Where to find the hottest growth stocks

Swapping your hard-earned cows for magic beans can make sense. But how do you know which ones will grow and grow? Matthew Partridge reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Swapping your hard-earned cows for magic beans can make sense. But how do you know which ones will grow and grow? Matthew Partridge reports.

At MoneyWeek, we tend to favour value investing over growth give us a beaten-down bargain over a hot flash-in-the-pan tech stock any day. But we can't deny the past decade has been great for growth investors. Take US stocks: if you'd invested $1,000 in the S&P Growth Index (companies with high sales growth and fast-growing profits) in November 2007, it would now be worth nearly $2,500 an annual return of about 8%. The overall S&P returned 6% a year nearly $2,100. And the S&P Value Index which holds stocks that are cheap on metrics such as price/earnings (p/e) or price/book would have returned just $1,700, or 3.5% a year.

Can growth's hot run continue? There's plenty of justifiable scepticism out there. A lot of growth's impressive returns have been generated by the "FAANG" (Facebook, Apple, Amazon, Netflix and Google, now known as Alphabet) technology stocks, while historically high valuations mean that even fast-growing companies may struggle to justify their share multiples. And yet, so far this year, growth has continued to beat the wider market and trounce value stocks. So is it time to shift tack? Or is growth still the best place to be?

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

"There's a big danger that in the short run investors might become interested in other parts of the market, hitting growth companies," says Anthony Cross, co-manager of the Liontrust UK Growth Fund and UK Smaller Companies Fund, among others. In particular, he says, the top end of the UK small-cap sector "does look expensive at the moment". But investors shouldn't worry if prices tumble a bit, says Cross. "In the long run, fast growth and high returns on capital will push up the share prices of the best growth stocks, ensuring they outperform the market." He doesn't entirely discount valuation, but he would rather buy good firms at fair prices, rather than focus on searching for the best bargain.

The best way to make money is to follow the general growth strategy of "finding great companies, holding onto them and letting your winners run", with valuation as a decidedly secondary concern, agrees Standard Life's Harry Nimmo. Although he doesn't see himself as an "out-and-out" growth manager, he is happy to have a portfolio with a price/earnings ratio that is around 30% higher than the market average. And even now, those prepared to dig a little deeper will still find "plenty of fabulous growth opportunities", argues Premier Asset Management's Jake Robbins, who manages Premier's Global Alpha Growth Fund. Many firms benefit from the fact that "promises that were made during the tech boom of 1999-2000 are finally starting to come true and permeating into the wider economy".

Of course, you'd expect growth fund managers to back growth investing. But while studies suggest that value tends to win over time (so far, at least, although that's being called into question see box), you would be unwise to write growth off. "You don't know what will be successful in the future," cautions Professor Elroy Dimson of Cambridge's Judge Business School. Investors should make "no more than quite modest tilts towards a preferred strategy, so that portfolio diversification can be maintained". In other words, even if you favour value, having at least some exposure to growth makes sense from a diversification point of view.

What to look for

So how do you go about finding good quality growth shares? "Top-line growth of earnings and sales is key," emphasises Robbins. But it has to be consistent, and the company also must be "able to generate a return on equity (see page 10) greater than its cost of capital". Similarly, Nimmo screens stocks by revenue growth, earnings quality (which includes consistency and visibility of future revenues among other things) and price momentum, then examines individual stocks more closely. Both men agree the best time to invest is when a company is in the middle of its growth phase. The ideal company is "not so young that it doesn't make any money, but not so mature that it has no room to grow further", says Robbins. Avoid blue-sky companies that aren't yet making any money, agrees Nimmo. "It's a common misconception that the best returns come from the riskiest shares." Instead, you want to find stocks with consistently above-average earnings particularly in the small-cap arena, which is already risky enough as it is.

Companies also need to be able to keep producing those above-average earnings, which means sustaining their competitive advantage, notes Cross. On that front, he says, "intangible assets are extremely powerful". Indeed, he only invests in companies that own intellectual property or brands that can ensure their long-term dominance. He is also interested in companies with "very strong distribution networks", that can help firms to scale up. "Strong customer relationships" also matter these "help generate recurring income and give firms enough security to make long-term strategic decisions". You should also make sure those at the top of the company have skin in the game, says Cross. He prefers to see individual directors owning at least 3% of a company's equity. This demonstrates they have confidence in the company, and helps to align their interests with those of the firm.

