Platinum is cheap – but will it ever get expensive again?

The platinum price has fallen so far, it's hard to see how it can get much lower. Dominic Frisby looks at what it would take to spark a turnaround.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today, we consider the investment case for the precious metal, platinum. I've identified platinum as "cheap" on these pages before and that is an adjective that still applies. In fact, now it is "even cheaper". So should we be buying, selling, holding what to do now?

Why does anyone need platinum?

Let's start with some basics. What is platinum actually used for? The answer is: lots of things. As much as one fifth of all manufactured objects contain platinum, according to some estimates, although such an assertion is hard to substantiate. Take a deep breath.

It's used in the chemicals industry (as a catalyst); in electronics (in hard drives); in glass manufacturing (particularly fibreglass); in petroleum refining; in medical equipment (stents, catheters, guidewires, neuromodulators, defibrillators and pacemakers all contain platinum); it has uses in the treatment of cancer; in medical implants; in fertiliser; in many different types of industrial sensors (thermocouples in furnaces, exhaust-gas control systems, carbon monoxide detectors); it coats jet-engine blades and high-performance spark plugs; and it finds use in fuel-cells.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now breathe out.

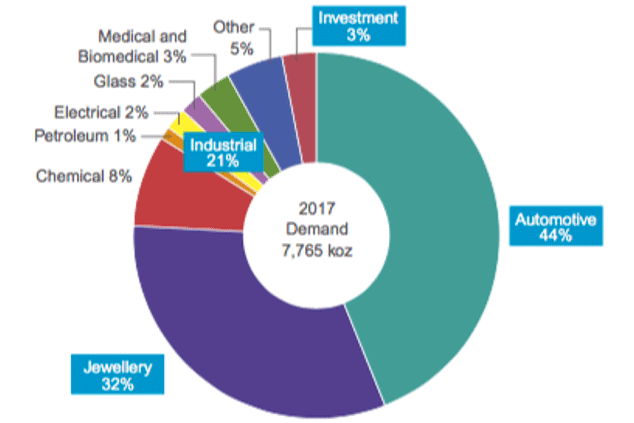

Platinum's two biggest uses are in jewellery and in the automotive industry, and these account for 76% of annual demand, as the pie chart below courtesy of the World Platinum Council shows.

Annual platinum demand was down slightly in 2017 at 7.8 million ounces, with supply at about eight million. Current projections from the World Platinum Council for 2018 are that supply will fall a little, and demand rise, with the two remaining more or less in equilibrium.

Roughly 75% of supply comes from mining and 25% from recycling. Of that mined supply, a good two thirds comes from South Africa. Platinum's fate is determined by one country in a way that no other commodity, except perhaps cobalt, is.

The decline of diesel has hit platinum hard perhaps unjustifiably so

The thorn in the platinum story has been the change in attitude towards diesel engines in Europe, for which we have Volkswagen and other manufacturers largely to thank.

Platinum's main use is in catalytic converters, and this is projected to fall in the coming years as regulations change and electric cars rise in popularity. It has basically meant that platinum has struggled to find a bid.

On this point of diesel usage, I should point out that western European diesel demand only accounts for about 15% of overall platinum use. If the diesel engine really is on its way out (and I would say that is by no means a certainty I can remember the "death of diesel" being a narrative in the 1990s too, which died as technology changed), then it is not quite the disaster for platinum that it has been perceived to be.

Yet, in terms of its price, rather reflecting the supply-demand equilibrium and the anti-diesel narrative, platinum has spent the last 18 months trading between about $1,040 an ounce and just below $900. While other assets have moved, platinum has been range bound.

Over the last three months it's been an utter dog. While the prices of most assets have been volatile, at least they've seen ups as well as downs. Platinum, on the other hand, has been tramping inexorably lower although it's rebounded a little this week. The current price is $925 an ounce.

Is platinum due a rally? Maybe even a 700% one?

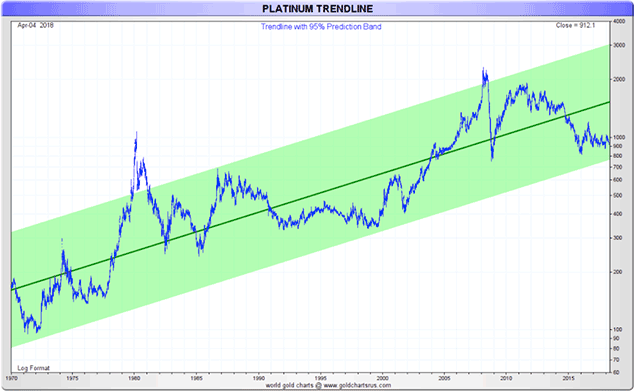

OK. Here's where it starts to get interesting. First, courtesy of Nick Laird at goldchartsrus.com, is a chart of the platinum price since 1970. Nick has drawn a green "prediction" band around the price. As you can see, we are at the lower end of the range.

