Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

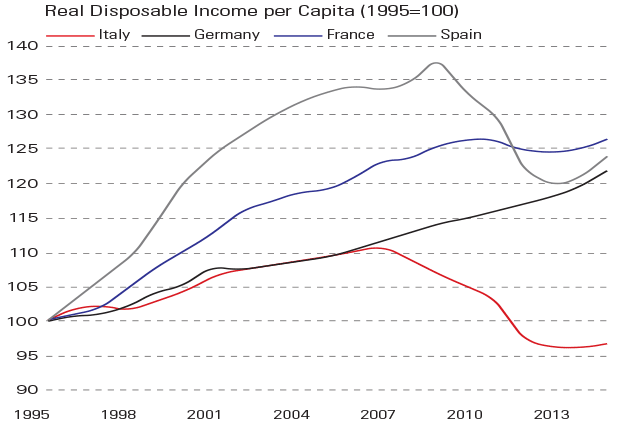

Italian equity and bond prices slipped sharply this week as a populist government took office. This chart highlights a key reason it was voted in. Inflation-adjusted disposable income per head has slipped below 1995 levels, while people in other big economies have become richer.

Before it adopted the euro in 1999, Italy was always especially inclined to inflate its way out of trouble by cutting interest rates, devaluing the lira or increasing government spending. Under the single currency the first two policies are impossible, while the third is heavily circumscribed by Brussels.

Unable to bolster the economy's potential growth with strong investment and structural reforms, Italy has slipped into an economic coma.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"Political risk is now the main driving force of financial markets. In 2017 investors... thought they had learned that political upheavals just create noise, with no lasting effect on market trends that are set by economic fundamentals. But in 2018 this relationship has been reversed. Wherever we look today at oil prices, global trade flows or conditions in Europe politics seems to overwhelm economic fundamentals and set the market trends... Will Italy crash out of the euro or cause an earth-shattering bond default? Almost certainly not. But [it] may have to suffer a Greek-style crisis to force a U-turn in populist politics similar to the one inflicted on [Greece] by the markets and the European Union a politico-economic crisis in Italy now seems like the biggest political risk facing... markets, outweighing the US-China trade [spat] or... the soaring [oil] price."

Anatole Kaletsky, Gavekal Research

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how