Want to profit from a gold rush? Invest in the picks and shovels

Investing in a booming industry can be a risky business – only a lucky few will strike gold and produce the hot products of the future. There’s a much safer way to bet on fast-growing sectors, says Dr Mike Tubbs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In investment parlance, a "picks-and-shovels" business is one that supplies essential equipment to companies in an industry, rather than the industry's end product. The term was coined during the Californian gold rush of the late 1840s, where some of the most successful businessmen were those selling supplies to the miners, rather than those mining for gold. The former made money whether gold was found or not as a result, it was a relatively safe way to profit from a highly speculative, highly risky industry.

Likewise, when a major new technology trend emerges, entrepreneurs can either aim to create a new consumer product (the equivalent of mining for gold few get lucky and most go bust), or they can create the tools that will be needed by all the companies that are aiming to make successful consumer products based on that technology (in other words, they can supply the picks and shovels).

The makers of the end products admittedly tend to be better-known, "sexier" and get the most press coverage. But while picks-and-shovels providers might not get the fame and the column inches, they are also often lower-risk investments. In any hot new technology sector, it's very difficult to predict which end-product manufacturer will be the last one standing, and which producers will struggle or even fail. By contrast, the picks-and-shovels companies don't care who wins they supply all contenders.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A classic example is the smartphone, where British chipmaker ARM supplied almost all the low-power consumption processor designs used by smartphone makers including Apple, Samsung, HTC, Huawei and Sony, among many others. By 2010, fully 95% of smartphones were using ARM chips. As for an example that demonstrates the risks of buying even apparently successful end-product providers, remember that Nokia was the leader in mobile phones for years but ended up falling by the wayside as the smartphone took off.

So what makes a successful picks-and-shovels supplier? Such companies typically have strong technological and sales skills suitable for building business-to-business relationships. End-product companies, on the other hand, are mostly business-to-consumer, and so need to have strong brands and marketing skills, as well as the ability to predict changing consumer tastes. Below, I take a look at several examples from different industries to illustrate what these companies do and how successful they can be, despite their relative lack of press coverage and advertising. We will also develop some guidelines for choosing promising future picks-and-shovels plays, which are mostly found in high-tech sectors such as biotech, pharmaceuticals, electronics, engineering, software, and technology hardware.

What to look for in a high-tech multi-bagger

Our first excellent example is taken from the biotech sector. Abcam (LSE: ABC) short for AntiBody CAMbridge, as it was founded by Cambridge University researcher, Jonathan Milner supplies antibodies and proteins to biotech researchers all over the world. Its technical expertise lies both in making a range of its own antibodies and in preparing a detailed technical data sheet for each antibody that it sells (whether of its own manufacture or from a third party that it has qualified). Abcam's key sales channel is an excellent website on which customers can view all its products with their datasheets and order their requirements. This website also acts as a platform for sales of its third-party suppliers' products, which is why the company is sometimes called "the Amazon of antibodies". Abcam shares are up from around 380p in April 2014 to around 1,240p recently.

Our second example is from the video-games sector. Video-games publishers have many similarities to gold miners some games do not catch on and some never even manage to cover their development costs, while others become roaring successes to rival Grand Theft Auto. But Keywords Studios (LSE: KWS) avoids this uncertainty it supplies games publishers with technical services such as localisation (translating a game to a different language and culture), providing audio, artwork, quality assurance and virtual reality. Keywords thus makes money whether a game is successful or not. The company has a lot of technical expertise so it can provide its wide range of technical services, but is the only one of our examples not to have R&D as defined for company accounts. Keywords shares are up from 145p in early 2015 to around 1,875p now a 13 bagger in just three years.

