Trump launches a trade war

The US Tariff Act of 1930 shows unequivocally that nobody wins a trade war. It exacerbated the Great Depression and led to a tit-for-tat series of trade barriers that took the global economic system decades to unravel.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"Until last week, Donald Trump's bark on trade protectionism had proved a good deal worse than his bite," says Jeremy Warner in The Sunday Telegraph. It seems "we relaxed too soon". The US president has announced levies on aluminium and steel imports, which will now incur tariffs of 10% and 25% respectively.

The market reaction to the news tells you pretty much everything you need to know about this policy's likely impact, says Nathaniel Taplin in The Wall Street Journal. The overall market was rattled, with the Dow and the S&P 500 falling by almost 2% each. Steel futures and shares in big steelmakers such as US Steel bounced. The listed arm of China's top steelmaker declined, but not as much as its Canadian and South Korean rivals.

More losers than winners

This new policy won't punish China, which is always accused of producing too much metal and dumping it on world markets at unfairly subsidised prices. The US used to take a lot of Chinese steel, but now Canada, Brazil and South Korea are the main exporters of the metal to the US. So "American allies" will pay the bill, says Taplin. The slide in the overall market, meanwhile, highlights the basic problem with protectionist measures: they produce more losers than winners.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The steel-using sector "dwarfs" the steel-producing sector, as Lawrence Summers notes in the Financial Times. Payrolls of steel and aluminium producers total around 203,000. Industries such as car making and construction, which use steel, employ around 6.5 million people. By making steel more expensive, the US government is raising local steel users' costs and reducing their international competitiveness. It is also increasing overall prices at a time when the economy is already motoring, with a robust labour market threatening to stoke significant wage inflation. Higher prices trim disposable incomes. So the overall impact is likely to be slightly lower growth as well as inflation.

This could get nasty

The big danger here, however, is "an escalation into a full-blown trade war", says Ben Inker in a note by asset managers GMO especially when you consider the "increasing numbers of populist leaders with a shaky grasp of economics around the world". The EU has already threatened to retaliate.

If this escalates, we could see tariffs in more and more sectors on both sides of the Atlantic, slowly throttling global trade and growth. It hardly helps that the Trump government has claimed the tariffs are a matter of national security instead of providing an economic justification for them, however specious. Countries have hitherto resisted resorting to this excuse, which is supposed to be used only in national emergencies. Having broken a taboo, Trump may be tempting others to follow. The world could be about to relearn a very expensive lesson (see below).

A race to the bottom

"It's easy to win a trade war," insisted Donald Trump last week. He appears not to have heard of the US Tariff Act of 1930, often known as the Smoot-Hawley Act after the two senators who sponsored the bill. It shows unequivocally that nobody wins a trade war. The Act exacerbated the Great Depression and led to a tit-for-tat series of trade barriers that took the global economic system decades to unravel.

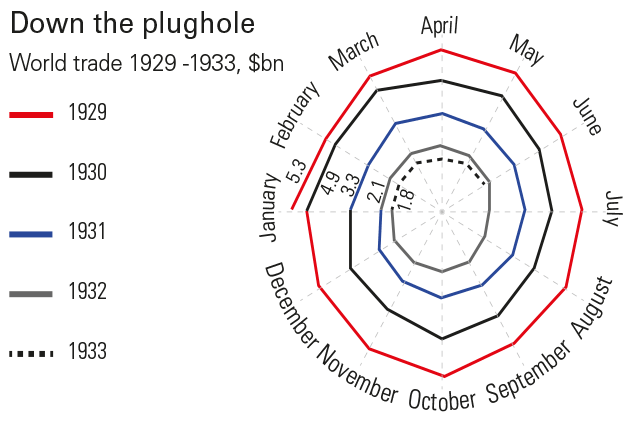

Congress, claiming it was protecting American jobs, launched a plan to bolster agriculture, which had slumped in the 1920s. But given the stark general economic backdrop, and politicians being politicians, legislators kept insisting on tariffs on all sorts of goods in exchange for their support, notes Chris Cillizza on CNN. It wasn't long before the bill began to mushroom. The final version increased almost 900 US import duties. Canada and Europe soon retaliated, and a rapid and alarming squeeze on world trade began as exporting became ever harder (see chart). US imports declined by 40% in the two years after Smoot-Hawley. US exports of eggs to Canada slipped from 919,000 in 1929 to 7,900 in 1932, says Cillizza.

Perhaps the most disconcerting thing about the outbreak of protectionism was that, even though virtually all economists realised it was likely to backfire spectacularly, and advised frantically against it, it still happened.Thomas Lamont, a partner at JP Morgan, said he "almost went down on [his] knees to beg Herbert Hoover to veto the asinine [bill]". Bad ideas can develop unstoppable momentum. "The fact that politicians know something to be madness," says The Economist, "does not stop them doing it."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.