Why gold is a better bet than gold miners

Mining stocks are traditionally a leveraged bet on the gold price. But that no longer seems to be true. Dominic Frisby explains why gold itself is now the better buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In today's Money Morning I want to look at gold and the large gold miners.

I'll consider the relative performance of the two and ask: which is the better investment?

Gold miners: maximising risk, while minimising reward

As my measure of gold miners, I am going to use the HUI (or, to give it its full title, the NYSE Arca Gold BUGS index). BUGS stands for "basket of unhedged gold stocks", meaning these companies do not hedge.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What does "hedge" mean? Some companies will sell their gold before they have actually mined it in order to guarantee a certain price. This practice hedging reduces risk. They know they will get this price for their metal.

But hedging can be disastrous in a bull market: you lock in a certain price, the gold price goes up, and you are forced to sell your gold at the lower price. You lose the benefits of the bull market.

After the bear markets of the 1980s and 90s, many miners carried this practice of hedging over into the 2000s and were made to look like fools, as they were selling their gold at $350 and $400 an ounce, when gold was $750 or $800.

However, I stress that hedging can be a saviour in a bear market. You sell your gold at $500 and it falls to $250 you're a genius.

Anyway, for the purposes of drawing a comparison between gold and the gold miners, we will look only at those large mining companies that do not hedge. Their index is the HUI. (I stress I am talking about large mining companies, not junior explorers and so on.)

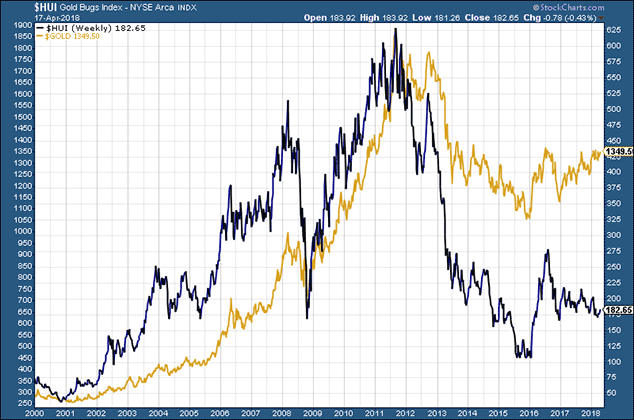

This first chart shows the relative performance of the two since 2000 overlaid. Gold is in gold and the miners are in dark blue.

You can see that over the last 18 years gold has gone from below $300 an ounce to $1,350, or thereabouts, yesterday. The HUI has gone from just below $75 to $182. So the HUI is up around 150%, while gold is up around 350%.

In terms of relative performance, in short, gold has annihilated the miners.

Miners are supposed to provide leverage to the gold price. That is why one speculates in them. If gold rises, say, 20% or 30%, you should be looking at at least a 50% gain in the mining company.

After all, you are taking on the additional risk of buying a mining company the risk of the competence of the management, the political risk, the operational risk and the compensation for that risk is the reward of greater gains.

Except that palpably has not happened. You would have been far better off just buying the metal. Far less risk; far greater gain.

Management of mining companies have to take a lot of responsibility for this. They haven't run their companies well. Incompetence is a sector-wide affliction. Bad decision follows bad decision. Companies are often run in the interests of management, not shareholders.

But there are other factors. Mining is getting much harder. Grade (the quality of the metal taken out of the ground) is declining. Political risk, from environmental campaigning to sudden, unexpected taxes to asset-seizing by dictators, is everywhere. Input costs keep growing.

If you look at the chart, you'll see that the miners really did outperform the metal by some distance from 2000 to 2008. They sold off by more in the financial crisis, but you'd expect that. In the period from 2009 to 2011 the two more or less matched each other.

The bear market that followed was what really separated the two. Gold went from $1,920 to $1,050 a loss of 45%. The miners went from $50 to $6. They lost almost 90%. They certainly gave you the required leverage then.

So, at this point, you're thinking: the leverage on the downside is considerably more than on the upside. What's the point?

The one saving grace comes in the year 2016. The first half was a good one for gold. It rose about 30%. The miners, coming off oversold levels, rose by 170% they almost tripled.

The issue is timing. If you can time your entries and exits well, then mining is a good game to play. Timing easy to say, not so easy to do.

The problem for the miners is that it has become easier to buy gold

Here's the main reason life is now so tough for the miners.

In the financial crisis of the 1930s, Homestake, at the time North America and possibly the world's largest gold miner, was one of the stand-out performers. Many cite this as a reason to own gold miners during financially tumultuous times.

However, what many people forget is that during the 1930s, Americans were not allowed to own gold. So Homestake became a proxy. It was Americans' only way of getting exposure to the gold price.

Today the reverse has happened. It has become incredibly easy to own gold. There are numerous ways an investor can gain access. You can go to a bullion dealer and buy physical bullion. You can use one of the online dealers. There are exchange-traded funds and a host of leveraged products from spreadbetting and CFDs to options and futures.