A tale of two chip providers

Our third example gives us a chance to look at some of the characteristics of a picks-and-shovels provider that are best avoided. Above we mentioned ARM, a huge success story in the semiconductor market. However, a cautionary tale from the same sector is the sorry story of Imagination Technologies. This company specialised in mobile graphics processors, and also owned a consumer electronics division called Pure. In April 2017, the share price fell by 70% when Apple said that it would stop using Imagination's intellectual property (IP) within two years. The collapse reflected the fact that Apple alone accounted for half of Imagination's revenue. In the end, the company was bought by Canyon Bridge, a China-aligned private-equity fund in September last year. Investors saw the share price fall from 445p in April 2013 to 104p in May 2017. This long decline reflected both ARM's decision to start supplying graphics chips (thus entering the sector as a major competitor) and Imagination's over-dependence on one customer who decided to stop using its key product.

Neither ARM nor Imagination are still listed. However, there is another very interesting picks-and-shovels play in the semiconductor hardware sector. ASML (Amsterdam: ASML) provides precision lithography equipment to most semiconductor chipmakers. Lithography is the key step in chip-making and ASML is the world leader. It has only one competitor, Nikon. As the leading company in the sector, ASML supplies most major chipmakers whether or not they are very successful in the market. ASML shares are up from €48 at the start of 2013 to roughly €160 recently.

Leaders in healthcare, engineering and software

ASML is the stronger of the two companies forming a global duopoly for precision lithography. This provides a wide protective "moat" against competition. A similar example in the health sector is Elekta (Stockholm: EKTA-B). This is one of the two companies that form an effective global duopoly in radiotherapy equipment. Global duopolies normally make for excellent pick-and-shovel investments.

Turning to the software sector, an interesting option is Craneware (LSE: CRW), a UK company whose entire revenue comes from the US. Hospitals in the US use Craneware's software for processes such as charge capture and pricing, revenue collection and retention, patient engagement, and cost analytics. Craneware's Chargemaster Toolkit is well known and respected among US hospital groups and the company is reported to have its software in a quarter of all US hospitals. That offers a platform for growth into the other three-quarters, as well as revenue growth by steady expansion of its suite of software products through new products. Craneware's position as a supplier gives it higher profitability and growth than the hospital sector it serves. Craneware's share price is up from 345p in mid-2013 to 1,825p now.

Our next example is Renishaw (LSE: RSW), which provides precision metrology tools to a wide range of manufacturers, who use them to assure product tolerances and quality and to maximise production output. It also makes metal 3D-printing systems and has a precision healthcare division. Renishaw invests heavily in research and development, and sells its products all over the world. It exhibits at all the major machine-tool exhibitions, where it meets customers and potential customers. The shares are up from 1,700p in early 2016 to 5,340p now.

Our final example is another from the healthcare sector. Illumina (Nasdaq: ILMN) provides the tools and services needed for genome sequencing. This is an increasingly important process in biotech research, and in the new area of personalised medicine, where drugs are tailored to a patient's genetic make-up. Illumina is the global market leader in this area and has continually developed its machines to bring down the cost of sequencing and thereby expand the market. Illumina's shares are up from $32 at the start of 2012 to around $255 recently an eightfold rise in six years.

So what makes a successful picks-and-shovels play?

These and other examples suggest a series of guidelines for selecting successful suppliers of picks and shovels whatever the industry. Firstly, the company needs to have a strong position in its global sub-sector or target-market niche. A company that dominates its global market, or forms one member of a global duopoly, is a good example of a particularly strong position. And there shouldn't be a stronger direct competitor with superior products in its market niche.

Secondly, it will have a technically advanced product range that is continually being improved through R&D, and could be supplemented with bolt-on acquisitions. Thirdly, it will have a strong balance sheet so there are no concerns about debt, and a cushion to take the company through any temporary recession. Finally, it will not be dependent on a single large customer as Imagination was with Apple.

The requirement for a strong market position means companies meeting these criteria are likely to be medium sized or bigger, and often of the size needed to enter the FTSE 350 or its overseas equivalents. I've listed the main characteristics of several of the companies that we have mentioned in the table below. The data comes from 2016-17 annual reports, except for that on ARM, which was acquired by Softbank last year and so its 2015 report was its last as a public company. Profitability (the fifth column along) is defined as operating profit/sales.

