The charts that matter: the war drums are beating – but how loudly?

The news has been dominated by wars and rumours of wars this week. John Stepek looks at the charts that matter to investors to see what effect that has had on the markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday: The biggest threat to markets from a trade war

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: Why you need to act before markets agree on the inflation story

Wednesday: Platinum is cheap but will it ever get expensive again?

Thursday: How will the stand-off in the UK property market be resolved?

Friday: The UK's retail apocalypse is overhyped

Podcasts will return from our Easter break next week.

The news has been dominated by wars and rumours of wars this week. One minute Donald Trump is getting ready to bomb Syria imminently, and the next he's saying he might not do it at all. It's made for a volatile week in markets, with some big moves, although overall the S&P 500 and Dow Jones are in fact modestly higher.

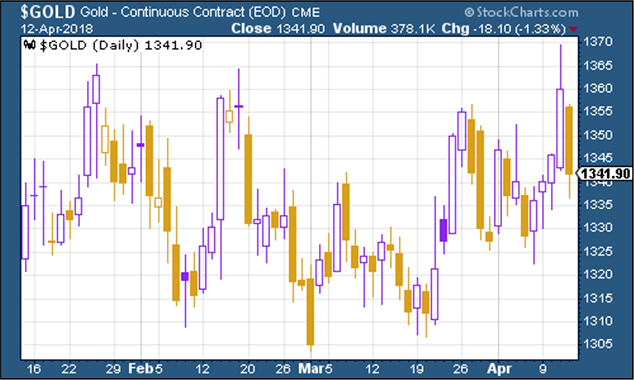

Gold shot higher this week, and then gave back its gains as fears over war surged, then receded in line with Trump's Twitter activity. As my colleague Dominic noted a week or so ago, gold's "big problem" is this $1,360 an ounce level. It bounced above that level this week, but hasn't convincingly breached it as yet.

(Gold: three months)

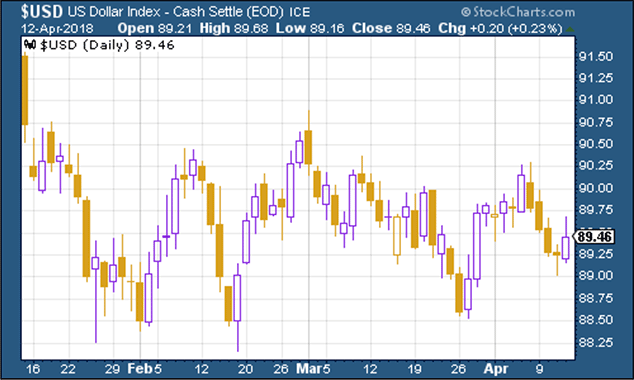

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners was actually little changed this week, and has been trading in a pretty tight range for most of the last three months.

(DXY: three months)

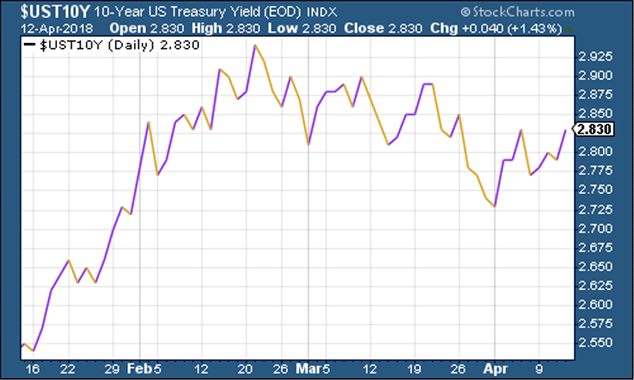

The yield on the ten-year US Treasury bond bounced back somewhat as safe haven demand receded.

(Ten-year US Treasury: three months)

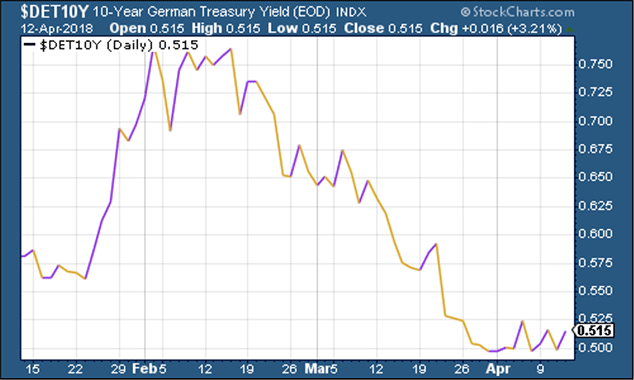

The yield on the ten-year German Bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate also seems to have found its comfort zone for the time being. It's bouncing along the 0.5% mark.

(Ten-year bund yield: three months)

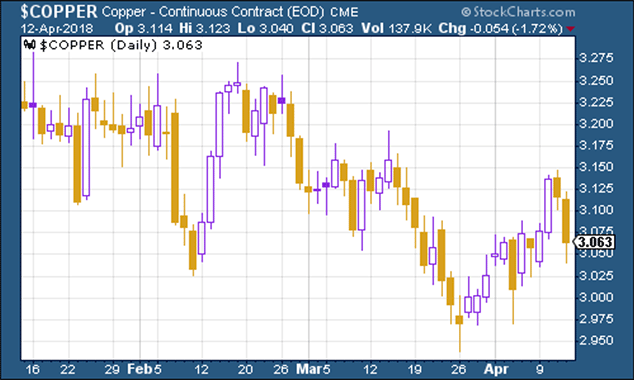

Copper has had a tougher week, again as the market worries whether or not global growth is really in good shape or not, and also amid concerns that the Federal Reserve may be quite serious about raising interest rates.

