Score attractive profits from the global growth of the beautiful game

Football has become a multi-billion-pound business in recent decades – and European leagues’ popularity in emerging markets means there’s more to come, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Football has become a multi-billion-pound business in recent decades and European leagues' popularity in emerging markets means there's more to come, says Matthew Partridge.

Twenty-five years ago British football was transformed by the decision of the clubs in the first division of the Football League to rebrand as the FA Premier League and strike new commercial deals. Since then football has grown from a beloved national pastime to a multi-billion-pound business. The 20 Premier League clubs had total revenue of €4.8bn (£4.3bn) in 2015/2016, making it Europe's biggest league, say accountants Deloitte.

The top division in Germany was second, with €2.7bn, while Spain, France and Italy collectively accounted for €5.84bn. Counting secondary divisions, European clubs have collective revenues of €24.6bn.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So football is now unequivocally a very big business. While ticket sales are important, the real driver of revenue growth is broadcasting rights, which have shot up exponentially. The first major television deal that the Premiership agreed with BSkyB in 1991 was worth £304m over five years equivalent to £60.8m a year.

By contrast, the current deal involving Sky and BT, which runs from 2016 to 2019 was worth £5.14bn for three years. This is nearly a 30-fold growth in annual terms, representing a compound growth rate of over 14% each year.

Keeping a grip on audiences

The question is whether this can continue. Growth should slow down in the UK market since "Sky and BT have seen their viewing figures drop by around 10% this season", says Kevin Tennent of York University's Management School and author of Foundations of Managing Sporting Events: Organising the 1966 FIFA World Cup. However, you should "expect to see the streaming services try to muscle in on football broadcasting".

After all, "Amazon Prime has recently bought rights to NFL matches, so there is no reason why the Premier League could not sell streaming rights separately to the likes of Amazon and Netflix".

"I see nothing at the moment to say that sports are fundamentally losing their grip on consumers' attention," agrees Stefan Szymanski, professor of sport management at the University of Michigan, who has acted as a consultant to several major sporting bodies, including FIFA, and has written the bestseller Soccernomics. "The most popular sports in general have been the most attractive content for broadcast", which should enable them "to command ever increasing prices."

Although "the boom will likely not be as big as it has been so far, positive growth rates in demand may still be expected for a while" predicts Ignacio Palacios-Huerta, professor of management, economics, and strategy at the London School of Economics and a member of the board of the Spanish top-flight club Athletic Club de Bilbao.

Finding new markets

One factor that will sustain growth over the next few decades is growing interest in football in emerging markets. "The opportunities in markets like China are huge", so "if the English Premier League can become the dominant league in China the revenue potential is vast", says Szymanski. "There is still room for growth in countries such as China and India where there is massively increasing interest," agrees Tennent. The only risk is that "eventually the Chinese government will want to favour the domestic product".

Even if that happens, it will take some time for the leagues in emerging markets to catch up with the standards of European football. And "the established nature of the various European top-flight leagues and the Champions League create a sort of interlinked business model that is well entrenched", says Tennent. The upshot is that in terms of overseas demand for Europe's elite, "there is likely to be growth and residual interest for a long time yet".

The globalisation of European top-flight football can also be seen when it comes to sponsorship. This "was traditionally dominated by businesses local to each team", says Alex Gillett, lecturer in marketing at York University and Tennent's co-author on the 1966 book.

However, "these global or Asian brands are able to outbid the local or even national British brands", which is good news for football clubs. One example of this "is the Indian tyre company MRF who traditionally sponsor cricket but who have now become Newcastle United's sleeve sponsor".

Broadening the audience

Another way to continue increasing the audience is to target demographic groups that have traditionally been less interested in football, particularly women and families. Around two-thirds of casual football fans in both the UK and France are male, according to market research by Kantar, while the 2017 National Supporters Survey suggests that only around of 9% those attending matches are female.