Where is the growth today?

Right now, Cross likes software companies, especially those involved in handling data. Companies in this sector "tend to have lots of intellectual property and high margins", says Cross, and some of the smaller players "may become takeover targets". He's also keen on engineering companies in the sector may lack the glamour of software firms, but they tend to be "shareholder friendly" with "strong margins and plenty of long-term thinking".

Like Cross, Nimmo is keen on software. But he is also bullish on retailers. Retail is traditionally viewed as a cyclical sector, driven by the economy and consumer confidence, rather than as a growth industry. However, while this may be true for the largest firms, Nimmo says there are plenty of opportunities among the smaller companies. Not only has the internet allowed smaller shops to sell their goods cheaply, it is also helping them to "build brands and sales channels rapidly and internationally". A number of UK chains are also taking advantage of the fact that "a connected world has also led to a distinct convergence of consumer taste". Of course, not all stores will benefit you need to focus on the winners and avoid the temptation to hunt for apparent bargains. "For every success there will be several also-rans that look deceptively cheap but are failing to adapt to the rapidly changing retail-sector environment".

Investing in pets, robots and microchips

Nimmo also likes healthcare, particularly animal healthcare veterinary holdings account for around 8% of his UK Smaller Companies Fund. These companies are profiting from "the long-term increase in expenditure on companion animal healthcare as pets become very much part of the family" .There are also some very interesting companies in the food and drinks industries he has had a lot of success with Fever-Tree, which sells premium drinks mixers and soft drinks.

As for other promising areas, "the entire semiconductor industry is getting its second wind as the result of the rapid expansion in interconnected devices", argues Robbins. This is also good news for companies that handle radio frequencies. As far as the FAANGs go, Amazon and Netflix are profitable, but "currently seem quite expensive". However, he reckons that as long as Apple which is more reasonably valued can continue to defend its place in the smartphone market, it should do well because it generates a lot of cash.

Other trends worth buying into include: industrial machinery, which is benefiting from therapid spread of automation, particularly in Japan; the end of cash, which will benefit payment-processing companies; and electric vehicles and the increasing need for batteries. We look at more specific ways to invest in the box below.

Is value really dead?

What if, writes John Stepek, you're an incorrigible sceptic like me? All of the fund managers interviewed by Matthew for the story above have great track records and I'd generally be comfortable with any of them managing my money. But is now with the S&P 500 at record levels and signs of unhinged euphoria everywhere really the time to back growth?It feels like this shouldn't be a difficult choice at this stage.

And yet the time has looked ripe for a "tilt" to value at many points over the past decade, but doing so has resulted in nothing but disappointment for value fans. As Goldman Sachs pointed out recently, value is enduring its worst stretch of underperformance since the days of the Great Depression.

Part of the problem is the broadly dour consensus on our future economic prospects. This means that investors have been willing to pay a premium for secular (long-term) growth themes that theoretically don't require strong economic growth to do well. So "disruptor" technologies such as electric cars and social-media behemoths do well, while cyclical stocks in more traditonal industries languish in the doldrums.

Yet as Goldman analyst Ben Snider points out, as long as there are human beings involved in markets (which admittedly we perhaps can't take entirely for granted), there will be opportunities for value investors most people systematically overvalue growth, which leaves opportunities for value to play catch-up when the tide turns. What could trigger such a turn? Snider reckons the most obvious catalyst would be "an acceleration in economic activity, either as a result of fiscal stimulus or productivity gains... or simply at the start of the next economic cycle". Meanwhile, as Mark Hulbert recently noted on MarketWatch.com, value stocks have only been cheaper relative to growth on one occasion in the past the 2000 dotcom boom. And we all know how that ended.

So if you'd rather place a bigger bet on value right now, how can you do it? An exchange-traded fund (ETF) might seem a good option, but be careful one high-profile ETF in the US, for example, has more than 10% of its portfolio invested in Apple probably not what you're thinking of when you want to invest in "value".

If you're looking for a value fund, a better bet and a far more concentrated one might be Gary Channon's Aurora Investment Trust (LSE: ARR). The trust is well respected it trades at a small premium to net asset value and top holdings include banking group Lloyds, housebuilder Bellway, and supermarkets Morrisons and Tesco. Another, more globally focused option is the contrarian-minded Scottish Investment Trust (LSE: SCIN), which trades at a discount of 10%. Top holdings include pest controller Rentokil and Australia's Treasury Wine.

The best investments to buy now

Anthony Cross co-manages the Liontrust UK Smaller Companies Fund with Julian Frosh (as well as Matthew Tonge and Victoria Stevens). The ongoing charge of 1.37% is a little high for our liking, but performance has been very strong, with the fund returning 1,121% over the past two decades (13.4% a year), compared with just 227% for the FTSE All-Share (6.2%). One of the fund's main holdings is Iomart Group (LSE: IOM), a Scottish IT company that has done very well out of the boom in cloud computing, with sales up nearly 270% over the past five years. Iomart currently trades on 17.8 times 2019 earnings.

As manager of the Premier Global Alpha Growth Fund, Jake Robbins has returned 123% (12.9% a year) since March 2011, compared with 69.8% for the FTSE All-Share. The ongoing charge is around 1.2%. Robbins particularly likes US-listed semiconductor company Skyworks Solutions (Nasdaq: SWKS). Its chips are used in a range of devices, but it makes a lot of its money from those used in smartphones, and so should benefit as they grow ever more powerful. Thanks to strong demand from both Apple and Huawei, revenue has doubled in the past four years. The company is on a p/e of 14.9.

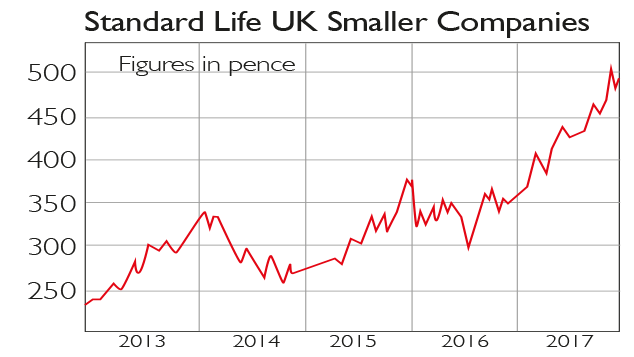

Since Harry Nimmo took over the Standard Life UK Smaller Companies Trust (LSE: SLS) in September 2003, it has returned 862% (19.3% a year), compared with 100% (8.8%) for the FTSE All-Share. It currently trades at a small discount of 2% to its net asset value (NAV) and has an annual charge of 1.08%. Nimmo is a big fan of retailer Ted Baker (LSE: TED). While the luxury sector in general is under pressure, Baker has more than doubled its revenues in the past four years by investing heavily in its online operations, which now account for a fifth of sales. It currently trades on 19.3 times forecast 2019 earnings.

Another British retailer that is doing very well is JD Sports Fashion (LSE: JD), which has seen revenue double over the past three years. Its 37% return on capital has generated enough money to fund a series of acquisitions, including Unlimited Sports Group and GO Outdoors. The aim of these takeovers is to maintain growth by broadening the type of sportswear it sells, and by expanding into western Europe, where the market for sporting apparel is growing faster than that of the US.JD trades on a p/e of below 15.

While most of the FAANG stocks are relatively expensive, Apple (Nasdaq: AAPL) is trading on a p/e of 15, which looks quite low given that revenues have grown by nearly half over the past five years. While sales of the iPhone 8 have been slow, demand for the new iPhone X has been strong. Apple's music and app subscription services should also keep revenues growing at a brisk rate. In the longer run, Apple is hoping the evolution of the "internet of things" will mean people end up using its smartphones and watches to control their appliances. Apple's 22% return on capital helps it to throw off plenty of cash.

If you're willing to venture slightly further afield you might be interested in CKD Corporation (Tokyo: 6407). CKD specialises in advanced machinery especially industrial robots which is seeing a surge in demand as automation continues to grow in both developed and emerging countries. As a result, sales have grown by 50% in the last four years. Among other things, CKD is currently working with PS Solutions on a platform that combines artificial intelligence and connected devices to automate production decisions and processes on farms. CKD trades at 16.3 times 2019 earnings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impact

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impactFrozen tax thresholds and pensions falling within the scope of inheritance tax will drag thousands more estates into losing their residence nil-rate band, analysis suggests

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive