Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

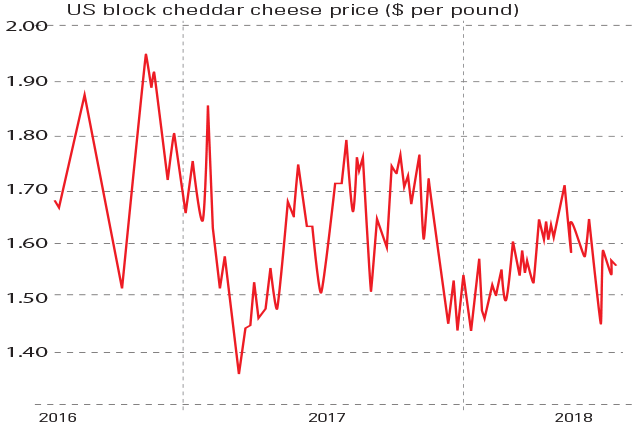

US cheese prices have crumbled thanks to a glut,says Myra Saefong in Barron's. The block cheddar cheese benchmark price settled at around $1.54 a pound after a bout of volatility this month. Traders predict more of the same for the year. But in the long run, prices should recover.

Two of the largest importers of US dairy products are China (which imported $577m in 2017) and Mexico (with $1.3bn), and both implemented tariffs on cheese in retaliation against US levies. These ongoing trade wars are likely to lead to dairy-farm closures, which would slow down cheese production.

US cheese prices have crumbled thanks to a glut the block cheddar cheese benchmark price settled at around $1.54 a pound As supply dries up, cheese prices will come to reflect a new balance between supply and demand.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"During more than 40 years of European integration, the UK economy has become so enmeshed with those of the rest of the EU that a vast tranche of our economic activity is only legally authorised by a thicket of EU laws Even before the referendum,some of us were urging that there was only one practical way we could get pretty well all we wanted: to become a fully independent country, freeing ourselves from three-quarters of the EU's laws, while continuing to enjoy "frictionless" trade. And also leaving us free to sign trade deals across the world, and even to exercise some control over EU immigration. This was to remain in the wider European Economic Area (EEA) by rejoining Norway in the European Free Trade Association. This could have solved virtually all the problems that have proved so intractable, including the Irish border."

Christopher Booker, The Telegraph

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

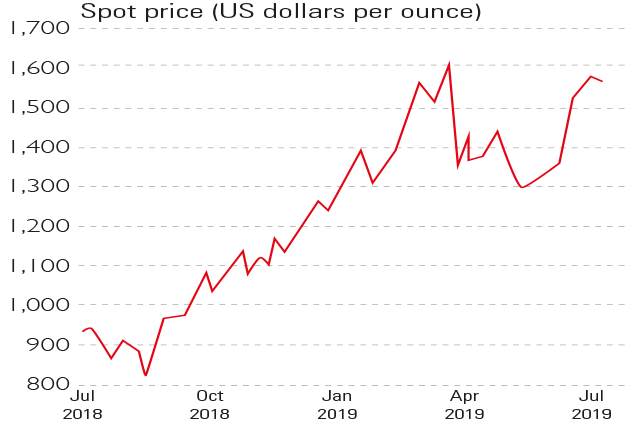

This chart pattern could be extraordinarily bullish for gold

This chart pattern could be extraordinarily bullish for goldCharts The mother of all patterns is developing in the gold charts, says Dominic Frisby. And if everything plays out well, gold could hit a price that investors could retire on.

-

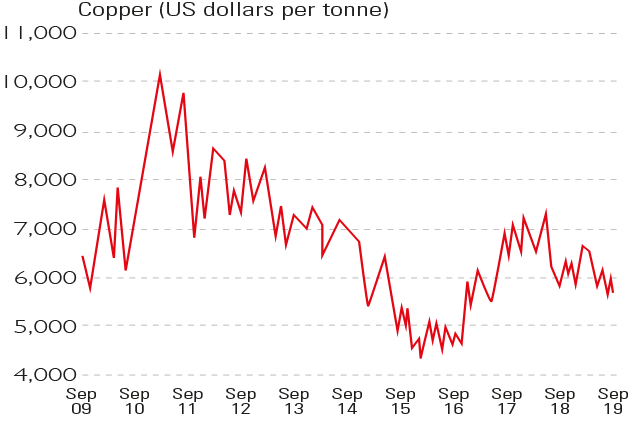

Chart of the week: Dr Copper diagnoses an ailing economy

Chart of the week: Dr Copper diagnoses an ailing economyCharts The price of copper has slipped by a fifth this year and is now at a near-two-year low of around $5,600 a tonne.

-

Chart of the week: palladium will lose its lustre

Chart of the week: palladium will lose its lustreCharts Palladium has gained 70% in a year. It now trades at about $1,530 per ounce. But any escalation in the US-China trade could spell an end to the rally.

