Nike – just buy it

Sportswear giant Nike has confounded the sceptics by remaining ahead of the competition.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The sportswear giant has confounded the sceptics by remaining ahead of the competition.

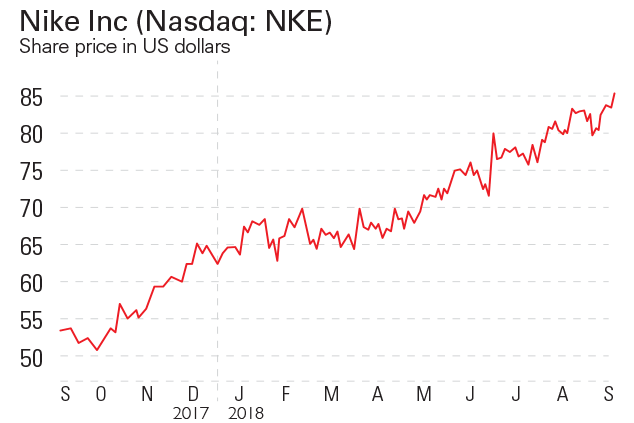

Nike's recent decision to sign controversial US quarterback Colin Kaepernick for its "Just Do It" campaign won big media coverage, but not all of it was positive. Kaepernick polarised opinion by kneeling during the US national anthem to protest against racial injustice (see also page 46). The move was viewed as disrespectful by many, including the US president, and some warned of a backlash against the brand. But after 50 years of building a marketing juggernaut, Nike knows what it's doing. The move saw online sales surge by 31%, and the shares hit fresh highs.

Springing nice surprises

Nike has a habit of springing positive surprises. In the run-up to fourth-quarter results in June, investors were wary. There were concerns about slowing sales, the effectiveness of the online strategy, and merchandise overhangs from previous seasons. Yet as it turned out, June's release was strong: sales and profits were up by 13%, beating expectations, and sending the share price soaring.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The need to compete with the likes of Amazon is driving Nike to embrace technology across the business, with the aim of doubling "innovation", "speed" and "digitisation". Innovating new platforms (such as "Nike Air" or "Vapor Max" in the past) and building them up quickly gives the company an advantage in responding to consumers hungry for choice and new products.

Investment in research and development allows it to use cutting-edge materials to distinguish it from rivals. Meanwhile, the time taken to get products to market has fallen by more than half, and investment in robotics, for example, could lead to further huge gains. Citibank analysed the Nike 2017 Air Max and reckons automation would cut labour and materials costs by a half and a fifth respectively, giving the shoe a 55% gross margin (up about 25%). Extending this across the range could boost earnings greatly, and cut supply chains.

On the digital front, Nike's app is one of the top 20 shopping apps, and professional high-impact posting, tweeting and blogging are on the up. Partnering with Amazon, for example, allows greater point-of-sale management. Also, if Nike sells direct to consumers, this should reduce the number of third-party sellers of Nike products, not only boosting margins but also cutting the amount of overhanging stock being sold at a discount. Online analytics also provide a data trove to monitor shifting consumer demand, enabling tighter control of new product supply.

Staying ahead of the pack

Ambitious, well-executed steps to remain ahead of the consumer must, if they're to be worth anything, mean big leaps in financial performance rather than fiddling around the edges. Nike with its top brand, strong management, and high investment in research and development has what it takes. The figures so far suggest more is going right than wrong, and that management is delivering to plan.

As we see former detractors now playing catch-up as the share price surges, there's a useful lesson here. Sentiment and share prices can change quickly. If you are considering investing in a quality business, then trying to time the purchase in the short term can be high-risk and mean missing out. In the main, to buy a company is to trust its management. Market noise is as often as not merely distraction. You might get odd looks but there's a lot to be said for standing by your convictions while sticking your fingers in your ears.

Investors' optimism is justified

The shares trade on a forward price/earnings multiple of nearly 30. That's above the typical range, but not enough to stop investors buying the stock has outperformed the overall market by some 14% since its last earnings results. Analysts are largely upbeat and now expect annual percentage earnings growth in the low teens. Although corporate transformation is not without risk (the ideas not only need to be good, they also need to be executed well), there's clearly optimism about the future, given the share-price strength. While a case for long-term buying now can be made, closely watching for a near-term investment at $70-$75 on any broad market setback would be ideal (the next set of results is due on Tuesday 25 September). However, interest among investors is high. Fundamental changes are afoot, and momentum shouldn't be underestimated further short-term gains are possible.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn