The next big technology start-up: Saudi Arabia

The desert kingdom is in the throes of radical upheaval – its leader wants to follow Facebook’s example, and “move fast and break things”. Investors should be wary, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The desert kingdom is in the throes of radical upheaval its leader wants to follow Facebook's example, and "move fast and break things". Investors should be wary, says John Stepek.

Succession whether in a country or a business is a dangerous time. All change, even if it's beneficial in the long run, is traumatic. The most underrated feature of democracy is that it enables the peaceful transition of power from one group to another and even then, things often get broken. It's a point that we should bear in mind as we watch the extraordinary events unfolding in Saudi Arabia right now.

Put simply, the favoured son of the 81-year-old King Salman, Crown Prince Mohammed bin Salman (also known as MBS), is consolidating his grip on power via an "anti-corruption" purge aimed at clearing a path for his ambitious plans to transform the kingdom of Saudi Arabia.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Among those arrested so far are Saudi's richest man, Prince Alwaleed bin Talal (often known as the Saudi Warren Buffett), and Prince Mutaib bin Abdullah, the former head of the National Guard and the son of the former king (King Abdullah), who was once seen as a contender for the throne.

Meanwhile, dozens of bank accounts of individuals who are not under arrest have been frozen too, reports Bloomberg. In effect, the 32-year-old king-in-waiting is dismantling Saudi Arabia's existing governance system, in which power was distributed between branches of the ruling family, the various ruling factions scratched each others' backs, and the population was kept happy by handouts paid for by oil.

Now, notes John Kemp on Reuters, MBS has taken control of all three of the kingdom's most significant power bases (defence, interior and National Guard). As Kemp notes, this is not necessarily bad news (for the world at large, if not those under arrest). "Power sharing and clientelism have underpinned the stability of the Saudi state, but are also blamed for its inability to change and adapt." And if there's one thing that Saudi Arabia needs to do right now, it's adapt.

Saudi can't afford to be a one-trick pony

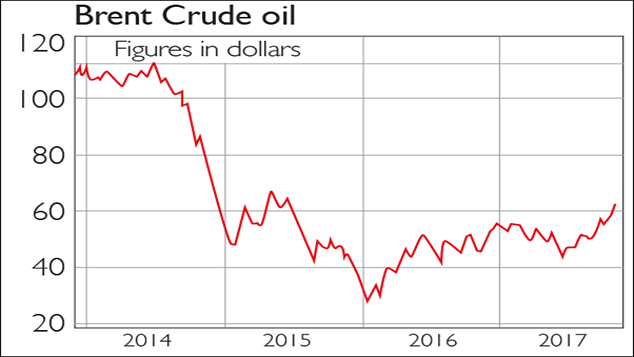

The Saudi economy is currently almost entirely dependent on oil, which generates around 90% of the nation's revenues. That was fine while the oil price was sitting north of $100 a barrel. But that dependence has become a significant liability since the 2014 oil-price crash. The country's economy is in recession, says Julian Frazer of the Official Monetary and Financial Institutions Forum, with GDP shrinking for a second quarter between April and June. Officially, the unemployment rate is sitting at about 12%, but youth unemployment is thought to be roughly double that, says Fortune magazine.

That's bad news at the best of times, but it's particularly bad when you have a population as young as Saudi Arabia's 60% of citizens are 25 or younger, and the average age is below 30. A youthful population is marvellous when it comes to potential growth, but it's also a serious threat to social stability, particularly in a repressive society such as Saudi Arabia.

With the oil-price collapse, there isn't enough money left in the coffers to maintain generous government salaries (the International Monetary Fund reckons Saudi Arabia needs the oil price to be about $77 a barrel to balance its budget). A 5% VAT charge will be imposed from January 2018, and subsidies on fuel, water and electricity are gradually being removed, moves that are unlikely to prove popular.

The potential for social unrest among the young is at least partly driving MBS's moves to relax some of the kingdom's most restrictive social policies. As Richard Spencer notes in The Times: "He has reined in the clerics by abolishing the powers of arrest of the religious police and has insisted that allowing women to drive, study and work without the permission of guardians' such as fathers and husbands is something they will just have to live with." Younger Saudis have also been among those cheering the anti-corruption purge loudest. But it's also about the changing nature of the oil market.

