Short Tesla – again

Electric-vehicle company Tesla is still struggling to produce enough cars, and the share price is down 20% form it peak. Short it, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Elon Musk's electric-vehicle company is still struggling to produce enough cars.

The past nine years have been great for technology investors. Near-zero interest rates and money printing meant a lot of money chasing a limited number of opportunities. Politicians and pundits were queueing up to jump on the tech-stock bandwagon, and it didn't seem to matter that companies were a year or even decades away from making profits. However, since the start of last year, things have been changing.

There are several reasons for this. High-profile events, such as the controversy over Facebook's influence on recent elections, have dented public confidence in the tech giants. The collapse in the value of bitcoin at the turn of the year (its recent mini-rally notwithstanding) has also made people think again about tech shares. And rising interest rates mean that investors are starting to care more about the financial sustainability of companies, including those firms whose value depends on guesses about profits that may only appear long into the future, if at all.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While all technology companies have struggled in this environment, one firm that has done particularly badly is the electric-car company Tesla (Nasdaq: TSLA). You may remember that I suggested you short it in July 2017 (issue 854) only to recommend that you close the position 18 months later in January (issue 880) at a significant loss. Since then the price has fallen to $280, 20% down on its peak, fuelled by a voluntary recall of 123,000 cars and the controversy over its role in investigating a recent fatal crash. That crash may be the least of Tesla's worries, however.

Earlier this month Tesla missed its targets for production of its Model 3 saloon. Production was halted for the second time in two months to give it a chance to improve the manufacturing process. And, while Tesla says it has solved many of the problems that were preventing it from increasing production, it needs to be able to sell enough models to generate the cash needed to support its high levels of debt, something that is particularly important when interest rates are rising. If it can't, it may have to issue more equity, which would hit the share price.

There are also questions about its longer-term plans. Short-seller Jim Chanos, a long-standing critic of the company, has pointed out that, despite Tesla's promise to produce two further models one next year and the other in 2020 there are few signs that it is doing any of the production work for this. Meanwhile, its major competitors are quietly getting on with their own plans for electric cars.

Despite my previous negative experience with shorting the company, I think you should short Tesla at £4 per $1 at the current price of $283. In that case, you should cover the position if it goes to $425, giving you a possible downside of £568.

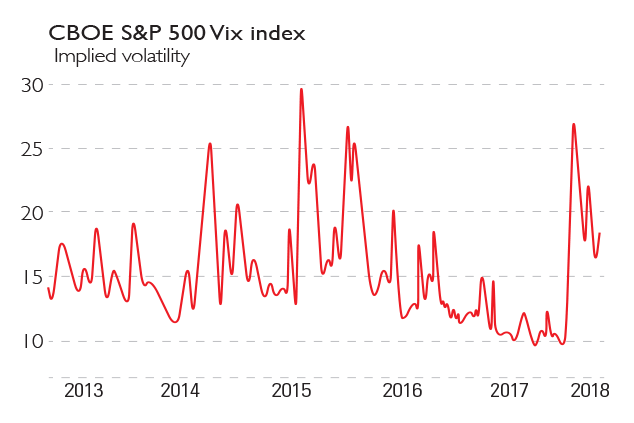

Trading techniques: following the fear index

The CBOE Volatility index (better known as the Vix and sometimes called the fear index) is derived from the price of call and put options the right to buy (call) or sell (put) an asset at a set price for a certain time on S&P 500 futures traded on the Chicago Board Options Exchange. It uses the price of these options to work out the implied volatility of the stockmarket which, put as simply as possible, means it measures how risky traders consider the stockmarket to be.

As with many sentiment indicators, there is much debate over how to react to changes in Vix levels. Some consider a high Vix to be a sign to adopt a more cautious position, since it implies that market sentiment is negative. On the other hand, contrarians see a high Vix as a sign to consider increasing your position to take advantage of the opportunities created by fear. Because the Vix can be quite a volatile index itself, some traders don't use the raw Vix, but rather a moving average of the past ten or 20 days to give a smoother snapshot of the current level of market fear.

Buying during the major spikes in 1998, 2010 and 2011 would have made you money, but would have cost you dear in 2001, 2002 and just before the collapse of Lehman Brothers. A study by Fabio Cacia and Rossen Tzvetkov of Lund University found that a contrarian strategy of taking a long position in S&P 500 futures when the Vix was high and selling when it was low would have outperformed the market. But the study only tested for this during two short periods 2001-2002 and 2006-2007 so it's hard to draw any firm conclusions from these results.

How my tips have fared

It has been an eventful fortnight. Firstly, property firm Hammerson's shares plunged due to the French company Klpierre withdrawing its takeover bid (see page 23). The shares have bounced back, but the move automatically triggered the adjusted stop-loss that I had recommended in issue 889, closing out the position at 510p for a modest loss of £24. The prices of three of my other long positions, Micron, IG Group and Renault, have also fallen, though all three are still making money.

Fortunately, mixed in with this bad news, some of our long positions have done better, with the share price of both Brazilian oil firm Petrobras and pub chain Greene King rising. My Petrobras trade is now making a profit of £782.50. However, it's Greene King that is the start performer, rising 100p over the last 14 days. This is because of its recent trading update, which said that despite sluggish sales from the bad weather in March, the company would stick with its current profit guidance and did not expect to reduce its dividend. This means that we are already making a paper profit of £400.

My short positions aren't doing so well. Bitcoin's rally to $9,200 the highest that it has been for five weeks has slashed profits on that trade from £1,100 to £506. At the same time the S&P 500 has risen to 2,670, cutting the profit there to £45. So my shorts are making a combined profit of £551, down from £1,285 in issue 891. Add in the £2,233 profits from our long positions and deduct the losses from our closed positions and you come up with overall profits of £1,770.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?