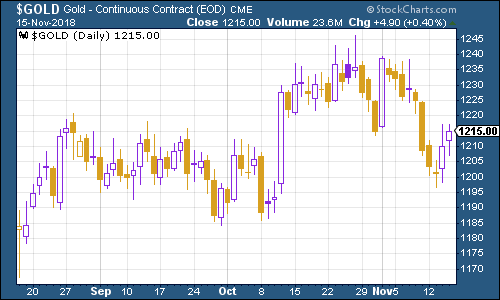

Gold (measured in dollar terms) has had a reasonable week. It's still meandering around $1,200 an ounce. The US Federal Reserve has shown few signs as yet of wilting under market pressure, but there's enough scary stuff going on to keep gold propped up.

(Gold: three months)

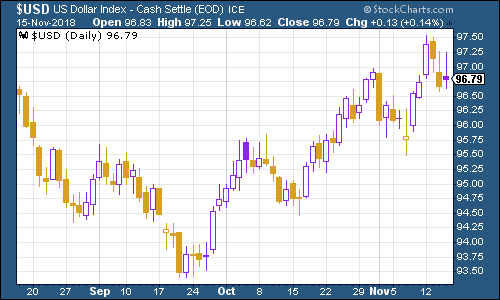

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell back from its recent highs this week. Analysts at Morgan Stanley reckon the dollar's bull run is over. That might well be the case but there's also an element of wishful thinking there if the dollar's bull run doesn't end, then the chances of having another run higher in the stockmarket any time soon seem low.

(DXY: three months)

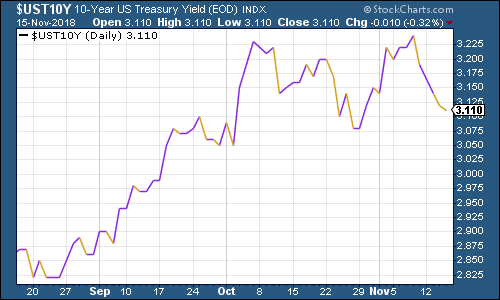

A general sense of nervousness in the markets saw the yield on the ten-year US Treasury bond decline.

(Ten-year US Treasury yield: three months)

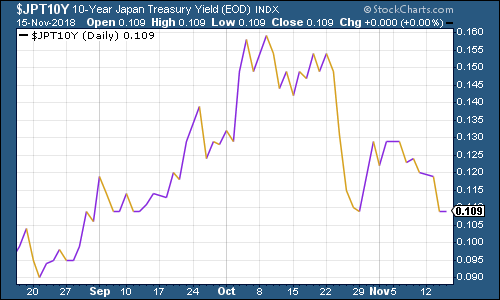

The same went for the Japanese government bond (JGB) yield.

(Ten-year Japanese government bond yield: three months)

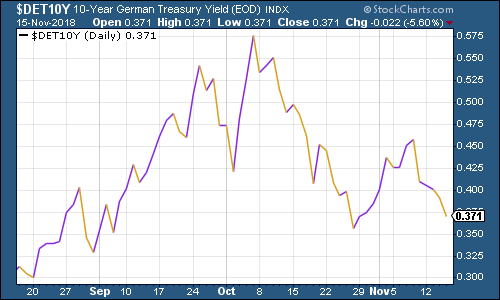

As for Europe, fears over Brexit upheaval saw the yield on the ten-year German bund (the borrowing cost of Germany's government, Europe's "risk-free" rate) dip.

(Ten-year bund yield: three months)

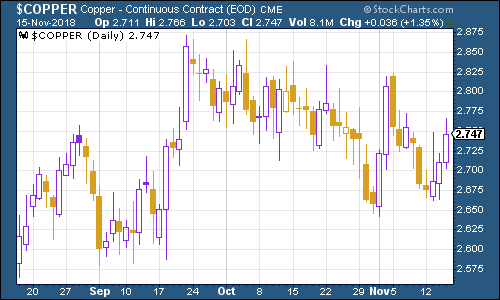

Interestingly, copper rallied somewhat this week, which was at least partly due to the dollar weakening. It's interesting simply because many other assets have been faring badly.

(Copper: three months)

Cryptocurrency bitcoin had its first major move in over a month this week. Unfortunately for bitcoin bulls, it was a crash rather than a surge. Bitcoin finally went back below $6,000 per coin. What happened? Apparently, Bitcoin Cash is about to go through a "hard fork". This is not something I feel confident explaining to you but the fact that these little offshoots keep springing up can't help confidence.

More than that though, the cracks in bitcoin might reflect wider market concerns. After all, it's not the only asset to have cratered this week oil has done something very similar. The credit market is starting to show stress and I just wonder if maybe people are deciding that it's time to head for the hills and liquefy anything risky that still looks reasonably liquid.

(Bitcoin: three months)