(Copper: three months)

Bitcoin was suffering this week, and then had a sudden surge on Thursday, making it all the way back up to above $8,000 a coin from near-enough $6,500. Some argue that selling pressure has eased off (because with the deadline for paying US tax returns looming, any selling to pay taxes has been done). Others argue that it's a side effect of capital flight from Russia amid sanctions. Who knows? Either way, it's interesting to watch.

(Bitcoin: ten days)

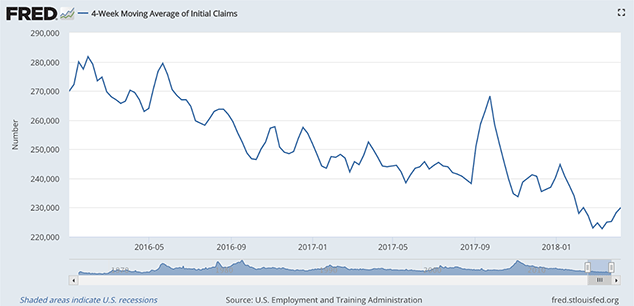

Turning to US employment, the four-week moving average of weekly US jobless claims remained low at 230,000 this week, while weekly claims came in at 223,000.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

As you can see, we're only just above the most recent trough. If Rosenberg is right (and obviously, there are a limited number of instances to go by historically, so this is "finger in the air" stuff) and this run continues, then it looks as though we're likely to keep on pushing that recession out further and further.

(Four-week moving average of US jobless claims: since start of 2016)

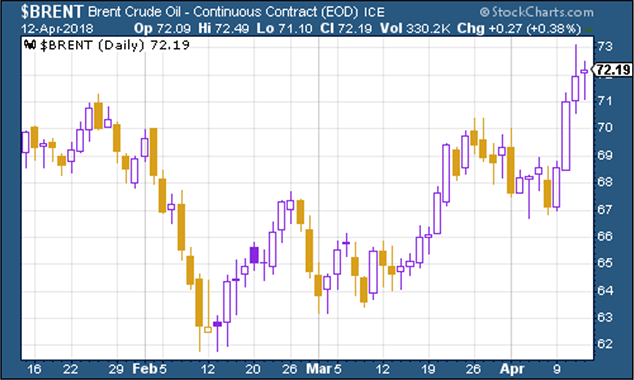

The oil price (as measured by Brent crude, the international/European benchmark) has surged in the last week, primarily as a result of the banging of war drums.

(Brent crude oil: three months)

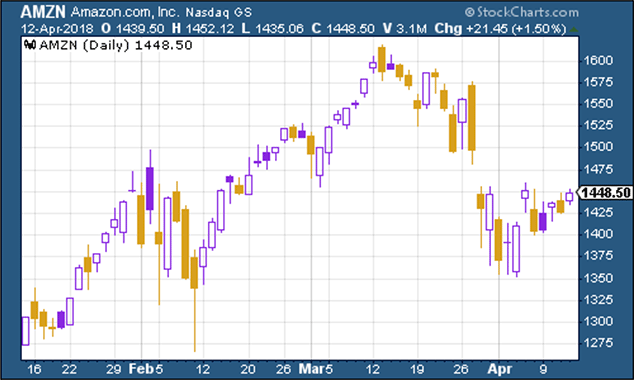

Internet giant Amazon had a better week as Trump's attention was occupied by Syria.

(Amazon: three months)

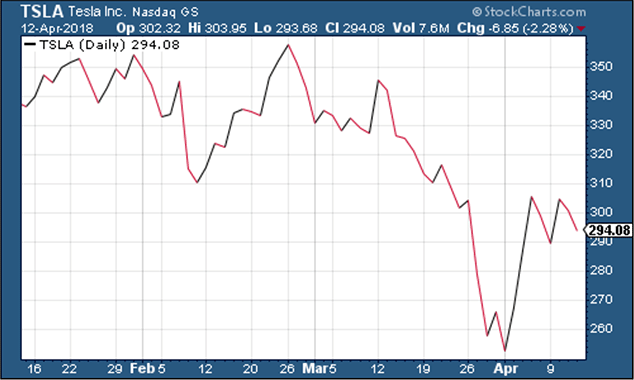

And incredibly, Tesla has put in another rally. That's partly down to Elon Musk (via Twitter) easing fears that the company would have to raise more funds imminently. It's hard to keep the Tesla true believers down. I'm still sceptical but it's not a stock I'd short.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

Average income tax by area: The parts of the UK paying the most tax mapped

Average income tax by area: The parts of the UK paying the most tax mappedThe UK’s total income tax bill was £240.7 billion 2022/23, but the tax burden is not spread equally around the country. We look at the towns and boroughs that have the highest average income tax bill.