What should you be buying today: gold or US stocks?

If you had played the ratio between stocks and gold right over time, you would have profited handsomely, says Dominic Frisby. So which should you buy now: gold or stocks?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Knowing which assets to be in and when is the secret to investing success.

Easy to say, harder to do.

Today we look at the ratio between gold and stocks over time, and ask which of the two we should be erring towards just now

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How smart timing can make your fortune (and bad timing can destroy it)

Stocks, meanwhile, as measured by the S&P 500, began the decade around 1,450, experienced two epic crashes and ended the decade nearly 25% lower around 1,100.

The 2010s have witnessed a rather different scenario. The S&P 500 has more than doubled, while gold is up little more than 10%. If you take September 2011 as your starting point, when gold hit $1,920, the numbers look even uglier (if you are on the gold side of the trade).

September 2011 was the point at which the ratio between the two reversed. In 2011, with gold worth $1,920 and the S&P 500 at 1,170, it took about 0.6 of an ounce of gold to buy one unit of the S&P 500. Now, with the S&P close to 2,500 and gold around $1,250, you need roughly two ounces.

Let's say you had sold one S&P 500 unit in 2000. You could have got around 5.4 ounces of gold. You then sold that gold in September 2011, when you could buy the S&P 500 for 0.6 ounces of gold. What was a single S&P unit in 2000, is now nine S&P units in 2011. That's some gain.

If you were then to sell those nine S&P units, now you'd get 18 ounces of gold.

Play the ratio between the two right in other words, get your asset allocation right and over time you compound your wealth considerably.

However, let's say you did the opposite. You sold 5.4oz of gold in 2000 and bought one S&P 500 unit. You switch back in 2011, that 5.4oz is now just 0.6oz. Ouch.

Switch back now, with the S&P 500 trading at two ounces of gold, and for 0.6 ounces you end up with about a third of an S&P unit. (If I've got the maths wrong, please correct me in the comments. I've tried to keep it readably simple.)

You've lost about two-thirds of your wealth and you haven't even been buying high-risk assets. You've just got your asset allocation wrong.

So where are we now?

The gold/S&P 500 ratio where to next?

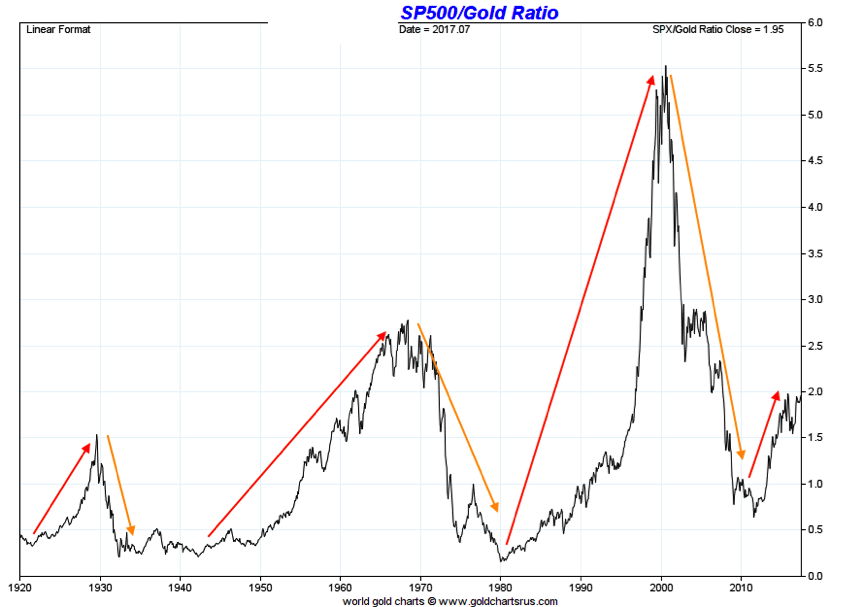

The point of maximum extreme, reached in the 1930s and in 1980 when stocks were at their cheapest was when it took just 0.2oz of gold to buy the S&P.

However, you will note the extreme at the other end has grown steadily higher over the past century. In 1929, the S&P could be bought for 1.5oz of gold. In 1970, it was 2.5 times. In 2000, it was 5.6 times.

There is a simple explanation for this. As Western society has progressed, if that's the word, over the 20th century, gold has become less prized. Meanwhile, the value of 500 of the largest companies in America has grown and grown. I know it's a statement that will break the heart of many a gold bug, but gold is just not as prized as it once was.

