The pharmas making pills tailored to your genes

Reading your genome is becoming easier and cheaper. That makes it possible to figure out which medicines will work for you. Dr Mike Tubbs picks the companies best-placed to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Reading your genome is becoming ever easier and cheaper. That makes it possible to figure out which medicines are more likely to work for you. Dr Mike Tubbs looks at the companies best-placed to profit.

Californian twins Alexis and Noah Beery werefirst diagnosed with cerebral palsy in 1998. By the age of two, the pair had failed to meet various developmental milestones and their parents, Joe and Retta, were understandably very worried. After treatment started, the twins appeared to improve, but by the time they were five, Alexis in particular started to regress, and her parents noted that the symptoms didn't match up to those of the typical cerebral-palsy sufferer.

Dogged research by Retta eventually led to a new diagnosis of a rare genetic disorder called DRD, which resulted in low levels of dopamine. Yet while treatment with an artificial dopamine drug (L-dopa) helped, other symptoms persisted and worsened. By this point, Joe had taken a job with a company that made genome-sequencing machines and, in 2010, the parents arranged to have the twins' genomes sequenced.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The results showed that the twins had both inherited a gene variant from each parent that, together, caused them to have low levels of not just dopamine but also two other neurotransmitters serotonin and noradrenalin. As a result, the twins were treated with both L-dopa and a supplement called 5-HTP, a precursor for serotonin. This has enabled the twins to live normal lives and take part in sports something that was inconceivable after the original diagnosis of cerebral palsy, and before the correct treatment was started. The Beerys provide a striking example of the power of personalised medicine the use of advanced diagnostic techniques to produce far more precise and effective treatments tailored to an individual's specific circumstances. And the good news for both patients and investors is that the field is coming on in leaps and bounds.

The power of genome sequencing

The cost of whole-genome sequencing has fallen dramatically to the point where it is now perfectly feasible for it to be used as a common diagnostic tool. The very first sequencing of a human genome in 2003 cost $2.7bn, but by 2006, this had fallen to $300,000 per person. By the time the Beery twins' genome was sequenced (around 2010), the cost was around $100,000. By 2014, that had fallen to just $1,000 and the new target is now $100. The global leader in sequencing systems is Illumina, which launched its first sequencing machine in 2006. Low-cost portable DNA sequencers are also now being made and sold by Oxford Nanopore, a UK company in which IP Group has a 19.6% stake. Oxford's latest funding round has raised funds to build a 34,000-square-foot manufacturing facility in Oxfordshire to produce the devices.

Swiss healthcare giant Roche was one of the first to spot the potential of using genetic diagnostics for personalised medicine in 2012, it bid $6.2bn for Illumina (which fended off the approach, and now has a market value of more than $34bn). Roche has continued to combine a focus on diagnostics with the development of powerful drugs its diagnostics division accounts for 23% of total revenue with the other 77% from biopharmaceuticals. Total 2017 revenue was CHF53.3bn, with diagnostics revenue at CHF12.1bn.

A well-established example of the use of gene identification to predict which patients will respond to a specific drug is the HER2 status test taken for breast cancer. HER2 (human epidermal growth factor receptor 2) is a gene which, in about 25% of breast cancers, causes breast cells to grow and divide in an uncontrolled way. If a breast cancer is found to be HER2 positive, then a drug such as Roche's Herceptin can be used to block the ability of the cancer cells to receive the chemical signals that tell them to grow. Roche has also developed the drug Zelboraf, which is approved for use in treating metastatic melanoma (melanoma which has spread to other parts of the body) with a mutation known as "BRAF V600".

Another example of the importance of gene identification is the inherited genetic mutation of the BRCA1 (actress Angelina Jolie had a double mastectomy in 2013 when she discovered she was a carrier) and BRCA2 genes, which gives a seriously increased risk of breast and ovarian cancer. About 12% of women in the general population will develop breast cancer sometime in their lives. But this figure rises to about 70% for women carrying the BRCA mutations. So it is vital for women with a family history of breast cancer to have their genome testedfor these mutations to give them the option of preventative treatment.

Gene identification is also leading to new hope for patients with serious diseases that previously had poor prognoses. For example, cystic fibrosis (CF) is one of the most common genetic diseases. It causes a thick, sticky mucus to build up in various organs. About 4% of cases are caused by a genetic mutation called G551D which causes a "gate" controlling the movement of charged salts in and out of cells to be wedged closed. However, a drug called Kalydeco from Vertex Pharmaceuticals can restore operation of the gate. So patients with CF are now tested to see whether they have the G551D genetic mutation and would therefore benefit from Kalydeco. Meanwhile, the latest NHS pilot project on targeted treatments is using genetic tests to determine the most effective drug to use on patients with common ailments such as depression and asthma.

