The charts that matter: the bubble in complacency bursts

Investors have been growing increasingly complacent, taking bigger, bolder and more reckless bets on the status quo lasting forever. That “bubble in complacency” has now burst, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Monday:Stockmarkets have finally noticed the widening cracks in the bond market

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday:Why did the stockmarket crash and what should you do now?

Wednesday:Two golden trading rules never trade while bored, and never at 3am

Thursday:Don't panic but don't ignore the market's warning signs

Friday:Wish the new Fed chair luck he'll really, really need it

And you can listen to this week's podcast now where Merryn and I talk about the excitement in the markets, the Vix index and investment scams, among other things.

What can I say? What a week. Been a while since we've had one of those and it ain't over yet.

Last week I was wondering how the market would react to rising bond yields. And on the podcast earlier this week, Merryn and I were struggling to find the bull case for many financial assets against a backdrop of rising yields and inflation.

Looks like we didn't have long to wait.

I spent a lot of time unpicking this in last week's Money Mornings, but the basic situation is this: markets became overpriced (the US market especially).

When markets are very overpriced as the US has been they're vulnerable. It's like the old Bible story. You build a house on rock, and it'll take a lot to knock it down. Build it on sand, and a stiff breeze will push it over.

So we had a market built on sand. And now we've got the first sniff of a big financial change coming. Not so much a stiff breeze, as a permanent, violent change in wind direction. Bond yields, after three-and-a-half decades of going down, are starting to go up.

No wonder markets are panicking. Since the financial crisis in particular, they have got used to the idea that the financial weather has been permanently calmed by the intervention of central banks. As a result, investors have taken ever bigger, bolder and more reckless bets on the status quo lasting forever.

There's been a bubble in complacency, effectively. The first sign of that bubble popping was the self-destruction of various financial instruments that were betting on the volatility index. They were at the sharpest end of the big bubble bet.

But the whole market, at a much more structural level, has been positioned for low volatility continuing. And the fallout from that changing is what we're seeing now.

How long will it carry on? I don't know. What I can tell you is that the US market is still rampantly overvalued as of the time of this writing (Friday morning). And investors have also realised that there's no easy way for central banks to bail them out of this if the threat is rising inflation and rising interest rates, then the solutions the Fed has (higher short-term rates) are not happy ones for the market.

The market will be rooting for weak economic data. And it'll be hoping for nods from the Fed that interest rates won't rise as quickly as planned (and I'm sure Donald Trump will be nudging the Fed in that direction too).

Markets also see a lot of short sharp rallies during times like these. Everyone thinks it's over, and "buy-the-dip" panic briefly takes over again. Only to run into another sell-off.

But overall, propping the market up looks like it'll be a much harder task from here on in.

These sorts of markets are brutal by the way. Avoid the temptation to trade them, particularly if you're a long-term bear who now feels the ever-so-slightly vengeful desire to profit by taking the short side. Chances are your capital will be whipsawed into many tiny pieces.

Time to take a look at the charts. This week was dominated by "risk-off". That's where you see money rushing out of stocks and into assets deemed "safer" the Japanese yen rocketed, for example. (The yen isn't included in the charts below, but I should probably introduce it we'll talk about why the yen matters next week).

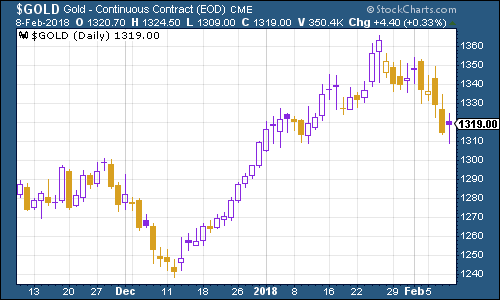

Gold edged lower during the week as the US dollar spiked, but it's interesting that it actually held up very well during the broader sell-off. Rising bond yields are not necessarily good for gold. But as long as interest rates rise more slowly than inflation (ie "real" interest rates remain low) then that should be good for gold as should general market panic.

