The charts that matter: Merkel prangs the euro and Trump’s tax travails

John Stepek looks at how Trump and Merkel’s fortunes this week have affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The main headline events of the week were Donald Trump's efforts to get his tax reform plans back on track, and German chancellor Angela Merkel's unexpectedly poor showing at the German elections at the weekend. So how did they affect the markets that matter most? Let's take a look.

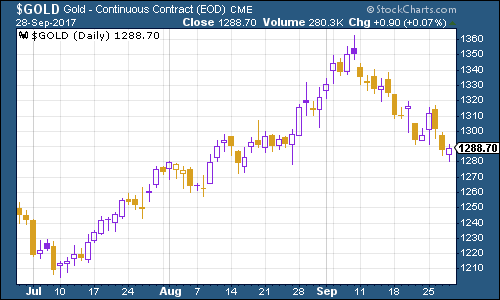

Gold

continued to slip this week as the dollar continued to claw back ground in the wake of the US Federal Reserve's interest rate comments last week. However, markets are still tentative about embracing a full-blown comeback for the US currency, and gold hasn't yet suffered as much as you might expect.

(Gold: three months)

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That of course, is partly because gold is underpinned by other fears, including the fact that we never know when North Korea will issue another missile threat and send everyone scrambling back to safe havens. But it's also because the dollar's rally is as much the result of other currencies weakening in particular, the euro.

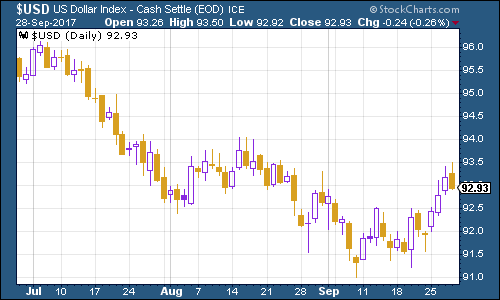

US dollar

You can see this in the juddering progress of the

index. This is a measure of the strength of the dollar against a basket of the currencies of its major trading partners. The euro is the biggest component of this basket. So a slide in the euro will generally make the dollar look stronger.

(DXY: three months)

So what's bothering the euro this week? One issues is that it's becoming clear that the European Central Bank doesn't want the currency to go much higher. But this week specifically, the euro is struggling after German chancellor Angela Merkel was badly weakened by the German election result, which like every other election in the last couple of years, didn't go entirely as planned.

We discussed this on Monday, but put simply, the far-right gained seats and Merkel's party lost them. She's still chancellor, but putting together a coalition will be a time-consuming pain in the neck. She'll probably also have to put some distance between her domestic image and the pedestal that certain breathlessly hysterical foreign commentators have put her on.

A weaker Merkel also means that, while Emmanuel Macron might fancy himself as the next president of Europe, it's going to be harder to create the "Franco-German" power couple that might have been able to drive through further integration as opposed to utopian speech-making. That in turn while not exactly bearish for the euro is not bullish for it either.

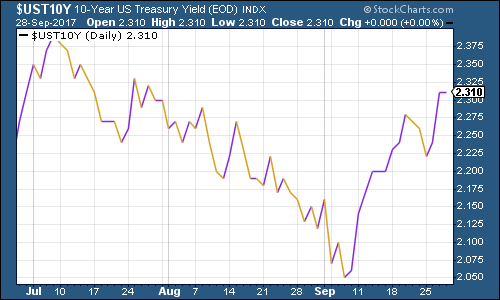

US Treasury bonds

Meanwhile, the yield on

perked up again. That's probably been helped by signs of progress on US president Donald Trump's tax reforms. But it may also be down to a dawning recognition that it's just conceivable that we're moving into an era of rising inflation and interest rates.

(Ten-year US Treasuries: three months)

That's something I've expected for a while, and I've been wrong so far. But I'll be keeping a close eye on the data. Looking back, it's interesting to see how quickly inflation can take off when it does I looked at this yesterday in my piece on the bond market crash of 1967 to 1971.