The rise of personalised medicine

So it's no surprise that the development of personalised medicine is accelerating rapidly. In the last three years, the number of approved drugs linked with a particular biomarker has shot up from 20 to 80, according to Diaceutics, a UK research company. Diaceutics identifies Roche as the clear leader in the field with Janssen (a division of Johnson & Johnson), Novartis, AstraZeneca and Bristol-Myers Squibb also well ahead of the pack. The followers are Eli Lilly, Sanofi, Amgen, Merck and GSK.

Biopharmaceutical companies are also now using genome sequencing in drug development. In 2012, for example, Amgen bought Iceland-based deCODE Genetics, which found that Icelanders aged 85 or older who scored well on cognitive tests were six times more likely to have a specific mutation of the APP gene than Alzheimer's patients. APP is the source protein for amyloid plaque a key indicator of Alzheimer's. Amgen and Novartis are now jointly developing a drug that will inhibit the process whereby amyloid plaques are formed from APP. In other words, they are trying to mimic in patients the protection that the APP mutation was giving to those healthy old Icelanders.

Meanwhile, Regeneron has built one of the world's most comprehensive genetics databases by combining genome analysis with anonymised electronic health records. This database is being used to identify genetic factors that cause or impact on a range of human diseases, which should make drug development faster and more precise.

New diagnostics from smaller companies

Several smaller companies are also developing new diagnostic techniques and collaborating with smaller drug companies on new treatments. An example is Aim-listed company Oncimmune with its EarlyCDT liquid biopsy platform technology (which uses a blood test to detect cancer, rather than a more invasive surgical biopsy). It is commercialising its EarlyCDT-Lung test, which can detect lung cancer up to four years earlier than other tests. It hopes to commercialise its liver test later this year. Oncimmune is cooperating with Scancell on the latter's melanoma (skin cancer) immunotherapy, SCIB-1. A trial of 16 patients with melanoma showed that the Oncimmune test predicted, with above-80% accuracy, those patients that would respond well to Scancell's melanoma treatment. Two-thirds of the patients immunised with this vaccine are "alive and well" five years later. A Phase II trial is expected to start in the latter half of this year.

Another Aim-listed company, Angle, is developing its Parsortix liquid biopsy technology for the early detection of ovarian, breast and prostate cancer. And Oxford Biodynamics is developing its EpiSwitch product platform both for early diagnosis and for distinguishing between responders and non-responders to a particular drug. Recent publications concern the application of this technique to rheumatoid arthritis and neuro-degenerative diseases.

In some cases genetic tests cannot predict in advance whether a drug will work in a particular patient. But the Institute of Cancer Research and Royal Marsden Hospital have developed an exciting new technique in which mini-tumours are grown in the laboratory from a patient's biopsy samples. Testing a drug on such mini tumours is 100% accurate in identifying cancer drugs that will not work on that patient, and 88% accurate in picking out drugs that will in fact shrink the patient's tumour.

Using scanners as precision tools

Personalised medicine is not just about genetic testing. MRI scans, for example, are diagnostic visualisation tools, but can also be used to make treatment more effective and personalised. For example, radiotherapy treatment uses ultrasound or other scans to locate a cancer, so that radiation can be focused on it. But the ideal would be to have simultaneous high resolution MRI ongoing during this treatment, which would enable even more accurate targeting of a tumour. That would result both in shorter treatment times and in far lower doses of radiation being delivered to surrounding healthy tissue.

Elekta, one of the world's leading radiotherapy companies, has partnered with Philips to develop a combined radiotherapy/high field MRI system with adaptive software which shows a high resolution MRI picture during software-controlled radiotherapy treatment. This means that not only is the radiation beam focused very accurately on the tumour, butthat its position can be varied during treatment, to allow for breathing motion and other body movements. The first patient was treated successfully last year, and the Elekta Unity system is now being tested in 16 hospitals prior to commercial launch.

Meanwhile the Elekta Digital project aims to use artificial intelligence to automate the preparation of personalised treatment plans tailored to each individual patient. We round up both this and some of the other most promising ways to invest in personalised medicine below.