(Gold: three months)

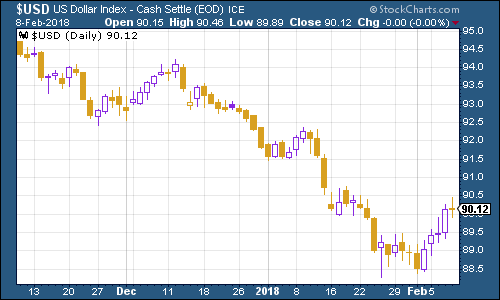

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners had a big rebound this week (as my colleague Dominic suspected was in the pipeline). That's a "risk-off" move as frightened investors run to the apparent safety of the US dollar.

(DXY: three months)

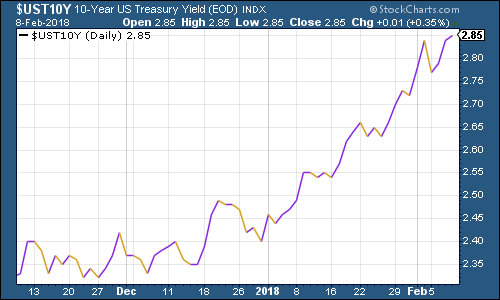

Another interesting move the yield on the ten-year US Treasury bond continued higher this week. This matters because the market has been in the habit of running to not from the US Treasury when it feels panicky. If Treasuries are no longer seen as somewhere to hide, then to me, at least, this is a sign that the deflationary psychology has been pretty much broken.

(Ten-year US Treasury: three months)

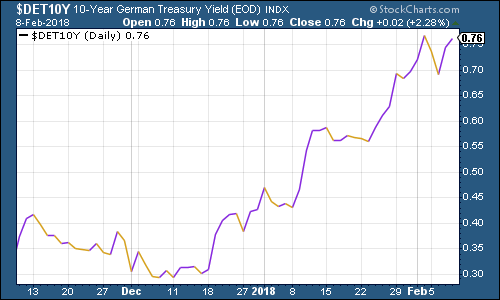

As for the ten-year German Bund the borrowing cost of Germany's government, which is Europe's "risk-free" rate there's still a large "spread" or gap between this and the US rate. And while the German bond is following its US peer higher, you can see that the markets aren't quite as convinced about the European Central Bank becoming more aggressive as they are about the Fed.

(Ten-year bund yield: three months)

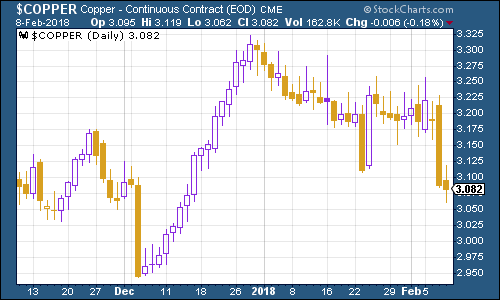

Copper finally succumbed to the market panic halfway through the week. This is to be expected. Copper is a "risk-on" asset and I'd have been surprised to see it hold up in a major stockmarket sell off. It'll be interesting to see how the conflict between panicky stock markets and a strong underlying economy plays out over the coming year.

Also, it's worth keeping an eye on China. We haven't talked much about China in market terms for a while, but the country genuinely appears to be shifting focus heavily to boosting consumption rather than infrastructure the commodity market can't expect the same level of "supercycle" boost it got during the early 2000s.

(Copper: three months)

Bitcoin continues to be a riddle wrapped in a mystery inside an enigma and plonked up on the blockchain. If you'd asked me to guess what bitcoin would do during the market upheaval, then I have to say, I'd have expected it to crash right along with it.

That'd have been the wrong guess, as the chart below shows. Indeed, this looks like being one of the best weeks that bitcoin has managed since the start of the year.

(Bitcoin: ten days)

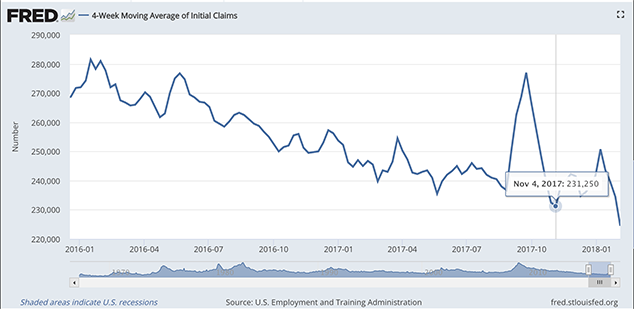

As for US employment non-farm payrolls were strong, but the indicator we like to keep an eye on is the four-week moving average of weekly US jobless claims, which fell back to 224,500 this week, while weekly claims came in at 221,000.

