How to cash in on the boom in cloud computing

Looking for the best way to invest in the inexorable rise of the world’s hottest technology businesses? You need to invest in the gatekeepers of the cloud, says Rupert Foster.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Since January 2015 the market capitalisation of Amazon has risen by $630bn a quite staggering increase of 550%. The company is now worth around $770bn. The natural conclusion is to assume that this impressive leap in value is all down to Amazon taking over the retail universe, and laying waste to the world's high streets and shopping centres as it does so.

And yet, you'd be wrong. Amazon may have disrupted or destroyed the business models of everyone from booksellers to supermarkets by selling goods online, but the main factor behind its more recent gains accounting for more than 50% of the rise in its market capitalisation is the soaring value of its "cloud" business, Amazon Web Services (AWS), which is now valued at around $400bn, up from just $40bn in early 2015. In short, Amazon's spectacular recent gains don't come from selling items out of warehouses stuffed with physical goods, but from being paid to store data in warehouses stuffed with banks of servers.

Amazon is far from being the only big-name beneficiary of the booming cloud business. Microsoft perhaps best known as a PC software behemoth has seen its own market cap rise by $445bn since early 2015. At least 80% of this gain is down to its own cloud business, Azure, and other cloud-related product areas. Other companies reaping vast value gains from the cloud include software services group Salesforce.com, search-engine giant Google and computing giant IBM. Which leads us neatly to what may be your most pressing question right now what exactly is the "cloud"?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What is the cloud?

The cloud is simply a way to store data remotely, in a bank of servers located perhaps in the same office building or somewhere else entirely, rather than in the hard drive of your computer. As long as you have access to the internet, you can then draw that data down or play with it, in the cloud, whenever you choose. In the early days of the cloud, most big companies built and owned their own data centres, stocked full of computer servers on which the data was stored. They would also own and run "redundancy" data centres, to act as back-up in case the first ones failed to work. This is known as "private cloud" provision ie, you create your own cloud.

The problem with private cloud provision was that it meant all of these big companies had to manage their own data centres. This generally was not their core competence you don't necessarily want to be spending a lot of time sourcing and managing increasingly complex IT equipment if you're running an investment bank, for example. Thus, when the opportunity came to outsource data-centre management, it was assumed that most companies of any size would jump at the chance to shift from their private clouds to the "public cloud".

In reality, the initial phase of growth took longer than anticipated. Companies worried about the security implications of moving to the public cloud having someone else looking after their sensitive data seemed a step too far. They were also concerned about the quality of their internet connections how could they access the data if web access went down? not to mention the cost of closing the data centres they had already built themselves. Yet security fears have been allayed over time by a lack of breaches at the large public-cloud operators. Internet speeds have been fast enough for all forms of cloud usage for a number of years now (unless you are a retail customer in rural England!). And as for the final point, companies have mostly decided to keep their legacy data centres, while electing to fill any of their new data storage needs by moving onto the public cloud. As a result, legacy or "on-prem" (short for "on-the-premises") data centres have only seen a very slow decline, while the growth of public-cloud usage has been slower than was first anticipated ten years ago.

Born in the cloud

However, the most cloud-intensive businesses of the modern age were all created so recently that they don't have any legacy data centres to be weaned away from. Indeed, these internet businesses have built their business models around the outsourced public cloud Amazon itself being a prime example. All of Amazon's e-commerce sites were stored on AWS by 2009. AWS was included within Amazon Retail until 2012, and Amazon Retail was its largest customer. Nowadays AWS's largest customers include film- and television-streaming giant Netflix, rent-a-room specialist Airbnb and music-streaming group Spotify. One of Microsoft's largest customers is taxi service Uber.

Cloud IT spending

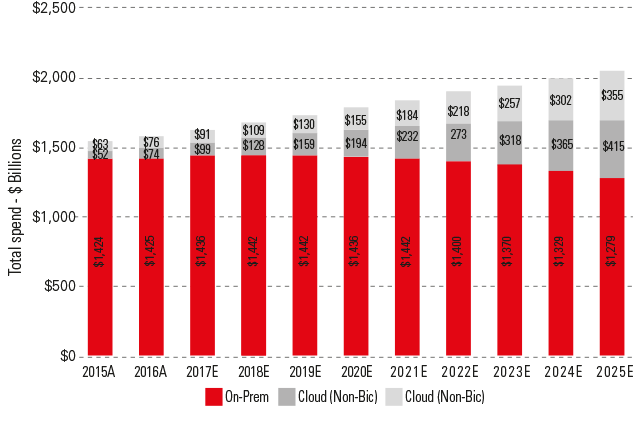

These companies are all really only capable of existing because of the public cloud. Most of them started small and without the capacity to build huge data centres off their own bat, and as it turned out, they didn't need to. It's these "cloud native" businesses, rather than traditional firms, that have been the main drivers of public cloud growth in recent years. Overall, about a third (roughly $1.6trn) of global IT spending of around $4.8trn is related to the cloud, and spending on private cloud provision still dominates overall industry spending. So far this has been stable, although as the chart above shows, it is expected to fall in the future, which means that investors remain very focused on public cloud provision in its myriad forms.

