What Britain’s best-loved estate agent can tell us about UK house prices

Estate agents’ fortunes can tell us a great deal about which way the housing market is going, says Dominic Frisby. And Foxtons’ share price is in freefall.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today we are talking estate agents.

We do so, because their fortunes can say a great deal about which way the housing market is going.

Specifically, we are focus on the "green Mini" brigade.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yup, it's everyone's favourite estate agent Foxtons.

Behold the wondrous pinnacle of the estate agents' art Foxtons

It's hard to understate the surge of exhilaration we experience when we are cold-called about a house we briefly had on the market 11 years ago and then the warmth we feel when we discover the caller is from Foxtons.

Equally hard to articulate is the sense of benevolence we encounter as we are splashed at a pedestrian crossing by a green Mini driving through a puddle at speed to make the lights.

If there is one company that acts as a kind of distillation of the communal love we hold as a nation towards the profession that is the estate agent, it is Foxtons.

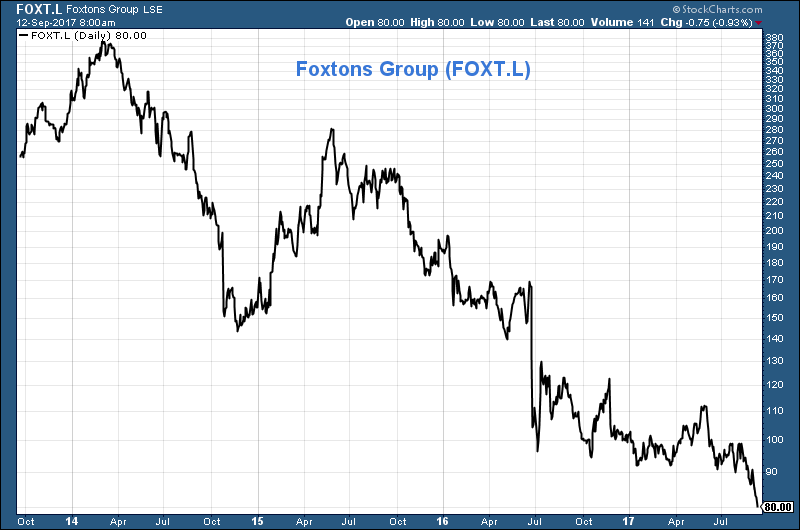

Foxtons Group went public in 2013, and caught the back end of the quantitative-easing infused boom in London property, rising to a high of 380p by spring 2014.

For me, spring 2014 is when the madness in the London property boom reached peak insanity. Buyers were everywhere, open days were mobbed, gazumping was rife, money was pouring in from abroad, lending was easy, agents wouldn't give you the time of day unless you were an unencumbered cash buyer, and houses which were first shown on the Saturday had sold by the following Monday.

And as you can see below, Foxtons' peak coincided with London's.

Many have blamed the decline in London property values on ex-chancellor George Osborne raising stamp duty. Sure, the higher duties have killed transactions the cost of moving is now so high, many chose to stay put but London was already in decline by the time Osborne announced his changes in late 2014, in his final budget before the 2015 election. Tighter lending laws, introduced in April 2014 and necessarily so were what put the brakes on.

Over the following three quarters, Foxtons lost nearly half of its market value. First, there was the slowdown in lending and thus transactions. In August 2014 there was a profit warning, with another the following October. Things improved in the first half of 2015, but then the bear took hold again.

Brexit was a big blow, knocking another 30% off or so. And I'm sure that if both sides of the referendum debate had been more upfront about the consequences of voting to leave the European Union on Foxtons' share price, "Leave" would have won by a considerably larger majority.

But in the 18 months since the referendum, support seemed to have been found at just above the 90p mark. Rather like London property, the price was stagnant and atrophying, rather than in outright decline.

Until this summer that is, when the 90p barrier gave way and the price sunk pretty pronto to 80p, where it sits as I write.

Foxtons is at an all-time low but it could well have further to fall

Irony of ironies, the genius market timer who is Jon Hunt, founder of Foxtons (he famously sold the business for £375m in 2007, just before the financial crisis), is currently via his company Ocubis selling a £50m plot in Vauxhall.

The agent he's appointed to handle the transaction is Strutt and Parker. Actions speak louder than words.

Foxtons got its initial public offering (IPO) away in 2013 at 230p, at the top of the targeted 190-230p range. By the end of its first day's trading, it was some 20% higher at 270p. Within a few months it saw its high of 380p.