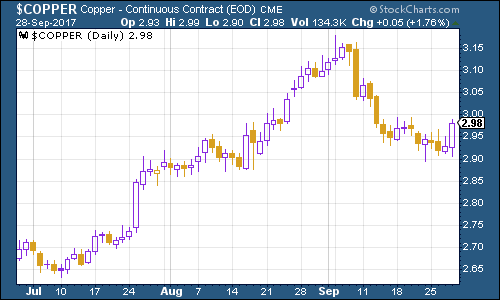

Copper

has started to perk up again. It had fallen pretty hard following its early-September surge, so the bounce might not be surprising. It might also suggest that investors are growing less concerned about China in general.

(Copper: three months)

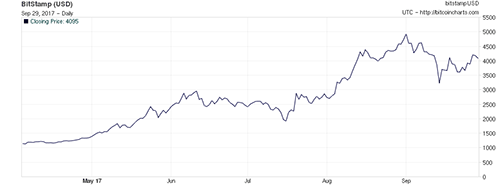

Bitcoin

is still going strong. It remains wildly volatile, but that's new asset classes for you. (If you missed

my colleague Charlie Morris's piece on bitcoin in MoneyWeek earlier this month

, check it out now).

Also if you're kicking yourself for not buying (or you've ever regretted any other missed opportunity), my colleague Dominic has some comforting words for you. It's really worth reading this it not only contains a hugely important psychological lesson for traders, but it's also very funny.

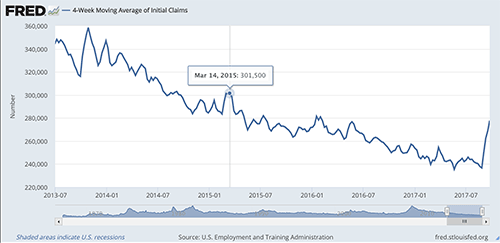

US jobless claims

This week, weekly

continue to be disrupted by hurricane activity. The four-week average jumped to 277,750 as claims came in at 272,000. That was in line with the 270,000 expected.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later. So far, 20 May has been the cyclical trough, but the stockmarket has only just set a new peak, and the disruption to the US jobless claims means we can't get a clear reading. So the jury's out on this one still.

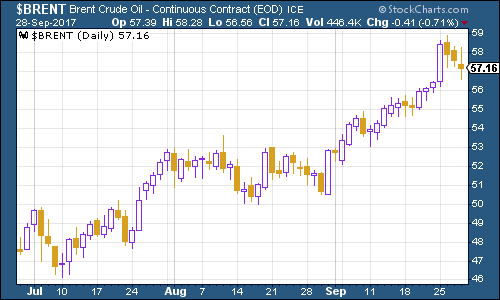

Oil price

Chart number seven is the

(as measured by Brent crude, the international/European benchmark). Oil headed higher yet again this week, although it's off its high. The spike this week was caused by strife in Turkey the country's president, Recep Tayyip Erdogan, threatened to switch off an oil pipeline from Iraqi Kurdistan after the autonomous province voted for independence in a referendum.

(Brent crude oil: three months)

Meanwhile, demand for oil is up and oil producers have managed to roughly stick to their decision to cut supply.

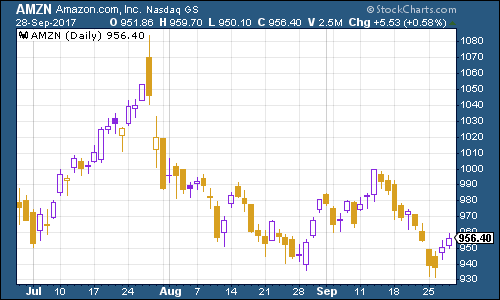

Amazon

Finally there's

. As the wider US markets continue to hit record highs, Amazon remains well off its August high.

(Amazon: three months)

As we've already noted, the political picture for big tech is darkening and there are some other toppy' signs that concern me a high-profile futures contract dedicated entirely to the FANG' stocks plus China's equivalents has just been launched, which speaks of a certain unhealthy focus on one sector of the market.

My colleague Merryn explains why we're thinking of dropping a particularly tech-heavy investment trust from our model portfolio in the MoneyWeek magazine editor's letter this week. I suspect it's the right decision.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King