The charts that matter: Big Tech starts to feel the strain

The wheels are finally coming off for Tesla. John Stepek looks at what's happened to the electric car maker's shares this week, and the other charts that matter to investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday: This is the world's most-hated stockmarket

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: Ignore politics only one thing really matters in investment

Wednesday: The next five years will be better for gold than the last five were

Thursday: Tesla is running out of road and so are the other big tech stocks

And if you missed this week's podcast, check it out now. Merryn and I talk about turning into contrarian indicators, about the terrifying possibility of companies or governments using our medical data to read our minds and more prosaically, about what you should be looking for in a "buy and hold forever" fund.

On to the charts for this week.

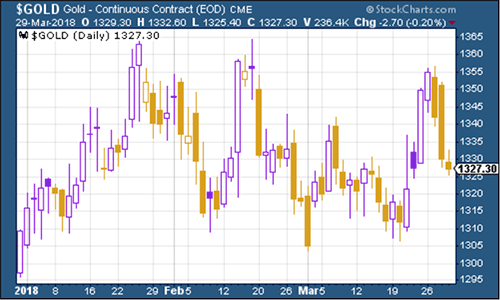

Gold surged as everyone got very worried about tech stocks, and then fell back again. As my colleague Dominic noted earlier in the week, gold's "big problem" is this $1,360 an ounce level. It hasn't convincingly breached it yet.

(Gold: three months)

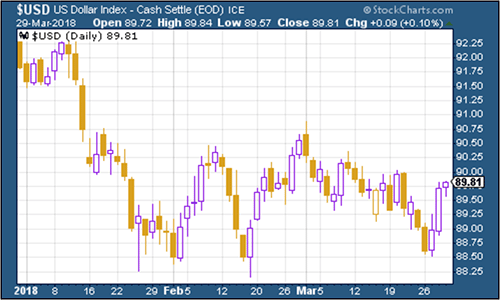

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners struggled mid-week but bounced back towards the end of the week amid strong economic data.

(DXY: three months)

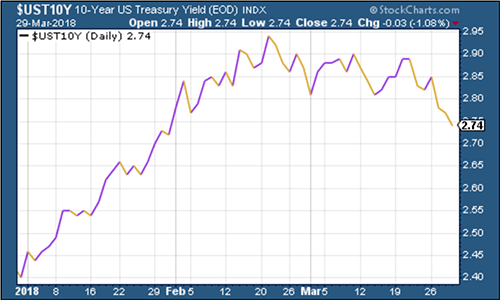

The yield on the ten-year US Treasury bond slipped back further as investors decided that maybe US government bonds were a safe haven after all, as stock markets became more volatile.

(Ten-year US Treasury: three months)

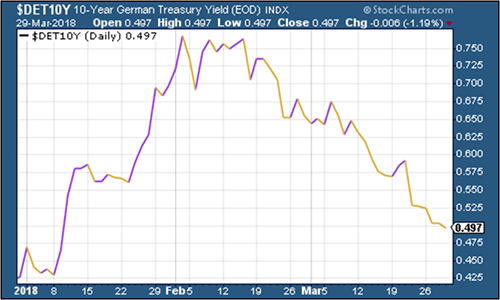

The yield on the ten-year German Bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate has also fallen sharply again. Again, trade war fears are having the biggest impact on Germany, who would be hit hard by restrictions on global trade.

(Ten-year Bund yield: three months)

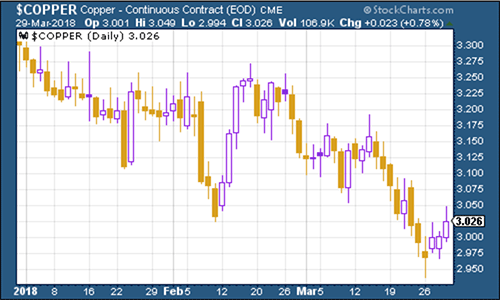

Copper bounced around the $3 a pound mark, where it's been struggling for a while.

