The charts that matter: watch out central bankers, politics is back in a big way

Since the financial crisis, central bankers have kept a lid on things. But we're into new phase now, says John Stepek. Politicians are looking to stir things up a bit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday: Lessons from Buffett's latest letter: stay patient and avoid debt

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: China's Great Leap Backward is bad news for investors

Wednesday: How the world's biggest financial market is affecting share prices

Thursday: Will the new Fed chairman's bark be worse than his bite?

Friday: Trump's tariffs are yet another sign that inflation is coming back

And if you missed this week's podcast, you can catch it here. Merryn and I tackle such vexed topics as: are Neil Woodford's glory days behind him, or is this a contrarian buying opportunity? Is Gift Aid a threat to democracy? And why would you ever want to buy a company from a private equity firm?

This has been an interesting week. The year began with such a tone of euphoria. Everyone was betting on the melt-up continuing. But the post-New Year hangover has well and truly kicked in.

Now, a quick caveat before I go on: I'm a terrible one for trying to spot patterns and incidents that are emblematic of significant turning points. It's a habit you have to control as an investor. Stories are a wonderful way to communicate (and that's my job, hence the habit) but they're not a great methodology for investors.

Stories harness facts to a narrative. The facts that fit the narrative make the final cut; the ones that don't, get tossed to one side. So it's easy to end up with an incomplete understanding of what's going on.

All the same, stories can be good for "big brush" work. And Federal Reserve boss Janet Yellen stepping down does seem to have been the ending of a pretty significant chapter. "Mission accomplished", was the message. But what exactly have the Fed and global central banks been doing for the past ten years?

Basically, they've been keeping a lid on things and kicking cans down the road. The Fed has suppressed market volatility. As soon as Yellen stepped down, it exploded higher. A coincidence? Yes and no. It didn't blow up explicitly because Yellen stepped down, but it was a well-timed warning of the shape of things to come that we're moving into a new phase.

Because the central banks as we've said for a long time have been suppressing more than financial market volatility. They've been suppressing political volatility too, while stoking the underlying resentment that has given rise to populism.

That's all coming to a head now. We thought we'd escaped the Great Depression scenario of trade wars. Now Trump looks like starting one.

The European Central Bank has kept the lid on discontent in the eurozone by printing money to paper over the solvency problems of various nations. But how long will that survive past Mario Draghi stepping down next year? Meanwhile, we have populist parties rising across the eurozone how long can it be before one of them gets enough power to have a proper debate on sovereignty issues that inexorably leads to the conclusion that the only way forward is to leave the EU?

And over here, it's possible that we could have a hard-left politician as UK chancellor a man who can't think of a single business person he admires, according to an interview with the FT this week at some point in the forseeable future.

Oh, and both China and Russia are now effectively run by dictators, who are becoming increasingly less shy about displaying that fact. So much for the great hopes of the 90s.

Monetary regimes can last for a long time. But they always break down eventually, because they're just systems. Once enough people are fed up because no system can work perfectly, and so inconsistencies and inequalities and inefficiencies pile up they stop abiding by the rules, and the systems break down.

That's when for want of a better word politics takes over as we try to formulate new systems. That's where we are now. The rules are changing. That's going to make the financial world much trickier to navigate.

Is that a good story? It's not a happy one. But I think in a very broad-brush way, it reflects where we are right now. So just keep it in mind the "meta-game" has changed, so the old correlations and cause-effect relationships that you could once take for granted have either stopped working or are going to stop working.

Anyway, away from the big picture stories and back to the charts. What's been going on?

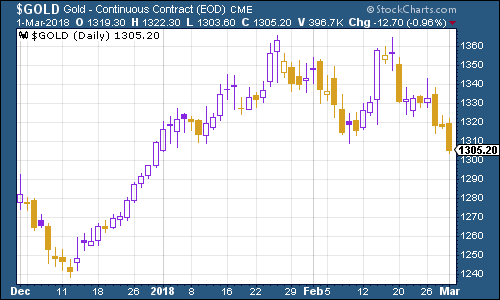

Gold wasn't too keen on the idea that the new Federal Reserve boss Jerome Powell might be more of a hawk than anyone had expected, when he highlighted strong US growth in a speech on Tuesday. However, Powell rowed back a little on Thursday (and I bet you he'll row back a lot faster if the market falls much further), and gold did bounce back somewhat on Friday (the chart below only goes up to Thursday's close) as markets grew rattled by Trump's protectionism.

(Gold: three months)

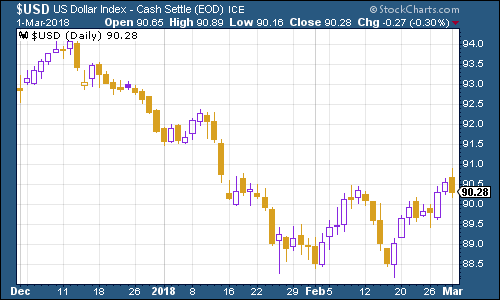

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners basically did the opposite of gold. It rebounded as Powell looked hawkish, but was hit by Trump's tariff threat.

(DXY: three months)

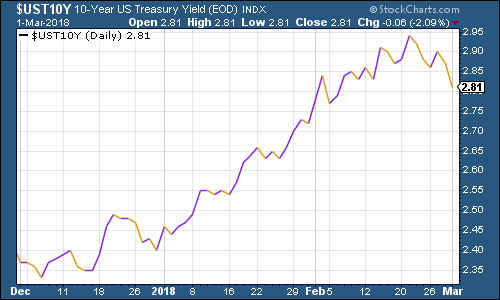

Meanwhile the yield on the ten-year US Treasury bond fell back from its recent charge at the 3% level. There are a lot of moving parts to this. One is simply that it was due to fall back it's risen too far, too fast.