That is not to say, however, that gold has no value.

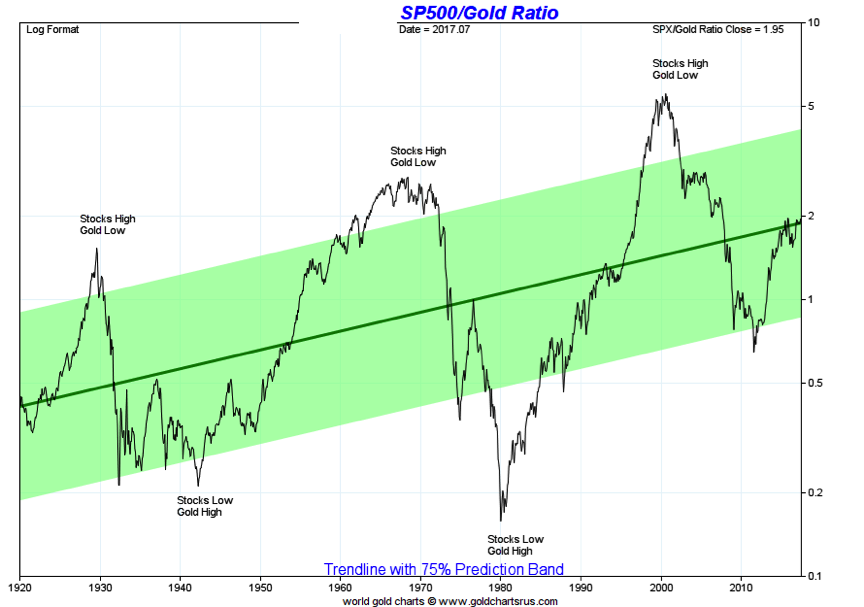

Below is a logarithmic version of the same chart for your information.

At the moment we are pretty much slap bang in the middle of the range. Where's that chart going next? Up towards the top of the range at four, five or six times the S&P, or back towards the bottom? That's the million-dollar question.

Right now, I'm inclined to say up towards the top. The world currently seems to believe more in companies and all the enterprise that comes with them than it does in gold. Companies keep getting bigger and more valuable.

But, who knows? Maybe we are re-living the 1970s and the market is set to turn, just as it did in 1976 (when it was also in the middle of the range), and head back towards the point where it costs just 0.2 oz to buy the S&P.

What is gold: money, or an Armageddon play?

I'll have a go at answering that question. It's a beautiful and prized metal which was once official money. That's no longer the case, although its main use is still as a store of value, as well as in jewellery.

Gold's main problem, in terms of investor psychology, is that it is no longer official money, and it is no longer perceived by the mainstream as having any real world use beyond being something quite nice to look at.

That perception has to change. It was starting to change in the 2000s as gold fever took over, but that has now dissipated.

When I first learned about the arguments for gold in 2005, as readers of these pages will know, I fell for it. Not only the metal itself, but its potential use as money once again: the discipline and honesty it instils in those in charge would do us all a great deal of good.

Digital gold would solve a lot of money transaction issues. And with all the various abuses of fiat currency that go on printing it, manipulating interest rates, debt and deficit I thought there was a genuine chance the whole thing would go pop and gold would reclaim its historic role.

As readers of these pages will also know, six years of bear market have taken their toll and as time has gone by I've grown more and more cynical. When a gold bug now says: "What about Asian demand?", I argue that Asian fascination could erode away just as Western demand did in the 20th century.

When a gold bug says: "gold has always been money", I say: "The horse was always transport. Then we invented the car."

I do buy the argument, however, that gold is money in extremis. At times of crisis, gold is the money of last resort. But the strategic decision to buy gold, so that when Armageddon comes you rake it in, doesn't make any sense to me. Armageddon doesn't happen all that frequently. And, when it does come, you're often too busy dealing with Armageddon to be trading gold.

However, readers of these pages will remember last week I was intrigued by a chart I saw showing the ratio between gold and the S&P over the last few years. There were signs the ratio between the two had flatlined.

Here's another version, showing the ratio between gold and stocks since 2009. When the price is rising, it means the value of stocks is rising vs gold; when it is falling, it means the value of gold is rising relative to stocks.

Have we reached a turning point here, with the S&P 500 at two times the price of an ounce of gold?

That's a question we all need to think about. What is the world going to put greater faith in from current levels given the current state of the world stocks or gold?

I'll leave you to think about that. And meanwhile, I'll be keeping a close eye on that ratio.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King