(Copper: three months)

Bitcoin's rough run has continued. I'm still trying to figure out what drives the cryptocurrency, but I can't help but think that it's primarily a creation of zero-interest rates so it will be interesting to see how it copes with a rising rate environment.

(Bitcoin: ten days)

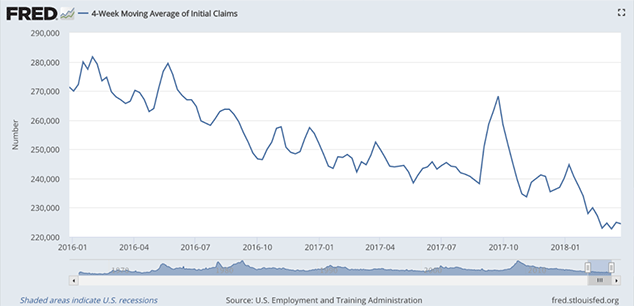

Turning to US employment, the four-week moving average of weekly US jobless claims remained low at 224,500 this week, while weekly claims came in at 215,000, the lowest weekly claim since January 1973 - a pretty impressive move.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later. As you can see, we're only just above the most recent trough. If Rosenberg is right (and obviously, there are a limited number of instances to go by historically, so this is "finger in the air" stuff) and this run continues, then it looks as though we're likely to keep on pushing that recession out further and further.

(Four-week moving average of US jobless claims: since start of 2016)

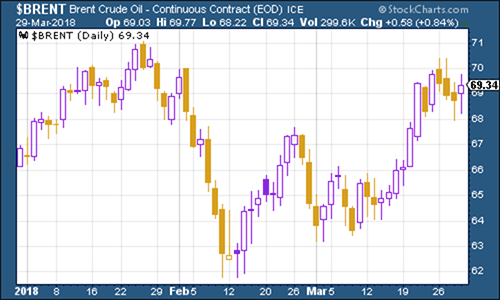

The oil price (as measured by Brent crude, the international/European benchmark) remained strong this week.

(Brent crude oil: three months)

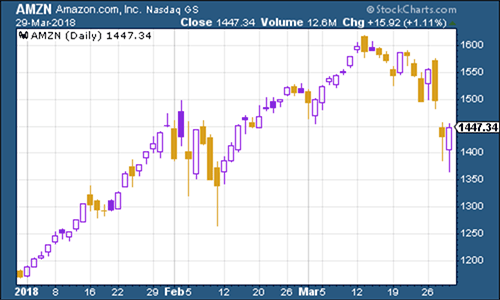

Internet giant Amazon had been holding up better than most of its peers in the tech sector, amid the sell-off around Facebook. But then Donald Trump came along and reminded people that he really doesn't like Jeff Bezos, and that he'd really like to make life harder for Amazon if possible.

Will he? Who knows? But it's not fun being in the sights of politicians when they're looking to raise hard cash from unpopular targets.

(Amazon: three months)

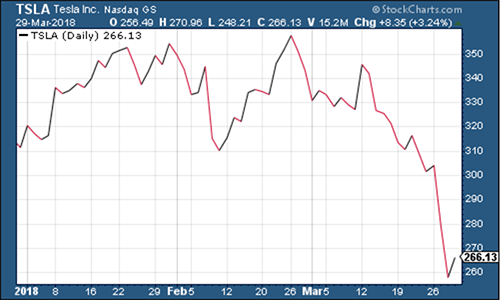

It looks as though the wheels are finally coming off for Tesla. It's had a nightmare week between product recalls and credit downgrades, investors are finally deciding that at some point, Elon Musk has to actually think about turning a profit rather than burning ever more of their cash.

The good news is that Tesla has probably now done its job (helped very much by bad behaviour on the part of Volkswagen). The shift towards electric vehicles is now firmly entrenched. Even if Tesla did collapse, that won't stop.

Is it a good investment though? I have to say, I don't think so.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?