Two is that despite the fact that tariffs are probably inflationary the idea of a trade war freaked markets out, which means that money rushes to the safety' of US Treasuries.

Three is that markets are still a little bit worried that the Fed will be overly hawkish, and as a result, the economy will slow down because interest rates rise too fast. Therefore, future interest rates will be lower than they otherwise would have been.

Phew. Told you there were a lot of moving parts

(Ten-year US Treasury: three months)

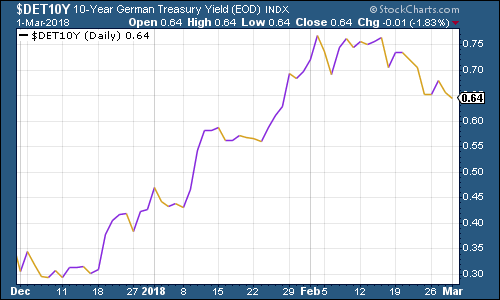

As for the yield on the ten-year German Bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate it fell too. Part of that might be nerves before the big election weekend you've got Italy (which I don't think will matter that much) going to the polls, but you also have Germany either trying to finalise a coalition or calling for a fresh election, which could be genuinely disruptive.

(Ten-year bund yield: three months)

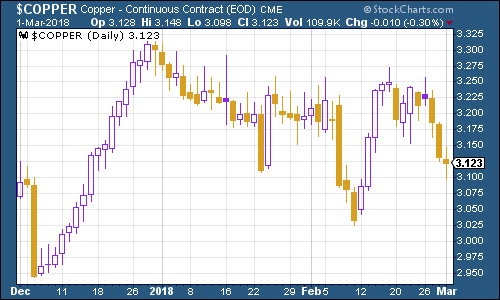

Copper fell back. Like most commodities it doesn't like a stronger dollar and there's also the concerns about Chinese factory activity (which was weaker than expected) to contend with.

(Copper: three months)

Bitcoin, the king of cryptocurrencies, appears to be stuck in what is known as a "trading range". I'd be lying if I told you I had any real idea of what drives movement in bitcoin. I suspect that it's probably best used as a capital flight barometer but that's an educated guess at best.

(Bitcoin: ten days)

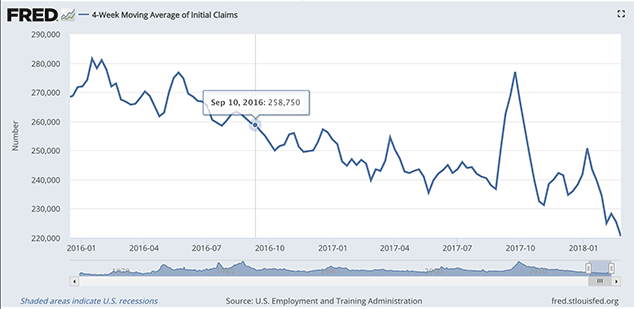

Turning to US employment, the four-week moving average of weekly US jobless claims, fell to 210,000 this week, which is the lowest level seen since 1969. Meanwhile weekly claims came in at 220,500.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later. We keep making new troughs, and pushing that recession out further and further.

(Four-week moving average of US jobless claims: since start of 2016)

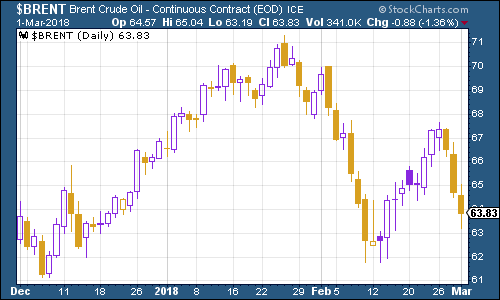

The oil price (as measured by Brent crude, the international/European benchmark) fell back, partly due to US dollar strength.

(Brent crude oil: three months)

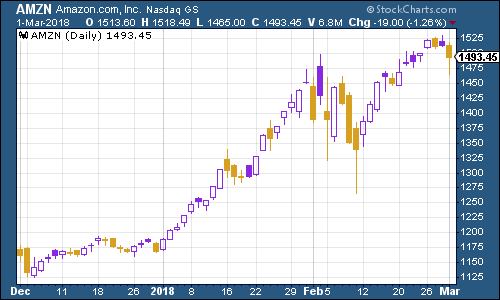

Meanwhile internet giant Amazon stayed strong despite the general jitters in markets. As I've said before, that's most likely because Amazon is a "can't lose" stock these days in terms of career risk. No one will get fired for owning Amazon.

(Amazon: three months)

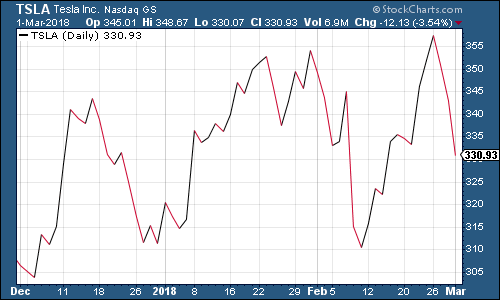

Meanwhile Tesla edged lower. There wasn't much news about the company this week but what is interesting is that California is now going to allow fully driverless cars to scoot about the state under their own steam, without any human beings at the wheel.

(Tesla: three months)

I think this is brilliant news I'd love to hand the driving over to a robot chauffeur although I have to say, I'm glad the Californians are volunteering to be the guinea pigs in this particular experiment.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.