Here’s what happened the last time the bond market crashed

John Stepek looks back to the “great bond massacre” of 1994 to find out what we can learn about today’s bond bubble.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

This article was first published in September 2017

I've been talking a lot about inflation this week rising inflation could be bad news for bonds.

So in the latest in our series on market crashes, I thought we'd take a look at the last time we saw a real panic in the bond market.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The "great bond massacre" of 1994...

The great bond massacre. That was the headline on a Fortune magazine article (by Al Ehrbar) published in 1994.

That year, global bond market investors lost, from peak to trough, along the lines of $1.5trn. Sure, these days that's just a third of a Fed (the US Federal Reserve's $4.5trn balance sheet should, I think, be the new benchmark measurement when referring to bond markets). But in those days, it was "the worst bond market loss in history", as Fortune put it.

So how come we don't hear much about it? Everyone knows about 1929, 1987, 2000 and 2008. Most people know the 1970s were basically awful, even if they can't pinpoint 1973/74 as the precise stockmarket crash dates. And I reckon more than half of you would be able to quote 1997 as the year of the Asian crisis.

But 1994? Let's look at what happened.

In February 1994, the Federal Reserve's key interest rate (the Federal Funds rate) was sitting at 3.0%. This was extremely low by historic standards. It had been sitting at that level for 17 months, and the last time anyone had seen rates go up was six years previously.

That in itself is a pretty useful reminder that, while our current situation is unprecedented in terms of scale, it's not the first time that interest rates have been left sitting at historic lows for a long period of time.

Meanwhile, as the Fortune article noted at the time, "wages were going nowhere, and companies dared not raise prices". However, at the same time, the US economy was perking up and had been growing for nearly three years. So the Fed thought it was about time for interest rates to start rising, to head off any threat of inflation.

In February 1994, the Fed raised interest rates to 3.25%. It raised them again in March and April, to 3.75%; and then by 0.5% in May and August (so we're at 4.75% now). Then, in November 1994, the Fed actually raised rates by 0.75% in one go. Even before the financial crisis, that would have been a punchy move. So by the year-end the Fed Funds rate stood at 5.5%.

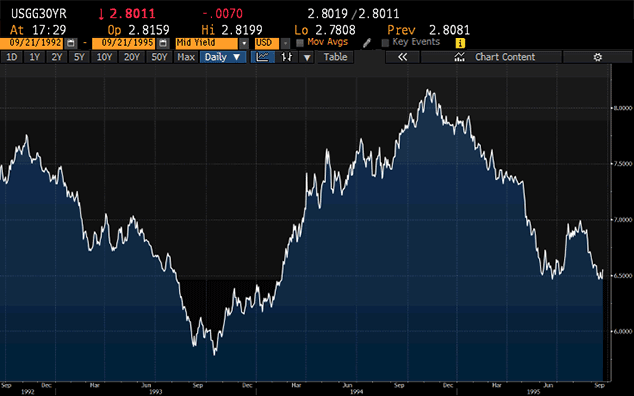

Bond investors hadn't expected the Fed to move as quickly as it did. There was a global bond panic, and yields shot up (which means that prices fell). The chart below shows what happened to yields on 30-year US Treasuries, for example. (If you can't make out the details, yields spiked from below 6% to above 8% a massive move for that market).

Bear in mind that a huge chunk of this move occurred within the first couple of rate hikes. The 30-year bond is more sensitive to short-term rate changes, but to quote again from the Fortune article of the day Gilbert de Botton of Global Asset Management in London, said "You had a snowballing liquidation completely out of proportion to the fundamentals".

The year the bond market had a little Minsky moment

There's a good argument to be made that the 1994 bond crash was one of the key events that turned the then Fed chairman Alan Greenspan into Wall Street's best pal the man who would never take the market by surprise again, and thus created even more epic levels of moral hazard than already existed.

But in fact at least according to a paper by the Bank for International Settlements (the BIS, the "central banks' central bank") written in December 1995 the real problem wasn't Fed policy (and given that the economy was just fine after this, that seems a reasonable conclusion).

It was "the internal dynamics of the bond market". In short, bond investors had simply become too complacent.

Bond market volatility was extremely low. Bond investors were betting on interest rates either remaining stable or falling further, and using leverage to do so. When you employ leverage borrowed money you magnify your gains and losses, and vastly increase your chances of being wiped out.

The more complacent people get and the more overvalued a market becomes, the more leverage they tend to use. This is why Hyman Minksy's model of financial markets is the most sensible mental model to use to think about these things. When prices are high and expectations are complacent, it's all too tempting to juice up your returns with borrowed money. Hence "stability breeds instability".

In case you're wondering what happened to stocks they had a bit of a scare when the Fed started raising rates, and fell by about 10% early in the year. But they hit the bottom for the year in April 1994 and really just spent most of the year meandering a bit higher. It was by no means a remarkable year one way or the other for stocks, and things perked up sharply in 1995.

Markets survived, and ultimately calmed down. But a lot of people got burned and a fair few scalps were claimed. As Jonathan Davis pointed out in an FT article on the topic a few years ago, the famed hedge fund investor Stanley Druckenmiller lost $650m in just two days.

Probably best known is that in December 1994, Orange County in California went bust due to its own leveraged bets on interest rates. For a very long time, it was America's biggest-ever municipal bankruptcy (indeed, it was only in July this year that the county made its final repayment on a $1bn bankruptcy bond that it had issued in order to repay some of its debts to public agencies).

Good news and bad news

The good news is that Paul Schmelzing, who wrote a very good piece on this topic for the Bank of England earlier this year, reckons that 1994 is not something we're likely to see repeated. That's mainly because the Fed is highly, highly unlikely to raise rates at the sort of pace we saw in 1994.

The bad news is that he reckons a repeat of the second half of the 1960s which was worse is much more likely. Next week, we'll take a look at that particular "crash" (it was more of a slow-motion disaster, but I certainly think it's a period that should be of great interest to us right now).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Do we need central banks, or is it time to privatise money?

Do we need central banks, or is it time to privatise money?Analysis Free banking is one alternative to central banks, but would switching to a radical new system be worth the risk?

-

Will turmoil in the Middle East trigger inflation?

Will turmoil in the Middle East trigger inflation?The risk of an escalating Middle East crisis continues to rise. Markets appear to be dismissing the prospect. Here's how investors can protect themselves.

-

Federal Reserve cuts US interest rates for the first time in more than four years

Federal Reserve cuts US interest rates for the first time in more than four yearsPolicymakers at the US central bank also suggested rates would be cut further before the year is out

-

The Bank of England can’t afford to hike interest rates again

The Bank of England can’t afford to hike interest rates againWith inflation falling, the cost of borrowing rising and the economy heading into an election year, the Bank of England can’t afford to increase interest rates again.