The charts that matter: the Fed steps in to soothe the jitters

John Stepek with another roundup of the charts that matter to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

This week was, of course, the UK Budget. As Budgets go, it wasn't an especially eventful one, which is pretty much the best we could hope for. The horrible-looking GDP forecast revisions were expected, and chancellor Phil Hammond was a bit more generous in terms of spending than markets had thought, and so the overall market reaction was broadly positive.

A more important factor for our various charts this week was that the minutes from the latest Federal Reserve meeting also came out. They were a little more "dovish" than markets had expected, which meant a weaker dollar (particularly against the Japanese yen, which has rallied hard in recent weeks).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While the Fed still looks likely to raise rates next month, there is more uncertainty over just how aggressive it will be in the next year. And so the US currency edged lower. Stockmarkets like easy monetary policy, and so they headed higher.

Meanwhile, in Europe, Germany began the week with a big setback in its efforts to form a government. But it's now looking as though Angela Merkel's CDU might be able to rekindle their relationship with the centre-left SPD. Perhaps the prospect of another election that might send even more votes away from the dominant two parties made Martin Schulz think again.

Political paralysis and loose monetary policy a pretty typical week in the life of our post-2008 world, in other words.

And now, turning to our regular charts

Now we'll turn to our charts, but first, if you missed any of this week's Money Mornings, here are the links to catch-up.

Monday: What Germany's political crisis means for your money

Tuesday: "What fresh hell is this?" Your last-minute Budget 2017 preview

Wednesday: We've seen the low for the pound sterling is in a bull market now

Thursday: Budget 2017: it could have been worse

Friday: The Great Depression: How the Wall Street Crash of 1929 unfolded

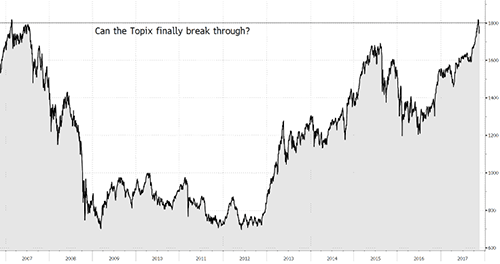

For the next few weeks at least, I'm adding the Topix index, Japan's key stock market, to our list. (In Japan, the Nikkei is analogous to the Dow Jones; the Topix is the S&P 500).

The reason we're keeping an eye on the Topix is because its progress in breaking through what Jonathan Allum at broker SMBC Nikko describes as "the iron coffin lid", could give us a sense of how investors are feeling about markets.

The coffin lid is the 1,800 level, which as the chart below shows, the Topix was last challenging in 2007.

A convincing breakout here would be very bullish indeed, as it would convince many technical traders that the only way is up for Japan. A failure to breakthrough might suggest a correction or even the start of a new bear market was on the horizon.

This week, the Topix has clawed its way higher by around 20 points to 1,780. So fingers crossed, it's looking good so far.

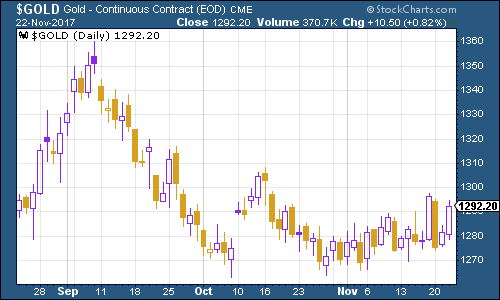

Gold had a rebound this week as the dollar weakened. For now, $1,270 per ounce seems to be a bit of line in the sand.

(Gold: three months)

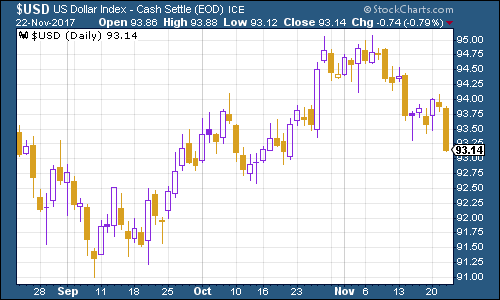

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners slid back quite significantly as the Fed was more dovish than expected.

