Beware of a quick Vix

The crash of an obscure derivative-based fund demonstrates why you should never invest in anything you don’t understand.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The crash of an obscure derivative-based fund demonstrates why you should never invest in anything you don't understand.

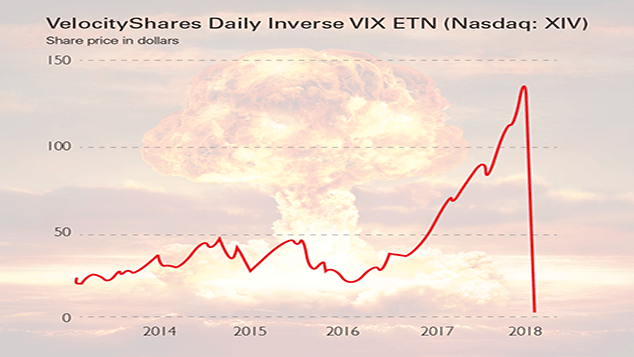

Last week, a small hedge fund made an 8,600% return by betting on the inevitable. It had bet that the VelocityShares Daily Inverse Vix Short-Term exchange-traded note, which was shorting the Vix index, would go to zero. Given that Credit Suisse, the product issuer, warns in bold type in the prospectus (albeit on page 197) that "the long-term expected value of your ETNs is zero", this would appear to be close to a sure thing.

And yet the odds of such an outcome were priced very cheaply, which is how US-based Ibex Investors managed to turn a mere $200,000 into $17.5m when the product (XIV for short) blew up last week as a result of volatility in the markets suddenly spiking hard (see the chart above).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There are some useful reminders here for investors. Firstly, be wary of complexity, and don't invest in anything you don't understand anyone who had actually read the XIV prospectus would surely have thought twice. Secondly, don't extrapolate the recent past into the distant future XIV investors were betting on volatility continuing to fall, even though it was already at or near historic lows.

Finally, avoid fragile investment strategies that effectively involve picking up pennies in front of a steamroller, as the adage goes those that put money in your pocket nicely for as long as certain conditions hold true, but then squish you if your luck changes. The XIV made its investors a great deal of money until the day it lost them everything.

But this isn't just a story about a few obscure derivative-based funds. The end of an era for low volatility could have much broader implications. As Bloomberg notes, "the average volatility rate for 2017 was lower than every single trading day from 22 December 1995 to 20 June 20 2005".

That backdrop of extraordinary calm has, as Edward Chancellor notes on Breakingviews, incentivised the use of many more strategies that are effectively short volatility, even if they are not direct bets on the Vix (see below). The success of trades ranging from buying high-yield debt to share-buyback schemes funded by taking on corporate debt all depend on volatility remaining quiescent and on interest rates being suppressed.

With global central banks and the Federal Reserve in particular now tightening monetary policy rather than loosening it, this spike in volatility could merely be the first of many. As Jonathan Lavine of Bain Capital tells the Financial Times, the biggest concern about the recent spike was "the ferocity of the move, not triggered by any material news and propelled by a small corner of financial markets. You have to ask yourself what would happen in the event of real bad news."

The Vix index explained

The CBOE Volatility Index (which has the ticker symbol VIX) was launched in 1993, based on ideas in a research paper by finance academics Menachem Brenner andDan Galai. It aims to measure investor expectations of volatility in the S&P 500. In other words, it is a measure of how violently the stockmarket is expected to swing around over the following 30 days.

The Vix's value is derived from the price of options bought by investors to protect (hedge) against a fall, or to bet on a rise in the market. The cheaper the options, the lower the Vix.

A low Vix (below 20, loosely speaking) indicates that investors expect the market to be calm, while higher readings suggest the opposite, which is why the Vix is sometimes known as Wall Street's fear gauge.

Yet while in the past it has been cited by some as a potentially contrarian indicator (a high Vix is bullish, a low one bearish), in practice, a higher or lower Vix has shown little predictive value.

One problem with the Vix's growing popularity is that as both Barron's and Bloomberg highlighted last year the proliferation of direct and indirect bets on the index staying low has in itself distorted and suppressed the Vix, creating the potential for a sharp spike, as seen last week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how