-

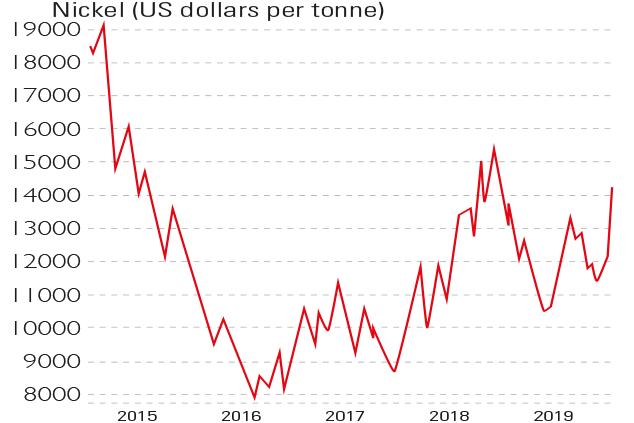

Chart of the week: nickel bucks the metals trend

Chart of the week: nickel bucks the metals trendCharts The price of nickel has soared by almost a quarter to a 13-month high in just a fortnight.

-

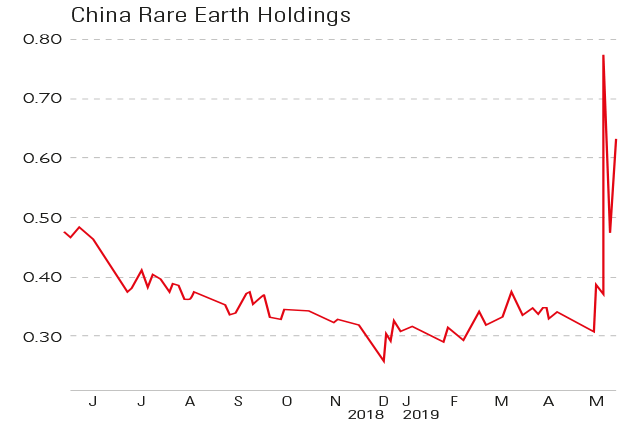

Chart of the week: China’s trade war trump card

Chart of the week: China’s trade war trump cardCharts China is by far the dominant supplier of rare earth metals - a group of 17 elements used in applications ranging from military and industrial lasers to energy-saving light fittings – accounting for 71% of the entire global supply.

-

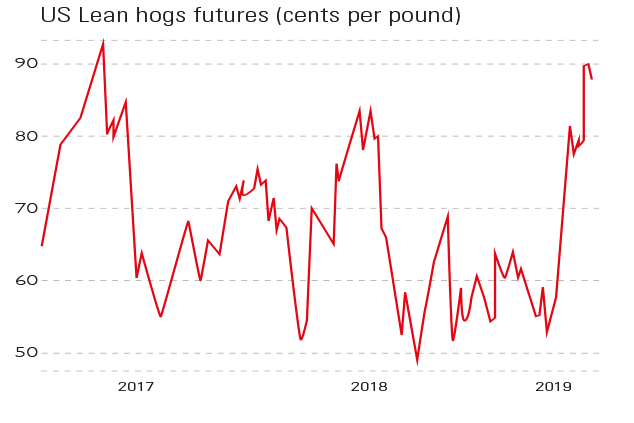

Chart of the week: hogs high on swine fever

Chart of the week: hogs high on swine feverCharts The number of pigs in China, around 450 million, is set to shrink by a third by the end of 2019 as swine flu rages – meanwhile, US pork sales to China have hit a record high.

-

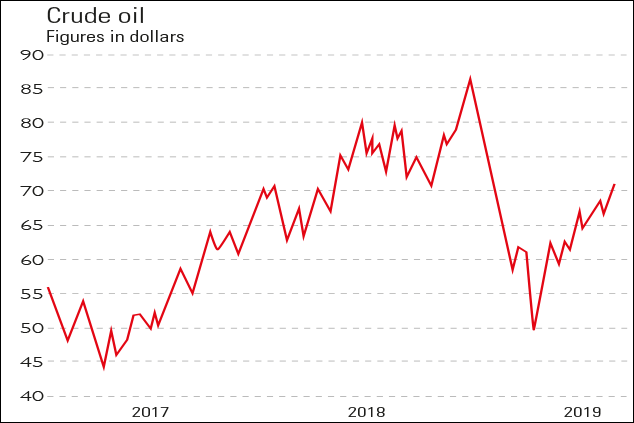

Chart of the week: will the oil rally last?

Chart of the week: will the oil rally last?Charts A disruption to supplies from the North African country could give oil prices a big short-term boost.

-

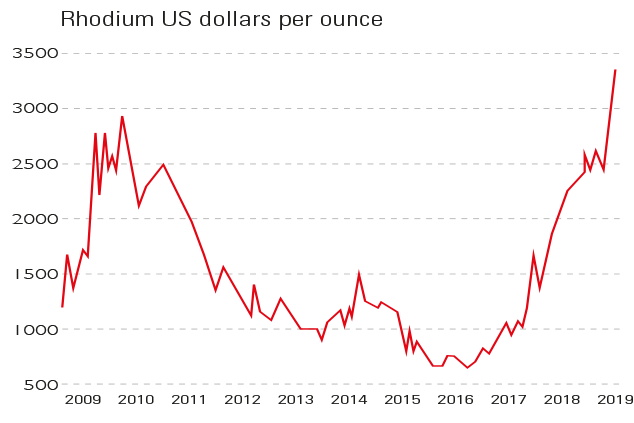

Chart of the week: rhodium on the rise

Chart of the week: rhodium on the riseCharts Rhodium has gained more than 30% this year, and now costs at least twice as much as gold or palladium.