The current situation is that anyone who has ever bought Foxtons is now underwater.

Foxtons' market cap now stands at around £220m a full £155m below Hunt's selling price (and there has been quite a bit of expansion since).

Using rounded numbers, in 2016 revenue was £133m, pre-tax profits came in at £19m, earnings per share (EPS) 5.7p, the price/earnings (p/e) ratio 18 and the yield 2%.

The forecast for 2017, according to Digital Look, is for revenue to drop to £120m, pre-tax profits to be £10m, EPS to be 3p, the p/e to be 29 and yield 1.8%.

Assuming those forecasts more or less come good, you have to say, even at 80p, Foxtons is not especially cheap.

However, in July, Foxtons reported that first-half, pre-tax profits had fallen by 64% to £3.8m from £10.5m in the first half of 2016, while revenue also fell by 15% to £58.5m.

Group adjusted earnings before interest, tax, depreciation and amortisation fell by about 45% and EPS came in at 1.2p from 3.0p the year before. This is worse than forecast.

The reason given was "unprecedented" economic and political uncertainty. Foxtons added that it expects trading conditions for the second half of the year to be "challenging", which is estate agent speak for "horrible".

If the trend of the first half continues into the second not such an unreasonable projection earnings will thus come in around £7.6m some 25% lower than forecast.

In short, there is room for a further slide in Foxtons' share price, particularly if the property market continues to stagnate.

Let's be clear this is not just Foxtons

I should stress, however, that Foxtons does actually make money. In its favour, also, is that it has no debt.

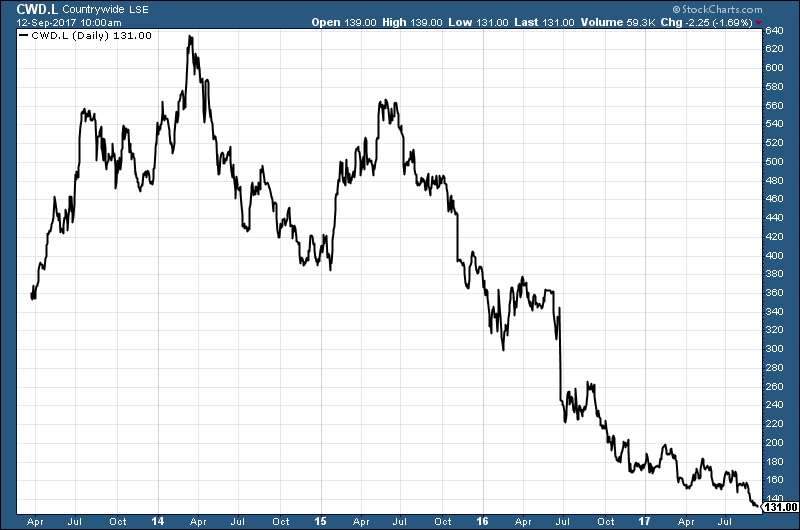

Its rival Countrywide, which counts John D Wood as part of its roster, is in a more parlous state, I'd say, with the additional noose of debt around its neck.

The price action is similar. The outlook bleaker.

It is easy to lay the blame for the plight of these estate agents at the door of new, cheaper online rivals such as Purple Bricks, and there is some truth to that.

But, after a stellar first half, Purple Bricks itself has also been in decline since the summer, when it hit 500p. It's now 20% lower at around 400p.

I get the whole growth argument Purple Bricks is a new way of selling your home, "blablablah", as my French friend is always saying to me but with a market cap of over £1bn, revenue considerably lower than Foxtons' or Countrywide's and loss-making, for me this is the most compelling short of them all.

(To be honest, I don't see why Rightmove and Zoopla don't just cut out the middleman and became estate agents themselves. The platform is already there, as is the market share).

So all in all, the plight of the estate agents is fairly grim, and lower prices beckon across the board. This is a consequence of low transaction volumes. The current chancellor could sort that in his Budget later this year by lightening the stamp duty load but I'm not sure if it is his inclination to do that.

So what does it mean for house prices? Well, the estate agents may be sending out the message that house prices are headed lower, but the builders and indeed both Rightmove and Zoopla have largely enjoyed a flatter share price action. This might be explained by there being some anticipation of further building ahead. But to make a full-on bearish call on UK housing, you'd probably want to see their share prices in freefall as well.

Maybe we'll see that too. But meanwhile, I wouldn't touch the estate agents with a bargepole, unless it was the short end of the stick, if you catch my drift.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.