Obviously, there's the long-term threat posed by renewables, advances in battery technology, and the electric vehicle. But a more immediate threat is that oil shale has radically changed the power dynamic. Saudi is currently no longer the world's biggest oil producer the US is. So even if you're not convinced that the current mania for electrification and automation spells the long-term demise of oil as the world's most important commodity, Saudi now has a lot more competition as a supplier. In short, the country desperately needs to diversify, for both economic and social reasons.

2030 vision

That's where the crown prince's "Vision 2030" scheme, unveiled at the start of last year, comes in. In the process of weaning Saudi Arabia off oil, he wants to diversify the economy massively. On the leisure side, developers are building shopping malls with cinemas in them, just waiting for film theatres to be made legal again (they were shut down due to clerical pressure in the 1970s). MBS also wants to encourage tourism with new Red Sea resorts (for now, it's virtually impossible to visit Saudi Arabia as a tourist, other than to go to Mecca for the Hajj). "Private healthcare and education are also in the works," reports Fortune.

Meanwhile, Saudi's sovereign wealth fund, the Public Investment Fund, is collaborating with BlackRock on a $40bn investment vehicle, and with Japanese telecoms giant SoftBank on a $45bn tech fund. Just last month, the Future Investment Initiative "Davos in the desert", as some described it was held in Riyadh, with attendees including the IMF's Christine Lagarde, Virgin founder Richard Branson, US Treasury Secretary Steve Mnuchin and Larry Fink of BlackRock.

Among other things, MBS laid out plans for Neom a $500bn investment zone near to Egypt and Jordan ("a hyper-advanced city and innovation hub that will be powered entirely by renewable energy", says Frazer, "it is as close practically as the project can be to both Africa and Europe").

This is all about creating private-sector jobs to get the economy growing again, stave off unrest by reducing youth unemployment, and move Saudi onto a more sustainable path MBS has cited Dubai as something of a role model on various occasions. And the part-sale of the giant state oil company Saudi Aramco is key to funding this vision (see below).

A risky foreign policy

From that point of view, the crackdown represents interesting timing, given its potential to deter investors just when MBS needs the money most. As Thomas Lippman of the Middle East Institute puts it in The Washington Post, "When you sack the minister of the economy and you arrest two of the most prominent business personalities in the country that's bound to make people think: Wait a minute. Do I want to jump into this pool right now?'"

The prospect of having funds and property confiscated perhaps because you've done business with the wrong princeling is naturally unsettling to Western investors. So has he overplayed his hand?

On the upside, MBS has declared that he wants a "moderate, open" Saudi Arabia, and some business people have welcomed the corruption crackdown Reuters reports one senior executive as saying: "It's great news for the clean ones among us 99.99% are ecstatic." And there's no doubt about it a more open Saudi Arabia could be a very interesting investment proposition. The Middle East generally is still a highly niche investment region, but you can imagine the potential for much stronger economic growth in a wide range of sectors if youth unemployment was reduced and the kingdom's social conservatism was relaxed even a little.

On the other hand, there is the danger posed by MBS's pursuit of what can only be described as a muscular foreign policy. His uncompromising approach to internal affairs is matched by his approach to the country's allies and enemies in the region, and it's one that risks making what has always been a volatile part of the world even more turbulent. Saudi's "Cold War" with Iran is heating up fast, with proxy battles going on in Yemen and Syria.

The Saudi-born prime minister of Lebanon Saad al-Hariri meanwhile was effectively "sacked" by the Saudis on Saturday, reports the BBC, for failing to contain the influence of Iranian allies Hezbollah over the country's unity government. Saudi has also been blockading Qatar for nearly six months, accusing the emirate of sponsoring terrorist groups in the region and generally being too close to Iran.

What could go wrong?

So there's a lot that could go right and a great deal that could go horribly wrong. According to Bloomberg, MBS models himself on the likes of Bill Gates and Facebook founder Mark Zuckerberg, whose motto was once "move fast and break things".

In an interview last year, he asked: "If I work according to their methods, what will I create?" We're beginning to find out, but it will be some time before we know whether MBS's plans for Saudi Arabia can progress much beyond the drawing board, or whether he will be overwhelmed by his task in the face of internal and external battles, deteriorating finances, and a dissatisfied population.

As Frida Ghitis puts it on CNN, the prince "will either sweep the table, winning it all and becoming the all-powerful, transformative ruler of the desert kingdom, or fail spectacularly, with unforeseeable consequences for the region". So it's too early for investors to get excited about the potential for Vision 2030. However, for now, his actions do have immediate consequences for the oil industry. We look at how to invest accordingly below.

