Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

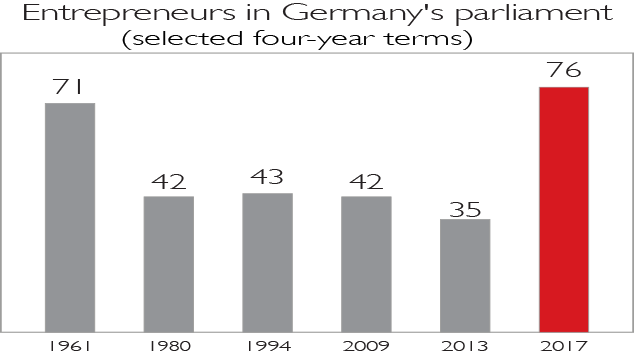

Before September's election, entrepreneurs had been an endangered species in the German parliament. The money on offer for MPs is less than a typical company owner's salary. But now they've made a comeback, as the Frankfurter Allgemeine Sonntagszeitung points out. In the last Bundestag there were just 35 company owners and self-employed MPs; now there are 76 (of 709). The proportion of entrepreneurs in parliament is now roughly the same as in the overall population. Whether that will provide more impetus for economic liberalisation, however, remains to be seen.

Viewpoint

Jamie Dimon, CEO of JPMorgan Chase, says bitcoin is ideal for criminals in Venezuela; BlackRock CEO Larry Fink is also up in arms. They want regulators to do something. Wall Street never calls for more rules. It feels threatened because cryptocurrencies will make Dimon & Co. redundant by cutting out the middleman. In the case of initial coin offerings (ICOs), the companies are essentially conducting a virtual crowdfunding by giving coins or tokens out to investors directly. There is no call for Wall Street to charge millions to organise it. So let's hope its lobbying is ignored. A new financial system is developing there's no need to throttle it at birth.

Miriam Meckel, WirtschaftsWoche

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how