(DXY: three months)

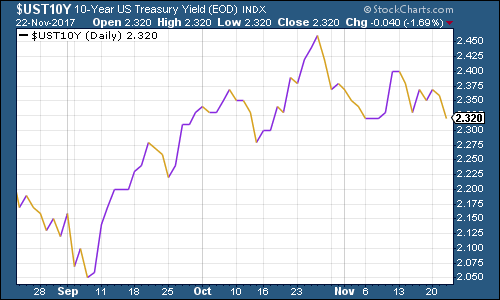

Meanwhile, the yield on ten-year US Treasury bonds also ticked lower as the market revisited its assumptions on interest rates and inflation. Again, we're still holding below the 2.4% mark that's now seen as a major line in the sand by many analysts.

(Ten-year US Treasury: three months)

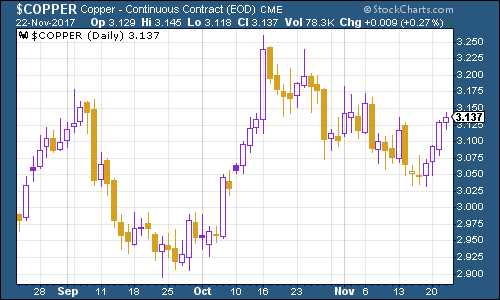

Copper had a major rebound this week, helped partly by the weaker dollar.

(Copper: three months)

Bitcoin has taken a bit of a breather at the $8,000 mark. This week we heard one analyst calling for $10,000 and the thing is, that doesn't seem particularly ridiculous right now. In fact, it hardly seems worth bothering to get in for a measly 25% gain...

(Bitcoin: six months)

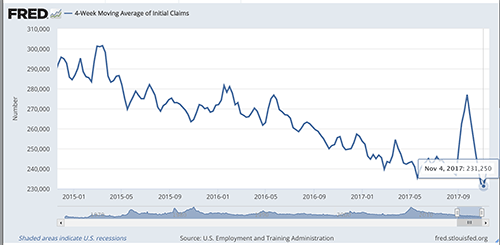

This week, the four-week moving average of weekly US jobless claims rose, to 239,750, although weekly claims fell to 239,000. According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

As the chart below shows, the most recent cyclical trough was just a couple of weeks ago, at 231,250. So we could still be a way from the peak.

(Four-week moving average, US jobless claims, year-to-date)

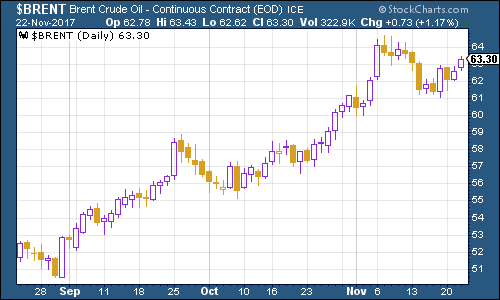

The oil price (as measured by Brent crude, the international/European benchmark) regained a lot of ground this week as traders expect oil cartel Opec to extend its production cuts. The gang of oil producers meets up next on November 30th.

That said, Russia oil producers are getting annoyed because they feel that the oil production cuts have driven up prices and enabled US shale producers to get back into the game.

(Brent crude oil: three months)

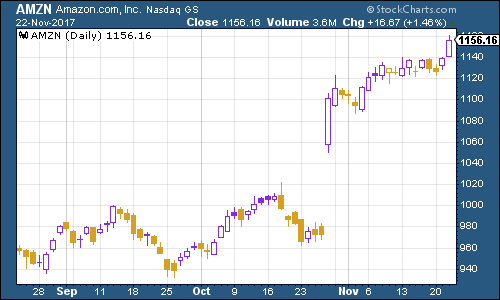

Finally, internet giant Amazon continued higher this week, perhaps appropriately enough given that it's Black Friday.

How long can this continue? I find it interesting that, as John Authers notes in the FT, exchange-traded fund provider ProShares has literally just launched the CLIX ETF, which is 100% long online retailers, and 50% short bricks and mortar retailers in the US. Or you can go for EMTY (geddit?), which is shorting an index of 56 retailers.

This is at a time when WalMart king of the bricks and mortar dinosaurs just filed results that look as though it might embarking on a proper attempt at catching up with Amazon.

They say that they don't ring a bell at the top, and most of the time they don't but I can tell you for sure that these sorts of financial products don't get issued at the bottom.

(Amazon: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how