The last time we were in this "buy zone" was the late 1990s, when platinum was $350. It rose over 700% over the next decade.

Is $900 the new $350? A 700% rise from $900 would be very welcome chez Frisby.

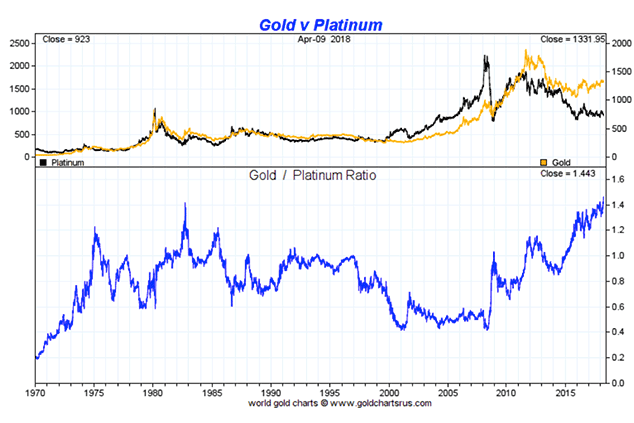

Platinum is more expensive than gold, right? Everyone knows that. Well, normally it is. The historical average is that platinum is somewhere around a third more expensive than gold. That isn't the case now though. Gold, at $1,335 an ounce, is more than 1.4 times as expensive as platinum.

On a relative basis, gold is the most expensive it has ever been, or platinum as cheap as it has been. Here, again courtesy of Mr Laird, are the visuals. (The blue line at the bottom shows the price of gold divided by the price of platinum.)

A collapse in the gold price to take this average back to normal levels is possible, but I would say a rise in platinum is the more likely.

Assuming no change in the gold price, a return to the historical average of 1.3 would see platinum rise to more than $1,700. A return to the levels we saw in the 2000s with platinum at more than twice the value of gold would see it north of $2,500.

These are the kind of longer-term targets I am looking at, but we won't see them until there is some kind of change of narrative within the platinum space. At the moment, it's all about declining catalytic converter demand.

But narrative begets price and price begets narrative. We need some new essential use for platinum to be found, some technology that the world can't do without, to which platinum is essential or some such story to get the market excited.

It could just as easily be something as banal as insatiable jewellery demand, due to some actor hailing platinum in some film. But we need something to get the narrative going. For now we are range-bound, hopefully towards the end of a bear market.

On a short-term basis, we are entering a seasonally strong time of year for platinum, and most momentum indicators are at extremes, pointing to some kind of relief rally, at least.

If nothing else, $750 must surely be the bottom for platinum

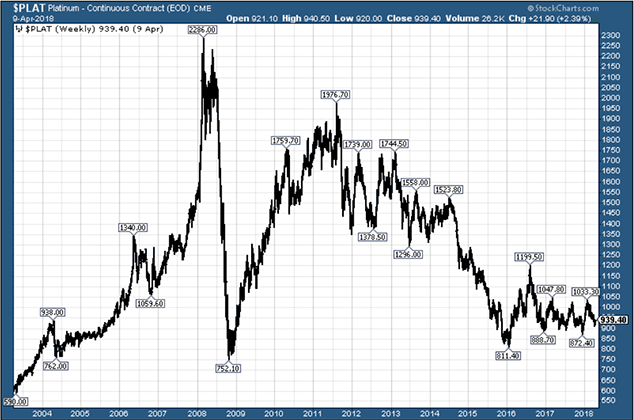

Longer-term I think we need to consider the long-term price action. Here is platinum over the last 15 years, with price labels.

You can see the incredible run-up it had in the 2000s, the crash of 2008, the rebound, the post-2011 bear market and the range in which it has been trading over the last three years.

I would suggest that the 2016 low at $810 is a major area of support, as are the 2004 and 2008 crash lows at $750. My inner pessimist fears we will test $810, and if things get really horrible, $750.

My trader friends all say I'm being ridiculous and it will never get that low. But if it does, it will be trading at well below its cost of production and many mines will close. Many are surviving only on diesel fumes with platinum at $925.

So the risk of buying at current levels is maybe 15%. Many forecasters have said stupid things that have come back to bite them, but I can't see how platinum goes below $750. And it's unlikely even to get there, though never say never.

The other risk, of course, is opportunity cost that platinum remains in its current range, while party after party goes on elsewhere.

This is a market nobody cares about. Such markets are good to buy into. One day a lot of people will care. But patience – a lot of it – is required.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how