Swimming through alphabet soup

As you may have noticed, the cloud is an area awash with acronyms. There appears to be nothing that IT engineers enjoy more than making up confusing acronyms for every aspect of their business lives, and then using them as much as possible to prevent any outsider from deciphering anything useful about their industry. In IT speak, the cloud is broken up into three main areas. Infrastructure-as-a-Service (IaaS) relates to the provision of remote data centres about $40bn is set to be spent on IaaS this year. Platform-as-a-Service (PaaS) is similar, but instead the cloud is hosting applications that can be used by developers or end users spending here is expected to reach $15bn this year. Finally, there's the largest area Software-as-a-Service (SaaS). This refers to the hosting of all services on the cloud, such as Microsoft Office 365 (which offers widely used word processing, spreadsheet and presentation software), or Salesforce.com's customer relationship management software.

As data centres and other equipment used for private clouds run by individual companies become obsolete, they are likely to be gradually replaced by public cloud services. Public cloud services are almost natural oligopolies. There are two main reasons for that. Firstly, the economies of scale are extremely powerful. Secondly, the ability to catch up with a leading player is nigh-on impossible for a late entrant (unless they focus in small niche areas what's known as the "edge of the cloud" in IT speak). This is good news for the main companies in the sector because there is still plenty of room for growth.

Goldman Sachs estimates that IaaS and PaaS have barely scratched their potential market to be specific, they reckon that only 7% of that market has been penetrated so far. Penetration is increasing very slowly at a rate of 1%-2% growth per year but due to the relatively small number of leading players in the sector, this means dramatic growth rates for the companies best placed to take advantage. The SaaS space, meanwhile, represents a larger, more competitive, market, with many more players jostling for attention. But the oligopolistic players in the IaaS and PaaS space still have major advantages here, in terms of their ability to bundle SaaS products to benefit their customers. AWS doesn't just offer storage to its customers it also currently offers 103 different cloud-related services, and this number is rising on a monthly basis. Most analysts see no reason why over time cloud services can't account for 50%-70% of the market overall, which suggests that the main players will enjoy strong growth in this market for the next ten to 20 years.

The cloud-market leaders

The three biggest players in the sector are AWS, Microsoft, and GCP (Google). Last year AWS had a 42% share of the public cloud business, Microsoft came second at 14%, and Google lagged behind at 5%. This year alone the three plan to spend about $30bn between them on developing their businesses. Microsoft is seeing the fastest growth an incredible 100% a year, while AWS grew at a 46% annual rate in the last quarter. At this rate, Microsoft will have a 22% share of the market by 2019 while AWS's will have fallen to 35%. Microsoft's secret weapon is the corporate relationships it has built up during 30 years of providing Windows software to customers around the world. AWS, by contrast, only came into existence in 2006, and moreover, because Amazon is so active in other industries such as online grocery and food delivery AWS is effectively barred from an entire range of businesses who don't want to "get into bed" with the perceived enemy. As for the third major player, Goldman Sachs reckons that Google can build its market share up to 10% by next year, helped by its superior machine learning and artificial intelligence capabilities.

Use of the public cloud has accelerated in the past year hence the strong share-price performance of the leading names in the sector. This acceleration is usually a sign that a technology is moving into the mass market, and it's true that public cloud companies are increasingly making inroads into new companies by selling them services that they can use on their own private clouds. These include ways to analyse and use data to make an underlying business more effective. Google and Amazon have multibillion dollar research and development budgets for advanced technologies such as artificial intelligence and machine learning, which means that their product offerings generally dwarf anything a customer can create in-house.

Should you invest in these companies?

In short, this is a rapidly growing sector with plenty of room to get even bigger. And the biggest players have a near unassailable position. As a result, AWS, Microsoft Azure and Google Core are all great growth businesses. But they have seen huge share-price gains too. So is the good news in the price?