Successful investing in picks-and-shovels suppliers

It is clear from the table that these seven companies are highly profitable and invest heavily in research and development with the exception of Keywords, which boasts a wide range of technical expertise rather than conventional R&D and have strong finances (net cash). The measure of Abcam's R&D as a proportion of sales is lowered by the third-party sales that are an integral part of its business model, as these allow it to offer the widest possible range of antibodies and proteins to researchers. The attractive returns delivered by most of the picks-and-shovels providers described above demonstrate the benefits of investing in such companies if carefully chosen, they can offer steady growth and high profitability. The case of Imagination Technologies shows, however, that it is important to be aware of the four criteria we mention above and to actively use them in screening potential investments.

The companies in the table below have all delivered share-price gains well ahead of the FTSE 100, and we believe this is likely to continue, although some are currently standing at fairly high price/earnings ratios. The FTSE 100 was up 11% from early March 2013 to early March this year, whereas the companies in the table have enjoyed increases ranging from over three times in two years (Renishaw) to 13 times in three years (Keywords). We look at other promising stocks below.

Five more promising picks-and-shovels investments

As well as the seven excellent picks-and-shovels companies in the table above, investors should examine other options in different market niches as part of building a diversified portfolio which will also go some way to protecting you from potential Imagination Technologies-style scenarios. The following five companies all have strong market positions and good prospects in their respective niches.

Checkpoint (Nasdaq: CHKP) is the largest pure-play cybersecurity company in the world. It is currently enjoying steady growth and high profitability. Cybersecurity is an issue for most companies these days, all of which need to protect their businesses from the financial and reputational risks arising from hacking. Some 70% of the company's revenue is predictable since it comes from maintenance and subscriptions.

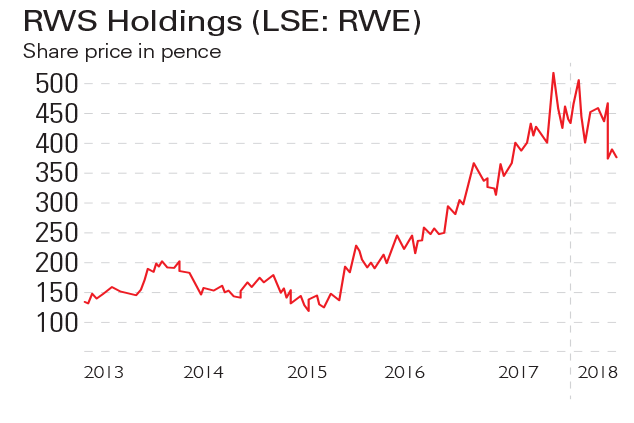

RWS (LSE: RWS) is the global leader in translating patents into different languages for the biopharmaceutical industry. Patent translation needs to be of very high quality, because errors in just a few words can substantially reduce the strength of a patent. As a result, reputation matters in this business, giving RWS a decent-sized "moat".

Salesforce.com (NYSE: CRM) has an almost unassailable market position in CRM (customer relationship management), with more than four times the market share of the second player in the sector. The company has strong growth and high free cash flow, and it invests 14.4% of sales in research and development, enabling it to maintain its lead in the sector.

Symrise (Frankfurt: SY1) is one of the four largest fragrances and flavourings companies in the world, supplying the food, beverage and pharmaceutical industries. The company has a track record of growth using both R&D and acquisitions.

Software company Wirecard (Frankfurt: WDI) offers electronic payment services, card and account products in countries around the world. It has a banking licence and can offer companies an end-to-end infrastructure solution for card and mobile payment products.

These five companies, together with the seven listed in the main story above (Abcam, ASML, Craneware, Elekta, Illumina, Keywords and Renishaw), provide a wide variety of picks-and-shovels plays for investors. They come from widely differing industries, which means you can easily diversify by investing in a number of them, further lowering your risk.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how