However, football is belatedly realising that it is "foolish to ignore 50% of the population", argues Tennent. Indeed, clubs are "making progress in making their grounds more female friendly" and several "have dedicated family stands, which may also have the side effect of encouraging more female support". Both FIFA and the FA are trying to build up the woman's game, with FIFA outlining an objective of "increasing the number of female players to 60 million by 2026", says Palacios-Huerta. This scheme "focuses on participation all the way from school level to international competitions".

Most of these teams are still semi-professional and the quality of football is, at best, variable. Indeed, it's important to note that despite all the recent hype, many leading clubs, such as Manchester United, don't even have a women's side. However, this year's women's European championships received wide coverage in newspapers and four million people tuned into Channel Four to see England lose 3-0 in the semi-finals to Holland.

Converting revenue into profits

As every businessperson knows, growing your revenue doesn't matter if you're unable to keep your costs under control. In 2011 UEFA brought in Financial Fair Play, a system of soft wage caps, in an attempt to make sure wages didn't spiral out of control. The idea behind this is that "clubs cannot repeatedly spend more than their generated revenues, and will be obliged to meet all their transfer and employee payment commitments at all times".

The Premier League, along with most other divisions, has also adopted rules to penalise clubs that don't meet their bills, including points deductions and automatic relegation for clubs that enter administration.

Still, many experts are sceptical about whether football as an industry can ever be consistently profitable. "The main problem here remains that club owners and the fans still want the clubs to win, and the way to increase your chances of this is to pump more money in while trying to increase your commercial and match day incomes at the same time," says Tennent. "The data I have seen across teams, leagues and countries reveals a rather stable share of wages, despite huge differences over time and across leagues," says Palacios-Huerta.

However, the situation seems to be improving. The total losses sustained by European football clubs fell from €1.7bn in 2011 to only €286m in 2016, according to UEFA. Similarly, 14 out of 20 Premier League clubs now make a profit. In any case, higher transfer fees mean that "the biggest clubs now look like banks, given the book value of the players' contracts", notes Szymanski.

Takeover targets

Even those clubs that struggle to balance their books may be worth more than their balance sheets would suggest. This is because there are an increasing number of rich individuals willing to pay a premium price for clubs. This is the case because "when you buy into football you are buying publicity on a scale that you could not obtain anywhere else", argues Szymanski.

"As long as there is someone who thinks they can win friends and influence people by ploughing money into soccer clubs, there will continue to be vast sums of money invested in acquiring established clubs and sleeping giants'," agrees Gillett.

As well as the prestige of seeing their club win, there are business reasons why a rich individual may want to pay above the odds. This is because owning a club "offers networking opportunities around the matches and even perhaps direct marketing opportunities", says Tennent. "There is also a long-standing tradition in the English league that the directors of a club entertain the directors of the visiting club with lunch before the match."

This social aspect makes club ownership particularly attractive to tycoons who have made their fortune in Asia, where "eating with business partners can be important in sealing a deal".

This summer saw Chinese businessman Gao Jisheng spend a reported £210m for a 80% stake in Southampton in August, while Russia's Alisher Usmanov also had a bid of £1bn for Arsenal turned down by its owner Stan Kroenke.

Over half of clubs in Britain's top two tiers (and 14 out of 20 of the Premiership) now have foreign owners. Even teams outside the top flight have benefited, with former Disney CEO Michael Eisner buying third-tier Portsmouth in a deal that included £5.6m up front and a commitment to invest a further £10m.

This merger-mania has extended to the continent's other leagues. This year Chinese investors bought Inter Milan from Silvio Berlusconi, the former Italian prime minister, for $628m, while a rival consortium paid $287m for 68% of Inter Milan. Businessman Chen Yansheng has built up a 90% stake in Spain's RCD Espanyol over the past two years. Chinese property firm Dalian Wanda also owns 20% of Atletico Madrid, generally regarded as the third most successful Spanish team, behind only Barcelona and Real Madrid. Other well-known Chinese companies and tycoons also control French clubs Auxerre, Nice and Lyon.