These products proliferated in the mid-2000s. As they did so, the gold miners began to lose their edge. If you want leverage to the gold price, then buy a leveraged product. You don't need to take on the added company risk of a miner.

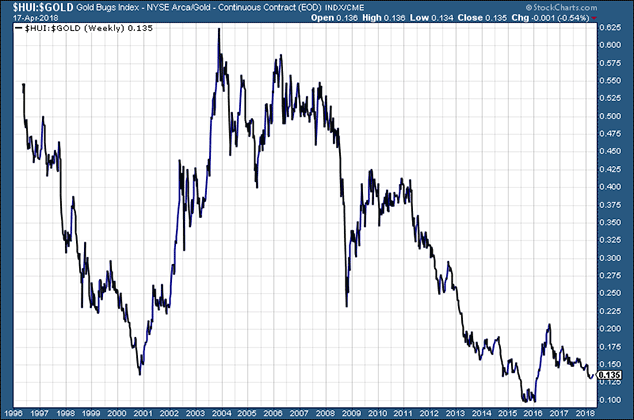

This chart shows the ratio between gold and the large miners going all the way back to 1996. When it is rising, the miners are outperforming gold. When it is falling, gold is outperforming.

You can see that, bar a few relief rallies, gold has dramatically outperformed the miners since the mid-2000s, when alternative gold investment products began to proliferate.

So, to answer the question: "Should I buy gold or large mining companies?" The short answer is "buy gold".

There are reasons to buy large miners. Perhaps the market is heavily oversold, as it was in 2001, 2008 or 2016 and you want to trade a relief rally. Perhaps there is some kind of special situation although these are more common in juniors, which are a different beast altogether.

But if your strategy is buy and hold, or buy and forget, go for the metal, not the miners.

Mining companies need to recognise this, and then do something with their companies to make them attractive again. Otherwise investors will continue to favour the metal.

And by the way, if you think the unhedged miners are bad, the hedged are even worse. Barrick (NYSE:ABX), which until recently was the world's largest producer, is today trading at $13. That's the price it was trading at in 2001, when gold was $250. It's been awful.

If you want to know how to buy the metal, you can read our report on how to buy gold here. And if you're in London, take a trip to the Sharps Pixley store in St James's and buy some metal there. The shop is stunning. You won't regret it.

Finally, a heads-up: I am putting together a kind of financial gameshow for the Edinburgh Festival this year a cross between The Price Is Right and The Chase, but about finance and economics. It should be fun.

If you happen to be in North London next week, my first try-out is at Downstairs At The King's Head in Crouch End on Monday April 23rd, with another next month on May 22. If you like watching shows when they're at the chaotic, experimental stage, (and, believe me, this show is chaotic and experimental) then, as the saying goes, "come on down". You can book tickets here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

These 2 stocks are set to soar

These 2 stocks are set to soarTips The returns from these two aluminium and tin stocks could be spectacular when the commodity cycle turns says David J Stevenson.

-

The best ways to buy strategic metals

The best ways to buy strategic metalsTips Weaker prices for strategic metals in the alternative-energy sector are an investment opportunity, says David Stevenson. Here, he picks some of the best ways to buy in.

-

A lesson for investors from a ill-fated silver mine

A lesson for investors from a ill-fated silver mineAnalysis Mining methods may have changed since the industry’s early days, but the business hasn’t – digging ore from the ground and selling it at a profit. The trouble is, says Dominic Frisby, the scams haven't changed either.

-

The natural resources industry is in a tight spot – which is bad news for the rest of us

The natural resources industry is in a tight spot – which is bad news for the rest of usOpinion The natural resources industry is in a bind. We need it to produce more energy and metals, but it has been starved of investment, plagued by supply chain issues, and hobbled by red tape. That’s bad news for everyone, says Dominic Frisby.

-

How to invest in the copper boom

How to invest in the copper boomTips The price of copper has slipped recently. But that’s temporary – the long-term outlook is very bullish, says Dominic Frisby. Here, he explains the best ways to invest in copper.

-

Why investors should consider adding Glencore to their portfolios

Why investors should consider adding Glencore to their portfoliosTips Commodities giant Glencore is well placed to capitalise on rising commodity prices and supply chain disruption, says Rupert Hargreaves. Here’s why you should consider buying Glencore shares.

-

How to invest in the multi-decade boom in industrial metals

How to invest in the multi-decade boom in industrial metalsTips The price of key industrial metals has already begun to rise. The renewable energy transition will take them higher, says David Stevenson. Here's how to profit.

-

Avoid China’s stockmarket – here’s what to invest in instead

Avoid China’s stockmarket – here’s what to invest in insteadOpinion China’s stockmarket is not a good place for investors to be. But you can't just ignore the world's second-largest economy, says Dominic Frisby. Here, he picks an alternative China play.