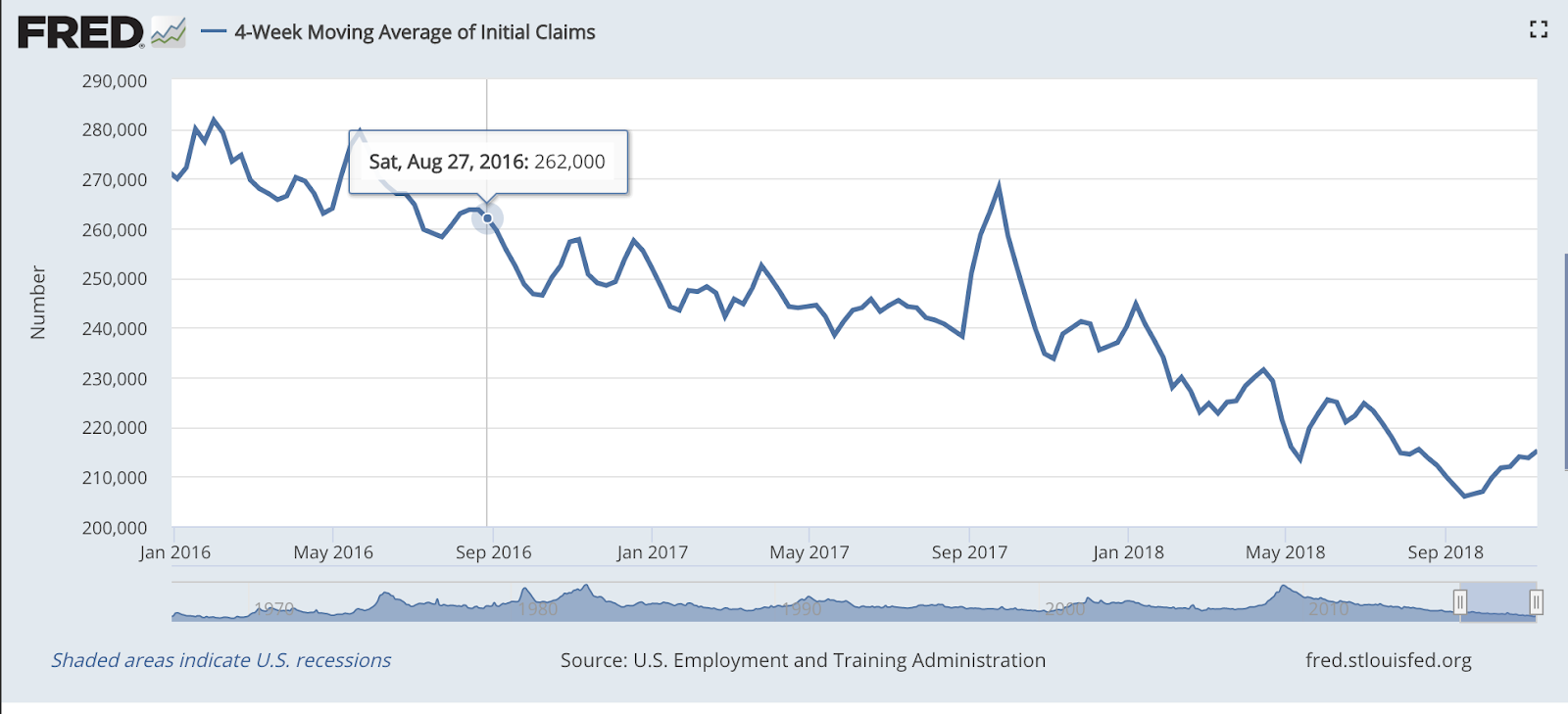

On US employment, the four-week moving average of weekly US jobless claims crept higher again, to 215,250. Meanwhile weekly claims came in at 216,000.

As David Rosenberg of Gluskin Sheff has noted in the past, the stockmarket usually does not hit its peak until after we've seen jobless claims (as measured by the 14-week moving average) hit rock bottom for a cycle. This is based on a small number of observations of course (because recessions are fairly rare), so you can't read too much into it. But Rosenberg has observed that the stockmarket peak usually follows about 14 weeks from when jobless claims hit the bottom, and a recession follows about a year later.

In other words, if we've already hit rock bottom for this cycle which would have been mid-to-late September then we should still be at least a year away from recession as yet, and probably a month or so away from a stockmarket peak. If mid-September really was the bottom, then that would imply a market peak around late December, or the start of next year. Worth keeping an eye on.

(US jobless claims, four-week moving average: since January 2016)

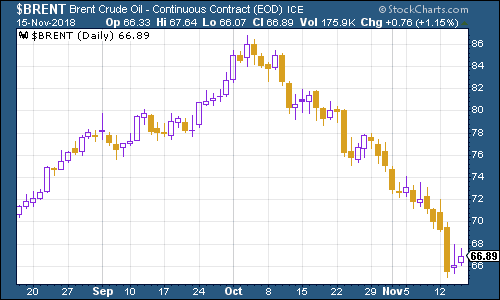

The oil price (as measured by Brent crude, the international/European benchmark) continued to fall, although it put in a gentle rally towards the end of the week. It's been a spectacular turnaround in terms of sentiment we've gone from a situation where everyone was betting on there being "too little oil", to one in which everyone thinks "there's too much oil".

How long that lasts is another matter.

(Brent crude oil: three months)

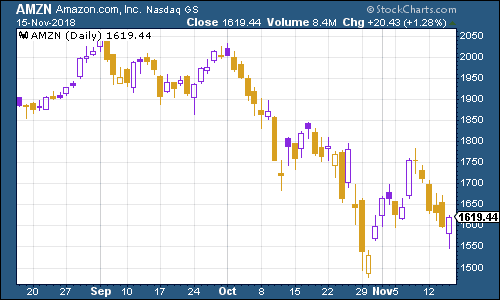

Internet giant Amazon has slipped back this week along with wider markets.

(Amazon: three months)

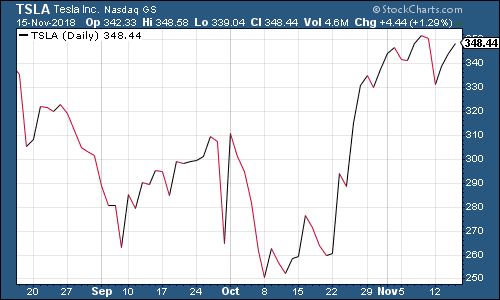

It's extraordinarily ironic that in a week that's been bad for everything, eccentrically-governed electric-car group Tesla is the exception. Maybe traders who see oil collapsing assume that this is the logical counter-trade.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.