The bad news for investors is that, after a period during the 1990s when a lot of clubs were floated on the stockmarket, most of them were taken back into private ownership, mostly through takeovers. However, investors can still buy a stake in several major and emerging European clubs. If that's not enough to whet your appetite, there are also other, more indirect ways to benefit from the continued boom in football. See the box below for some ideas on how to do this.

Six ways to invest in the global football boom

Throughout its history, Scottish football has been dominated by the "Old Firm" duo of Celtic and Rangers. The last time someone else won the top division was Aberdeen in 1984-1985. Since Rangers were relegated in 2011, Celtic (LSE: CCP) has been on top, winning the Scottish Premier League for the last six seasons, and is on course to make it seven in a row.

The club has recently submitted a planning proposal for an ambitious redevelopment of the land around its stadium, which should help boost revenue. In the long run, Celtic is angling to be admitted to the English Premier League, either directly or via promotion from a lower tier, which would massively boost its value. On a price/earnings ratio of 13.4 times forecast 2018 earnings, the shares are attractively priced.

Borussia Dortmund (Frankfurt: BVB) is one of Germany's leading clubs. It has had a large amount of success developing young players, who can either go on to play for the club, or be sold to other clubs. The most prominent example of this is Ousmane Dembl, who was sold this summer to Barcelona for €105m and up to €40m in additional payments. With ten players younger than 23 in the squad the side has plenty of talent remaining. The shares trade at eight times 2018 earnings, though those figures are skewed by Dembl's sale.

The dominant Italian team in recent years has been Juventus (Italy: JUVE), which has won Serie A for the past six years in a row and has reached the finals of the Champions League twice in the last three years. After losing a record €95m in 2011, the club made a big effort to get its finances in order and made a profit for the first time in six years in 2015. Its strategy is now to make sure that transfers end up turning a net profit. Its shares trade at 12.6 times 2017 earnings.

Dutch side AFC Ajax(Amsterdam: AJAX) has built a successful business finding talent from its academies, which boast the highest success rates in professional football. It also makes a lot of money from merchandise and broadcasting rights. The shares trade at four times current earnings, although these have been distorted by recent large transfers.

Paddy Power Betfair (LSE: PPB) owns the Paddy Power chain of bookmarkers and the Betfair betting exchange, which should benefit from the globalisation of football, especially since Asian viewers are already avid gamblers. Strong growth prospects justify a forecast p/e ratio of 17.7 times 2018 earnings.

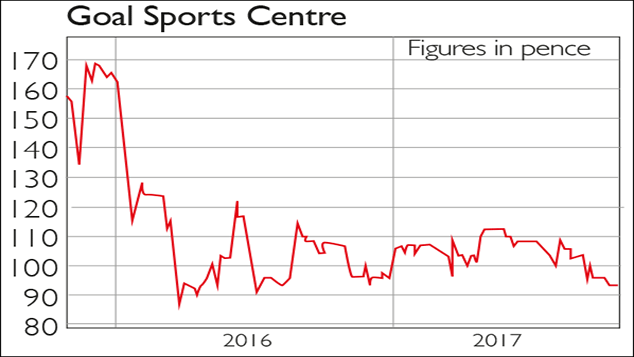

Football's growing popularity in the United States should aid the overseas expansions plans of Goal Soccer Centres (LSE: GOAL). The chain of five-a-side centres has had a turbulent few years, with its share price plunging more than half in the space of two and a half years. However, it has invested a lot of money in refurbishing its pitches and arranging a joint venture with Manchester City. The shares trades at 11 times 2018 earnings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

Dario Amodei: The AI boss in a showdown with Trump

Dario Amodei: The AI boss in a showdown with TrumpAnthropic’s CEO Dario Amodei was on an extraordinary upward trajectory when he found himself on the wrong side of the American president. He is about to be severely tested.

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.