How the world’s biggest financial market is affecting share prices

US stocks are going from strength to strength while European markets falter. But there’s no mystery. They are at the mercy of a much bigger market than equities.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

My subject today is the divergence between European and US markets why have European stocks been weak compared to the US?

Let's start with some basic stats.

Despite all the volatility earlier this month, the Dow Jones, the S&P 500 and the Nasdaq are all up on the year. Of the three, the Nasdaq has been the stand-out performer up around 8% (at the time of writing today looks like it might be a volatile one) and just a few points short of its all-time highs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That shows there is still risk appetite for tech and growth stories.

Germany's Dax is down on the year by just over 3%. The FTSE 100 is down by closer to 5%, and the FTSE 250 by just over 4%. France's CAC, however, is marginally in the black. Spain is down, but Italy's Borsa is up around 4%.

The days of stocks rising and falling on the tide together have not been so apparent this year.

As human beings, we crave an explanation. Why is mighty Germany down? Political uncertainty perhaps. But then Italy should be down as well.

The relative currency performance is perhaps the biggest factor. The US dollar has been weak. The US dollar index, which measures the dollar against the currencies of the USA's main trading partners, has fallen from 91.6 to 89.7.

Rising asset prices often accompany a falling currency. The euro has been strong - going from $1.20 to $1.23. The pound, in turn, is up a cent or so against the euro in 2018 (having begun the year at €1.12, it's now at €1.13).

The relative currency strength explains the relative outperformance by the US, the underperformance of Germany and the even greater underperformance by the UK.

If we benchmark Europe using the Euro Stoxx 50, which incorporates 50 blue-chip stocks from 11 eurozone countries (so not the UK), we see it's down about 1% on the year.

By the time you adjust it all for currency, it's been about the same as the Dow. I'm sure some whizz with a black box can find some arbitrage in there, but that's basically it.

There is still an appetite for tech. The blue chips are much of a muchness.

What's really driving stockmarkets right now

I'm doing a kind of financial game show at the Edinburgh Festival later this year, so I've been busy writing questions. Let me put one of them to you now.

Which is the largest financial market in the world?

A. The stockmarket.

B. The bond market.

C. The foreign exchange market.

The answer, by some considerable margin, is the foreign exchange market (even if overall trading volume is down from its late 2014 highs).

Why do I mention this here?

Because, quite simply, I'm of the view that the currency markets will determine where the stockmarkets, broadly speaking, go next.

As the pound strengthens, the UK stockmarkets will underperform. Sterling weakness following Brexit was a major factor in their strength two years back.

But the elephant in the room is the US dollar.

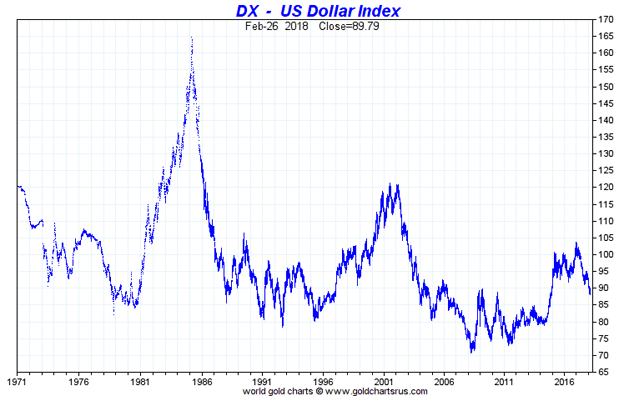

Trends in currencies can go on for a long time. The dollar was weak through the 1970s. From 1980 to 1985 it was extraordinarily strong. But for the next ten years it was weak. In 1995 the market turned and the dollar remained strong until 2002.

It then pretty much fell for six straight years until 2008. There was volatility during the financial crisis, but with an upward bias, and then the bull market really got going in the second half of 2011, going full steam ahead throughout Barack Obama's presidency until the end of 2016.

Here's the chart.

There was a major and significant change in trend that came shortly after Donald Trump was elected. Ever since then, the direction has been lower.

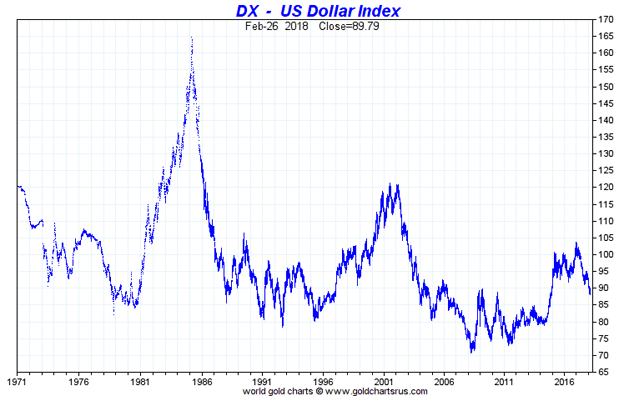

The next chart tells the story better than I do. Here's three years of the dollar.

But will those declines continue, or have they been arrested?

The dollar bears will point to the fact the trend is very much down. The bulls, however, will argue and I have a lot of sympathy with this argument that dollar is oversold and due a rally.

The index doesn't look like it wants to go below 88, where's there's been a double bottom. The dollar has now managed to get back above its 20-day moving average, which is now flat. These are all signs that the market may be stabilizing here.

Where's the US dollar heading now? Here's my gut instinct

I must say and I apologise, dear reader, because I know you like clear and strong opinion but on this one I feel ambivalent. I can find reasons why it will both rise and fall. I'm hedging my bets, both in the column and in my portfolio.

However, while I can see stabilisation over the next few months, and possibly even a rally, my instinct is that, longer-term this is a bear market for the dollar.

One reason is that the US administration has pretty much admitted that it doesn't want a strong currency, so there is not going to be a huge operation in place to defend it.

But perhaps my main reason is the typical, multi-year duration of those dollar bull and bear markets. We are only a year or so into this one. Typically, they go on for many years.

So that's my current outlook for the US dollar: short-term volatility with an upward bias. Longer-term it heads lower.

Let's see how that pans out. I await the judgement of the markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how