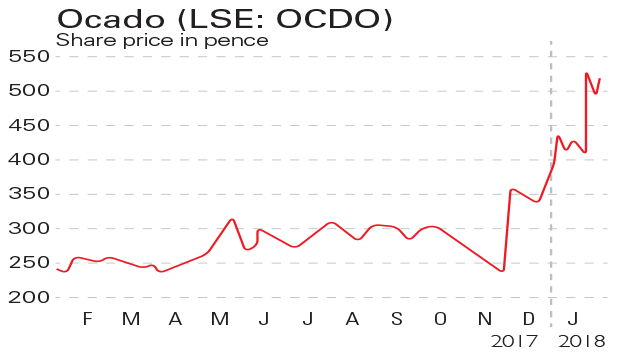

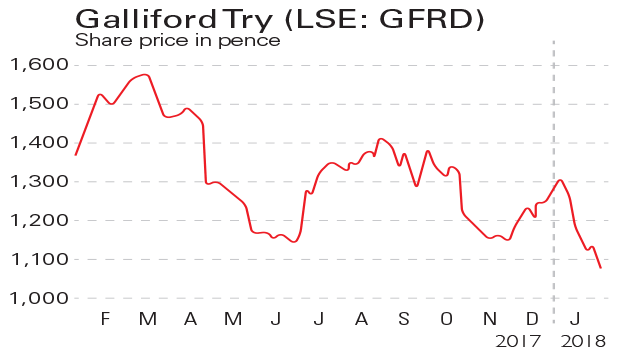

If you'd invested in: Ocado and Galliford Try

Online retailer Ocado is soaring despite being heavily shorted, but construction firm Galliford Try is suffering in the wake of the Carillion collapse.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only

Online grocery retailer Ocado (LSE: OCDO) is among the UK's most shorted stocks, but its shares have rocketed since November, when it announced plans to build a warehouse for and license its technology to French supermarket chain Groupe Casino. Two weeks ago it announced another deal to help Sobeys, one of Canada's largest food retailers, build a warehouse outside Toronto and allow the chain to use its e-commerce platform. And this week, despite announcing a profit warning and a pre-tax loss of £500,000 in 2017, it placed £143m of shares with investors, representing around 5% of additional share capital.

Be glad you didn't

Construction firm Galliford Try (LSE: GFRD) has suffered following the collapse of Carillion. In January the firm, which is working with Carillion and Balfour Beatty on the £550m Aberdeen Western Peripheral Route road, said it may have to fork out an extra £30m-£40m to complete the project. Earlier in April its shares also plunged when it abandoned an effort to buy rival builder Bovis Homes, following a £1.2bn approach. To add insult to injury, Bovis, having rebuffed Galliford's advances, hired one of its former CEOs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how