The dollar is due a rebound – but long-term, it looks like it’s in a bear market

The plummeting US dollar has been the stand-out financial theme of the year so far. Dominic Frisby looks at its prospects for the rest of the year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Don't forget, if you're not already a subscriber to MoneyWeek magazine, sign up now and you'll get your first four copies free.

The plummeting US dollar has probably been the stand-out financial theme of 2018 so far.

It has accompanied a mini-boom in stocks, in gold, in commodities, in the euro, in the pound, even in bond yields.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But it's now reached that point when "everybody is talking about it". It's gone too far, too fast. It feels excessive. And I think the theme of the next few weeks may be a pause for breath.

And after that, then what?

Everything else has been going up against the dollar

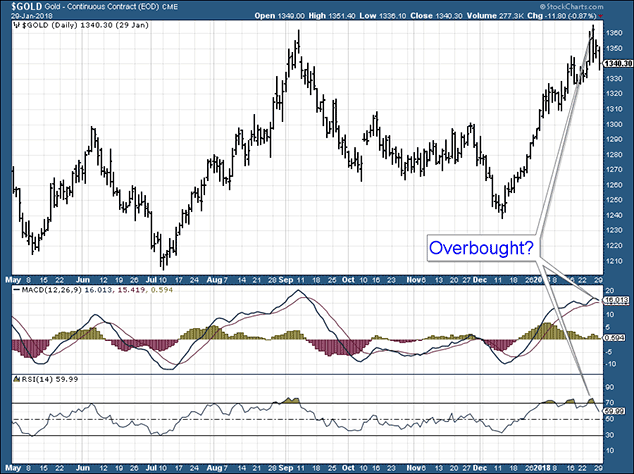

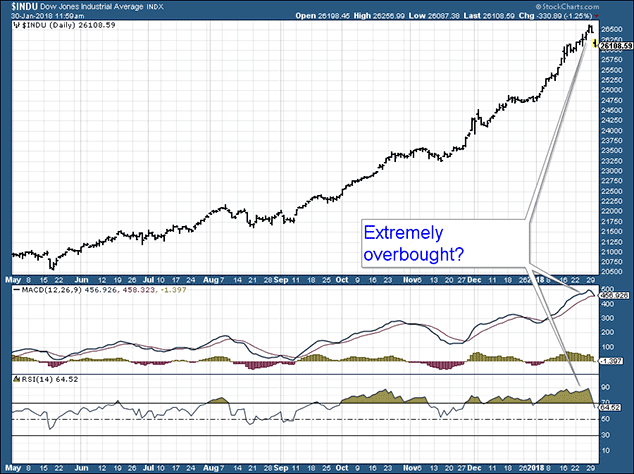

I'm going to start with two simple charts, one of the Dow Jones index and one of gold, with RSI (relative strength index) and MACD (moving average convergence/divergence) readings underneath them. You don't need to know what these are or how they work, just that they measure momentum. Strong momentum is typical of a bull market and a good sign but sometimes it can be "too strong".

Here's gold over the last nine months.

You can see that it has done pretty much nothing but go up since mid-December. This isn't the result of some mad rush to buy gold. There has not been a panic buying of sovereigns, gold eagles or gold exchange-traded funds (ETFs) indeed ETF holdings are only up by a few percent.

Rather it is a function of US dollar weakness.

Underneath the gold price you can see, first, MACD and, second, RSI. Both are at the upper end of their range. From such a point, corrections usually follow and indeed gold is down a little on the week.

Next we see the Dow Jones. This really has gone bananas. If you didn't know it was the Dow, you would think it was some overhyped cryptocurrency.

But both MACD and RSI are much higher than normal. If nothing else, this market is due a pause.

I looked at a long-term chart of the Dow going back to 1980 (I'm not going to post it here as I don't want to burden you with too many charts) and the daily MACD at more than 450 is the highest it's ever been. Trends are amazing things. They can go on for a long time. They can surprise everyone, but you have to say: be careful.

So the US dollar.

This chart below shows the dollar over the last 15 years. It is the US dollar index the dollar measured against the currencies of the US's major trading partners.

I have drawn a red horizontal line off the 2009 and 2010 highs, at around 88-89, as we have just touched that line. It is an obvious point for the index to find some support and retrace a little particularly give the overbought readings that are occurring everywhere else, especially in the US dollar "anti-trades".

Despite being childishly simple, horizontal lines can be useful tools.

I also draw your attention to the RSI underneath. It has reached a point from which retracement rallies have in the past been staged.

Then factor in some of the comments made by US treasury secretary Steven Mnuchin at Davos last week about the benefits of a weak currency, over which a lot of people got very excited and the dollar properly capitulated (on a short-term basis) and you can't help thinking that we reached one of those points of extremity at which markets turn.

The trend in the dollar is very much down. The turning point, give or take, came with the change of administration in the US and the arrival of Team Trump. But my prognosis, right or wrong, is that over the next few weeks we will see some respite and some retracement.

That's how I've positioned my short-term portfolio. I've taken profits on my sterling long, my crude oil long, my gold long, my Dow long, and I've gone ever so slightly short on the Russell 2000 (the index of US small-cap stocks). Perhaps the markets rocket on higher and I live to regret that choice, but that is the choice I have made.

My longer-term portfolio remains mostly unchanged, as this is just a short-term change in trend I see.

We could be heading for a major dollar bear market

So if the retracement which appears to have begun in the last couple of days continues, then what? The short answer is I'll be looking for some short-term oversold readings and then I'll be looking to get back in.

After some five years or more of mostly strong dollar, it's hard to get used to the idea that that may have changed, and that we're back in a weak dollar era. Is the dollar in a long-term secular bear market? I'd say it is.

The implications for the world are significant. The dollar is the global reserve currency. The dollar price is perhaps the single most important price.

Despite all the deflationary pressures of the past few years, many assets have continued to rise. My fear is that we'll now head into a period of the "wrong sort" of inflation, when the (if you're a central banker, at least) "wrong" things go up in price. We got a taste of this in the commodities boom of the 00s, it may be that we are in a similar period again.

If 88 on the dollar index doesn't hold, it could slide pretty quickly to 84 or even 80. The impact of this could be significant.

For now I watch and I wait but something is going on.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how