Aramco: should you buy into the IPO?

Saudi Arabian Oil Co., Aramco for short, won't struggle to find a venue to list in, should it choose to do so. US president Donald Trump tweeted that an Aramco listing would be "important to the US", and it doesn't sound like the purge has changed his mind. And the London Stock Exchange has been reviewing ways to bend its own rules in order to accommodate the listing. Little wonder it would prove a bonanza for all involved.

The state-owned group is by far the biggest oil company in the world it pumps roughly five times as many barrels a day as BP, for example, and has 13 times the oil reserves booked by Exxon Mobil, the world's largest independent oil company. The plan is to sell 5% of Aramco next year.

The Saudis put a total market value of $2trn on the company; Wall Street analysts reckon it's more like $1trn-$1.5trn. But even at the lower end of that range, this would be by far the biggest initial public offering (IPO) in history, raising between $50bn and $100bn to fund Vision 2030. Alibaba, the current IPO record holder, raised $21.8bn when it listed in 2014).

There's a snag, however a listing would entail revealing a lot more about Aramco than the Saudis may be comfortable with. A Fortune profile of the company notes that it failed to reveal details such as the number of rigs it has and how much oil it has left to extract.

That's a figure that has been the subject of a great deal of speculation and scepticism over the years unsurprisingly, because the number has remained unchanged at 260.8 billion barrels for decades. So it's possible that Aramco may end up being sold privately, assuming the Saudis can find someone willing to offer the right price.

If it does end up going public next year, would we consider investing? Almost any share can be a good purchase at the right price. But given the country's lack of transparency, Aramco's inexperience with life as a public company, and the fact that you'd be a minority shareholder alongside a government unused to sharing power, the price would have to be pretty low to get us interested.

The oil giants and funds to buy now

Clearly any disruption to supplies of oil from Saudi Arabia would be very bullish for oil prices. However, for now that seems very unlikely. What does seem more likely is that Saudi will use its influence with oil cartel Opec to maintain production cuts at its meeting in Vienna at the end of this month. If MBS needs a decent sales price for Aramco to fund his reform programme, then you'd expect him to be keen to prop up the oil price.

Has the oil price come too far, too fast? Quite possibly. Is the market underestimating the likely response from shale oil producers? Maybe. However, it does also seem unlikely that oil producers even in the US will bring supply online at the sort of pace that might put the current recovery in serious jeopardy. Remember that shale oil producers have no more desire to return to $30 a barrel than the Saudis do.

Given an oil price in the $50-$60 range, the uncertainty over dividend payouts from oil giants Royal Dutch Shell (LSE: RDSB) and BP (LSE: BP) has receded substantially, but then, as a result, so have the yields. We tipped them before when their yields were closer to the 7%-8% levels, and at around 5.5% they're still appealing from an income point of view, but just be aware that Shell in particular has come a long way this year and is now trading at close to a multi-decade high, whereas BP has only just managed to regain levels last seen before the Deepwater Horizon disaster.

If you'd prefer to invest in the oil sector via a fund, then it's worth looking to the US. The energy sector has been among the worst-performing this year, falling by around 8%, according to Barron's, which is quite something given the fact that the S&P 500 keeps setting new record highs. An interesting option is the US-listed SPDR S&P Oil & Gas Equipment & Services exchange traded fund (NYSE: XES). The ETF has had a rough year so far, but has picked up over the last month or so and with the crude price continuing to rally it could have further to go it's now trading at around $16.50 having started the year at around $24.

A UK-listed alternative that offers exposure to the US market is the iShares Oil & Gas Exploration & Production ETF (LSE: SPOG), whose top five holdings include US oil and gas producers ConocoPhillips, EOG Resources, Anadarko Petroleum, oil sands group Canadian Natural Resources, and US oil shale group Pioneer Natural Resources.

Finally, as Eoin Treacy points out on FullerTreacyMoney.com, the wider impact of oil prices on the economy should not be ignored. A rapidly rising oil price has been among "the leading contributing causes to recessions in the past". We might not be there yet, but rising oil prices push inflation higher while hurting growth, a toxic combination that could make life very tricky for central banks at a point where they are already trying to edge rates higher without undermining asset prices.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.