The best bets in personalised medicine

Roche (Zurich: ROG) is likely to remain the leader in personalised medicine for two reasons. First, its diagnostics division is the world's largest diagnostics company. Second, it invests more in research and development than any of its rivals in the biopharmaceutical sector, and as a result it has the largest pipeline of new drugs.

Roche is a world leader in oncology treatments and has nearly 90 oncology clinical trials in progress, with 33 of these in Phase III (late-stage) trials. Patents on all three of Roche's topbiologics expire in the US within the next two years, but new next-generation products (including cancer immunotherapy Tecentriq) should allow it to keep growing.

Although it is likely to be a low-risk stock, investors should note that the share price has remained in the CHF220-CHF275 range for the past five years. There is, however, a decent dividend yield of 3.6%, and the dividend has risen every year for the last 30 years.The other large pharmaceutical companies likely to be leaders in personalised medicine include AstraZeneca (LSE: AZN), Bristol-Myers Squibb (NYSE: BMY), Novartis (Zurich: NOVN) and possibly Merck (NYSE: MRK). All have approved immunotherapy drugs on the market.

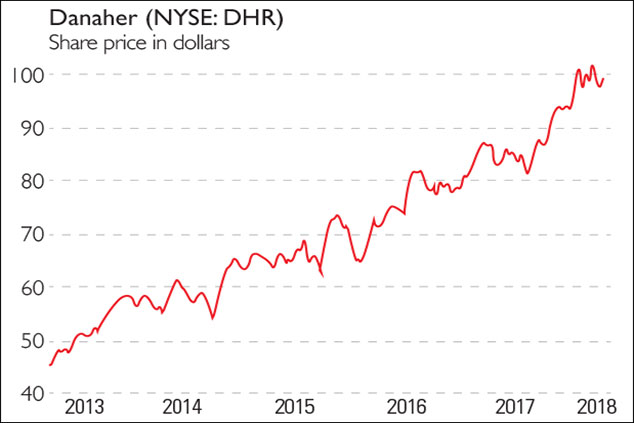

After Roche, the next largest diagnostics companies are Danaher (NYSE: DHR) and Abbott Laboratories (NYSE: ABT), both of which are expected to enjoy fairly strong growth. As well as its businesses in medical diagnostics, and in producing equipment to support life sciences companies, Danaher has environmental and dental businesses. Abbott also has four businesses in diagnostics, pharmaceuticals (mainly branded generics), medical devices and nutrition. Diagnostics accounted for $1.62bn (32%) of Danaher's fourth-quarter sales, and $1.91bn (25%) of Abbott's. The diagnostics units of both Abbott and Danaher have revenues of just under half that of Roche Diagnostics.

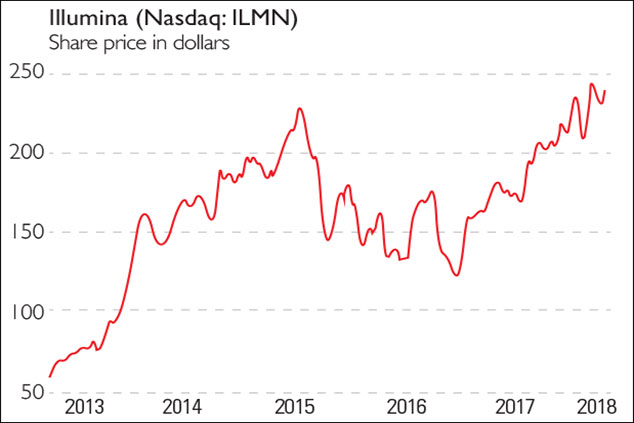

Genome-sequencing group Illumina (Nasdaq: ILMN) has seen its shares rise by more than 650% from early 2012 to early 2018. Little wonder it is a "pick and shovel" company that will be central to the rise of personalised medicine. It is priced for success, but is likely to enjoy continued profitable growth.Oxford Nanopore aims to be a leader in low-cost DNA sequencing but, since it is private, the only investment option is via IP Group (LSE: IPO) (Oxford is the largest constituent of IPO's portfolio). And there is Elekta (Stockholm: EKTAB), the leader in MRI-guided and personalised radiotherapy.

Smaller stocks(many of which are in the main story above) are likely to be riskier, with more volatile share prices. You should wait until any you are considering buying have had regulatory approval for their diagnostics or therapies, and have built substantial revenues, strong market positions, and have strong finances.

Disclosure: Mike Tubbs owns shares in many of the companies mentioned, including AstraZeneca, Bristol-Myers Squibb, Elekta, GSK, Illumina, IP Group, Novartis, Regeneron and Roche.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.