That's somewhat ironic, and I shall explain why. According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

Here's the ironic bit: until this week, the most recent trough was in November, at 231,250. And if that trough had held, then Rosenberg's indicator would be looking pretty damn prescient (this crash has appeared almost bang on time).

Yet, as the chart below shows, we've actually just hit a fresh cyclical trough this week.

Clearly, Rosenberg's indicator is a very rough one. And it's hardly scientific in terms of sample size (few historical indicators are). But it's an intriguing coincidence. And clearly, one big fear when interest rates start rising is that the Fed will manage to push the economy into recession (this is typically what happens, after all).

The market might be getting jittery and the employment data getting volatile because we're near some sort of turn. I'll be keeping a close eye on this one.

(Four-week moving average of US jobless claims: since start of 2016)

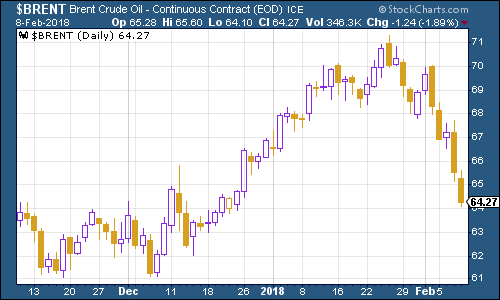

The oil price (as measured by Brent crude, the international/European benchmark) fell hard this week. Again, it's a risk-off move. And if it helps to take the edge off headline inflation figures in the near future, that might help to prop up the market mood again.

(Brent crude oil: three months)

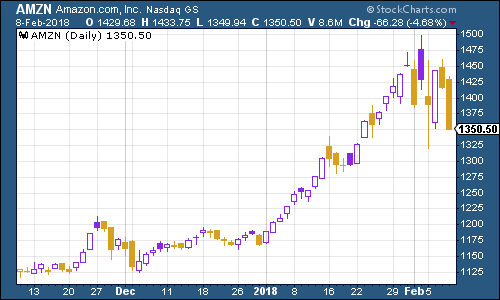

Relative to the rest of the market, it has to be said that internet giant Amazon has done pretty well. Interestingly, though, that's what you'd expect, as GMO's Jeremy Grantham pointed out in his "melt-up" theory a month or so ago. When things are heading for a crash, and the professional investors who have to be in the market but don't necessarily want to be are feeling jittery, they buy the quality stuff. And Amazon is now quality. No one will fire you for owning Amazon. That makes it the perfect stock for a professional investor to own in a crash because everyone else will look stupid too.

(Amazon: three months)

We can't quite say the same for Tesla which had quite the sell-off this week, as it is still having trouble delivering its Model 3 Teslas, which are basically the crucial indicator of whether or not this company has a future which involves actual profits, rather than simply turning cash into a tiny number of handmade electric cars.

(Tesla: three months)

By the way, while I wouldn't invest in Tesla, I do want to point out that Elon Musk's SpaceX rocket launch this week was an incredibly impressive achievement. As one wag put it on Bloomberg, he might not be able to get his cars into a showroom, but sending his own into space is pretty cool.

The Falcon Heavy was the most powerful rocket ever built by a private company. And the fact that it can carry heavy equipment at a lower price than existing rockets, opens the potential for opening up space that little bit more. It brings us that bit closer to asteroid mining and tourist trips to the Moon.

The odd misanthropes knocking it on Twitter just confirm for me that some people would simply rather see the human race fail, and all for the minuscule satisfaction of being the smuggest human beings left wrestling among the cinders.

Which of course, demonstrates the power of cognitive bias and the difficulty we have in changing our minds once we've decided on a world view. Which takes us back to where we started the painful cognitive shift that the wider market is now undergoing.

Constantly questioning your assumptions, having some humility about your worldview, and learning to live with uncertainty is hard work, but I tend to think that it's worth striving for.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how