Don’t dismiss the Cape ratio

It’s easy to criticise our favoured valuation measure, but investors ignore its track record at their peril, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's easy to criticise our favoured valuation measure, but investors ignore its track record at their peril.

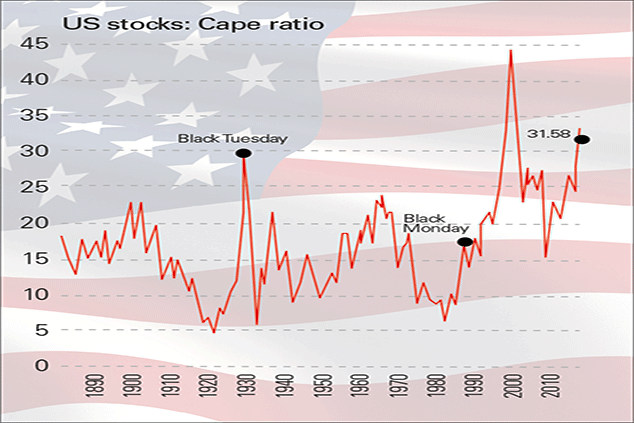

The cyclically adjusted price/earnings (Cape) ratio popularised by Yale professor Robert Shiller is one of MoneyWeek's favoured valuation measures for stockmarkets in general. The Cape looks at the price of a given market compared with average earnings over a ten-year period. The idea is to "smooth out" any fluctuations in the economic cycle and thus give a truer picture of whether a given market is overvalued or not. A high Cape indicates an expensive market a low Cape, a cheap one.

The Cape has come in for a lot of abuse in recent years. Critics argue that its predictive powers (if it ever had any) have been rendered obsolete by changing accounting standards, ultra-low interest rates, the monopolistic nature of dominant technology companies all of which are deemed reasons not to fear the current elevated levels of Cape (in the US, in particular).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Some of these concerns are more valid than others. But let's be very clear Cape is no use for timing the markets. It won't tell you exactly when to get out, and when to get back in (and nor will anything else). While it hit extreme levels ahead of the 2000 dotcom bust, the 1929 collapse, and even ahead of the 1987 crash, it's by no means a short-term indicator. For example, the US market has been overvalued to at least some extent on a Cape basis for most of the past 22 years, punctuated only by a few brief months spent at "fair value" following the 2008 financial crash (see chart above).

However, no one has ever claimed that the Cape is a market-timing tool. Where its strength lies is in its ability to give a good idea of how your returns are likely to look in the long run if you invest in a market at a given point in time.

In a recent paper on the subject, Rob Arnott, Vitali Kalesnik and Jim Masturzo of US asset manager Research Affiliates examined 12 international markets, including the US, and found that the Cape had useful predictive power, the longer the investment horizon. More to the point, they say: "We can have a spirited debate about whether the equilibrium US Cape ratio is 16 or 20 or a notch higher. But at 32 times ten-year average earnings, no matter what adjustments we make, the US market is expensive."

Rather than a simple "in" or "out" decision, a better use for the Cape is to help set your level of exposure to various global equity markets. When a market is expensive (as the US is), then shrink your portfolio's allocation to it in favour of cheaper markets. What's cheap on a Cape basis now? Russia is extremely cheap, on a Cape of below seven. It's not a market I'm keen on due to concerns over property rights (and US sanctions), but for less squeamish investors, now may be a good time to invest.

I wish I knew what a p/e ratio was,but I'm too embarrassed to ask

Many investors use the price/earnings (p/e) ratio as a measure of whether a share is cheap or not. There's a good reason for that it's one of the simplest valuation measures out there. You simply take the share price, and divide by the earnings (profits) per share. So a company with a share price of 50p and earnings per share (EPS) of 5p would have a p/e ratio of 10. A p/e ratio that's based on forecast earnings is often referred to as a forward p/e ratio, while one based on past earnings is sometimes described as a trailing p/e.

P/e ratios are also sometimes referred to as multiples, as in "Acme Widgets is trading on a multiple of ten times its earnings". In effect, a p/e of 10 means you are paying £10 for each £1 of earnings, while a p/e of 20 would mean you are paying £20 per £1 of earnings. So clearly, in theory, the lower the p/e, the cheaper the share.

However, a lower p/e does not always mean that a company is good value. If investors are only willing to pay £5 for each £1 of current earnings, say, then this implies that they don't really believe current earnings levels can be sustained. Instead, there may be serious problems that will hinder future growth or lead to falling profits. Meanwhile, those trading on higher p/e ratios might look expensive but in fact, might be expected to grow exceptionally strongly (for example, high-flying tech stocks typically trade on relatively high p/es).

Also bear in mind that some industries (mining and housebuilding being good examples) are extremely cyclical. They will trade on low multiples at the high point in the economic cycle (when they are very profitable) and high p/es at low points (when they may be loss-making). The cyclically adjusted price/earnings (Cape) ratio, which averages earnings out over ten years, is one way to go about correcting for this.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How should a good Catholic invest? Like the Vatican’s new stock index, it seems

How should a good Catholic invest? Like the Vatican’s new stock index, it seemsThe Vatican Bank has launched its first-ever stock index, championing companies that align with “Catholic principles”. But how well would it perform?

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up