How to bet on falling bonds

You can profit as the bond bull turns, says John Stepek. But be careful you don’t get trampled.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

You can profit as the bond bull turns but be careful you don't get trampled.

Last week we talked about the potential for rising inflation to derail global bond markets and what it might mean for your portfolio. But what if you want to bet directly on bond markets falling? How can you do it and what do you need to be aware of if you do?

As with most assets, you can "short" bonds (bet on bond prices falling and yields rising) with spread betting. However, the high levels of leverage involved mean it's all too easy to get shaken out by short-term moves, regardless of whether or not your long-term view is correct. Assuming you don't just want to take a quick punt, then the most obvious alternative is to invest in an "inverse" exchange-traded fund (ETF) that enables you to short the bond market. We'd suggest you avoid using leveraged ETFs or at least, if you do, accept that it's a punt, don't risk too much money and don't plan to hold them for more than a few days. We've gone into the maths before (search MoneyWeek.com for more), but the daily rebalancing means that the longer you hold, the more likely they are to diverge often radically from the performance of the underlying index. Even unleveraged short ETFs rebalance daily, but they won't diverge as quickly from the underlying index.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Also, remember that shorting is very different to going long, even without leverage. You are explicitly timing the market you are not aiming to make money from the income and return of your capital, you're aiming to profit from a drop in prices. So this isn't "buy and hold". Keep a close eye on your short bond trades, make sure the index is behaving as you expect it to and don't get overly confident the end of the bond bull market might look like a "sure thing" today, but it looked like a sure thing in 2012 too (and on several occasions before then).

So what should you use? We'd suggest betting against government bonds if you're looking for a "big-picture" punt on higher inflation and interest rates. The longer a bond has to go to maturity, the more sensitive it is to interest-rate changes (as measured by its "duration" see box below).

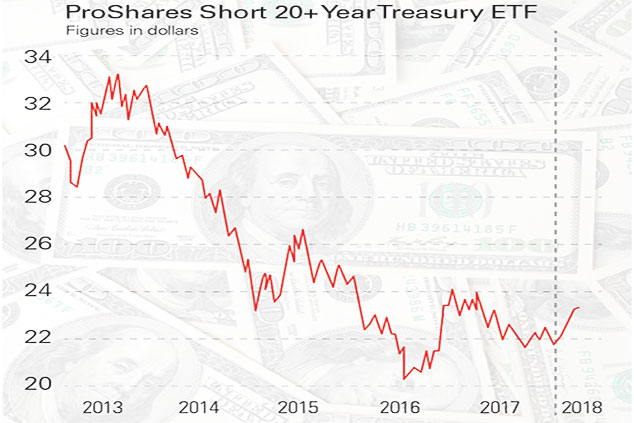

So if you are convinced we're going to see higher-than-expected inflation (and thus interest rates), then you want to short the longest duration bonds. The ProShares Short 20+ Year Treasury (NYSE: TBF) see chart above has a duration of just under 18 and promises to return the inverse of the ICE US Treasury 20+ Year Bond Index (which contains US government bonds which mature in no less than 20 years). If you'd rather not take the currency risk, another option is to short UK government bonds. WisdomTree's Boost Gilts 10Y 1x Short Daily ETP (LSE: 1GIS) has an annual fee of 0.25% and delivers the inverse daily performance of the Long Gilt Rolling Future Index.

I wish I knew what duration was,but I'm too embarrassed to ask

"Duration" is a measure of risk related to bonds. It describes how sensitive a given bond is to movements in interest rates. Think of the relationship between bond prices and interest rates as being like a seesaw: when one side (interest rates, for example) goes up, the other (in this case, bond prices) goes down.Duration (which can be found in the factsheet of most bond funds) tells you the likely percentage change in a bond's price in response to a one percentage point (100 basis points) change in interest rates. The higher the duration, the higher the "interest-rate risk" of the bond that is, the larger the change in price for any given change in interest rates.

Duration also tells you how long (in years) it will take for you to recoup the price you paid for the bond in the form of income from its coupons (interest payments) and the return of the original capital. So if a bond has a duration of ten years, that means you will have to hold on to it for ten years to recoup the original purchase price. It also indicates that a single percentage point rise in interest rates would cause the bond price to fall by 10% (while a single percentage point drop in interest rates would cause the bond price to rise by 10%).

As a rough guide, the duration of a bond increases along with maturity so the longer a bond has to go until it repays its face value, the longer its duration. Also, the lower the yield on the bond, the higher its duration the longer it takes for you to get paid back. All else being equal, a high-duration bond is riskier (more volatile) than a low-duration bond.For zero-coupon bonds (bonds that don't pay any income at all), the duration is always the remaining time to the bond's maturity. For interest-paying bonds, duration is always less than its maturity (because you will have made back your original investment at some point before the maturity date).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how