AWS is usually valued on an enterprise value (EV) to earnings before interest, tax, depreciation and amortisation (Ebitda) basis. This takes account of the company's high levels of capital expenditure necessary investment for future growth. Traditionally, a valuation of 15 times EV/Ebitda would be seen as high the Macau casinos traded up to that level in their boom of 2008-2014, for example. AWS currently trades on a multiple of 25 much higher than that. However, the business does have 60% Ebitda margins and sales growth of 46% a year and climbing. With market penetration at just 7% right now, there is also a decade or two of growth to come. So if growth rates can be maintained along with Ebitda margins (which, in fact, should actually rise as economies of scale improve further with size), the multiple would collapse to just seven times within four years. Given that many analysts expect growth to accelerate for the next 12-24 months before it starts to slow, that still looks a good valuation to me.

Microsoft trades on a price/earnings (p/e) multiple of 26 times for this year, which is a little less punchy than AWS's valuation. However, the whole Microsoft business is growing more slowly than AWS and Amazon, as the cloud business only makes up 15% of Microsoft's total group revenue. It will grow to be 35% of total group revenue in two to three years' time, and will allow Microsoft as a whole to see 15% annual earnings growth for the next two to three years. Given that, 26 times might seem high but as with AWS, this is growth that looks set to be predictable for many years.

However, the one thing we know in equity markets is that something will upturn the apple cart the difficulty is predicting when. Some analysts stress that SaaS is a more efficient service than IaaS/PaaS and that this will let rivals such as Salesforce.com steal growth from the public cloud triumvirate. Others stress that "edge of the cloud" technologies will get larger as clients' needs become more complex, making it harder for the big players to cater to the whole market.

Others see the risk of new entrants. Facebook has the server scale to get involved if it chooses and in China the triumvirate is excluded the market there is dominated by the traditional Chinese duo of Alibaba and Tencent. They can match the triumvirate for resources and thus capital spending budgets so when will they start to sell cloud services overseas? Lastly, as we have seen with Google in the search-engine business, and Google and Facebook in online media, competition authorities start to get interested when dominant players begin to make too much money and abuse their positions.

The public cloud space has all the makings of that story, with the added feature that the triumvirate (and its nearest rivals) are all US or Chinese businesses. Thus, European regulators and competition authorities are likely to be the first to query the power of AWS, Microsoft and Google in this sector. Yet many of these risks seem mid- to long-term, and so it's likely that for the next 12-24 months Amazon, Microsoft and Google will continue to provide investors with strong returns based on their hold over the public cloud. If you haven't bought in yet, there are still plenty of gains ahead.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is an investment strategist and adviser at J & C Foster, providing Asian, Consumer and Global Equities Strategy advice to a number of family offices and portfolio management organisations. He writes on Asia and Global Macroeconomics for a number of investment publications including MoneyWeek and HL Investment Times.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Is the AI boom a bubble – and will it burst?

Is the AI boom a bubble – and will it burst?Massive spending on AI infrastructure is starting to spook investors, but experts say the bubble doesn’t look like bursting yet

-

Amazon stock falls as AWS results underwhelm

Amazon stock falls as AWS results underwhelmApple stock rose after earnings on a return to growth in China; Amazon's share price fell despite an earnings beat

-

Nvidia dethrones Microsoft to become world’s most valuable company - should you invest?

Nvidia dethrones Microsoft to become world’s most valuable company - should you invest?The chipmaker’s share price continues to soar, leaving all in its wake. What is behind Nvidia’s rise?

-

Amazon shares fall on profitability concerns

Amazon shares fall on profitability concernsA big increase in capital spending plans compounded an earnings miss for Amazon following its Q4 results

-

3 ways to play the artificial intelligence boom

3 ways to play the artificial intelligence boomArtificial intelligence will play a huge role in many sectors. Look for a wider range of ways to profit.

-

What is Steve Ballmer's net worth?

What is Steve Ballmer's net worth?Steve Ballmer was Microsoft’s CEO from 2000 to 2014, and his huge net worth comes from his position at the top of the tech company

-

What is Jeff Bezos' net worth?

What is Jeff Bezos' net worth?Jeff Bezos' net worth stems from his large holdings in Amazon stock. We look at how he established the world’s biggest e-retailer, his space and media investments, and what’s in store for the James Bond franchise

-

Tap into the key long-term growth trends with these resilient performers

Tap into the key long-term growth trends with these resilient performersA professional investor tells us where he’d put his money. This week: Zehrid Osmani, portfolio manager, Martin Currie Global Portfolio Trust, picks three favourites.