The charts that matter: the global growth jitters

John Stepek examines how concerns over Chinese growth have affect the global economy's most important charts.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you missed any of this week's Money Mornings, here are the links you need.

Monday:Amid talk of "super-spikes" and shortages are we near peak oil bullishness?

Tuesday:Ignore the political noise over Brexit this is just business as usual

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wednesday:Britain must stop flipping housing ministers

Thursday:The global trade war is escalating fast

Friday:Get ready for a US "wage explosion"

A new podcast is coming on Monday if you haven't listened to the most recent one, you'll find it here.

Now over to this week's charts.

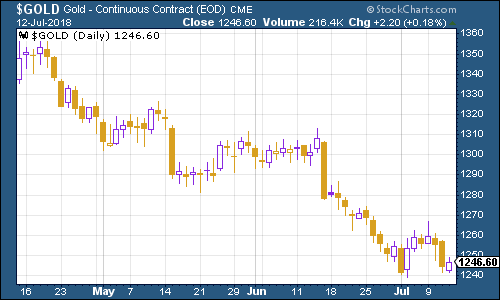

Gold has been struggling again this week. It's all about the stronger US dollar, as we discuss below.

(Gold: three months)

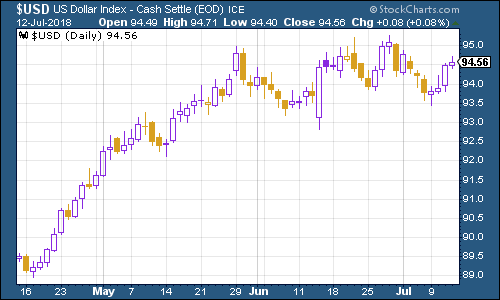

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners continues to be strong. The currency perked up this week as solid US inflation data kept the prospect of interest rate rises firmly on the table.

(DXY: three months)

The yield on the ten-year US Treasury bond was again, virtually unchanged this week.

(Ten-year US Treasury: three months)

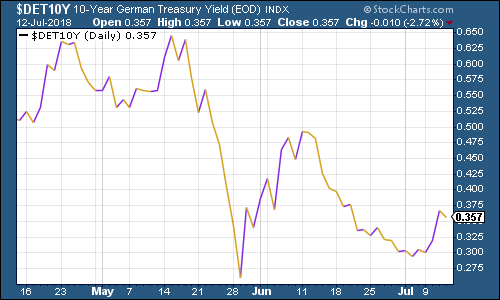

The yield on the ten-year German bund (the borrowing cost of Germany's government, which is Europe's "risk-free" rate) remained around the 0.3% mark as investors fret over everything from trade war to slowing eurozone growth.

(Ten-year bund yield: three months)

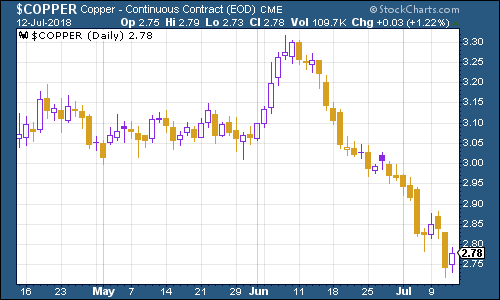

Copper just kept on sliding. The main driver of the collapse in copper appears to be concerns over Chinese growth and not just because of concerns over trade wars. China is also trying to crack down on the massive levels of debt in its economy. That's a good thing, but it's hard to do without denting demand and squeezing growth. I guess that's what happens when your economy becomes addicted to debt.

(Copper: three months)

Bitcoin appears to have found a level that it's comfortable at for now. The cryptocurrency appears to do well at points when investors are keen to shift money out of China. In other words, it's a great mechanism for facilitating capital flight. Which, when you think about it, could be very useful in our de-globalising world and one in which various trade barriers are being thrown up across the board.

(Bitcoin: three months)

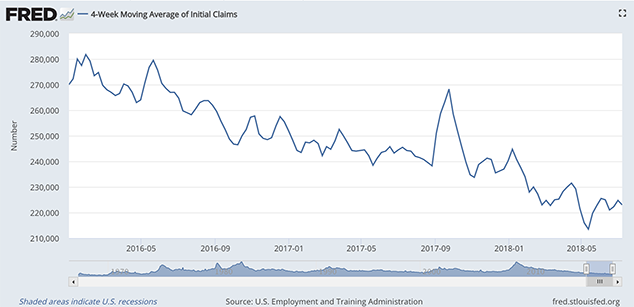

On US employment, the four-week moving average of weekly US jobless claims fell slightly to 223,000 this week, while weekly claims fell to 214,000. David Rosenberg of Gluskin Sheff notes that, in the past, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), then a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough of 213,500 about two months ago, so if there's anything to Rosenberg's observations (which are of course drawn from a limited pool of past cycles), then we should see the stock market hit new highs before this cycle is out.

And of course, at this rate, we could well see a fresh trough in the near future, although the labour market is so squeezed now that this may be a stretch.

(US jobless claims, four-week moving average: since January 2016)

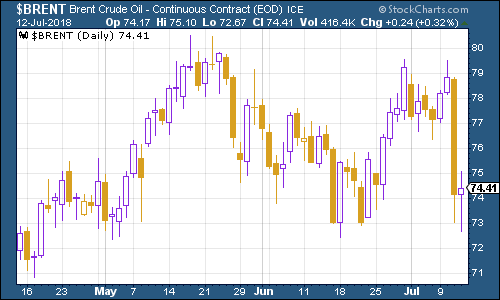

The oil price (as measured by Brent crude, the international/European benchmark) took a big hit this week as fears about the impact of trade tensions on global growth picked up.

(Brent crude oil: three months)

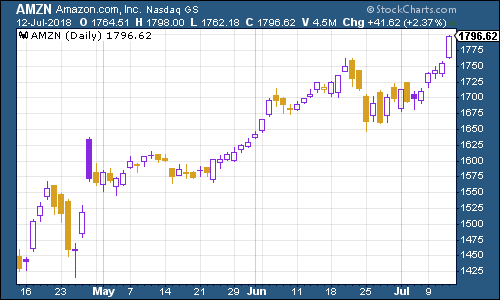

Another stunning week for Amazon. The stock hit new highs this week, partly helped by excitement in the run-up to "Prime day", which is its big annual sale. Whatever you think of the giant disruptor and lots of us work in industries that Amazon has upturned, so I'm sure many have mixed feelings about it it's an incredible company.

Still too expensive for my tastes though.

(Amazon: three months)

Electric car group Tesla had an unusually calm week share-price wise. This week, founder Elon Musk got in a strop about newspapers calling him a billionaire, even although he is well a billionaire. To be fair, a lot of these guys get annoyed if you underestimate their net wealth (which is usually a sure sign that they've got a lot less money than anyone thinks), so at least it's different.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Hints of private credit crisis rattle investors

Hints of private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control