Here’s how the S&P 500 could get to 5,000

America’s S&P 500 index has the feel of a late-stage bull market about it. It could be near the top, says Dominic Frisby. But it could also go much higher.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I've been thinking recently about the stockmarket, specifically the S&P 500 index.

I'm getting so many conflicting opinions that I want to take a step back and consider some of the longer-term possibilities.

Are we about to have a massive correction? A minor correction? Do we range trade?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And what about the possibility that this bull market just keeps on going?

This feels like the late stages of a bull market. But

Comprising companies from just about every sector of the economy, it also acts as a barometer of the state of the American economy. None other than Warren Buffett has described a bet on the S&P 500 as a bet on American enterprise.

And the truth is that there are far worse bets in the world. Is America going to do well? Probably. Is America a good place to do business? For the most part, yes. Are Americans good to do business with? For the most part, yes, I'll say.

Is America advancing and improving, innovating and inventing? Hell, yes! Humans are doing that pretty much everywhere, and America leads the pack.

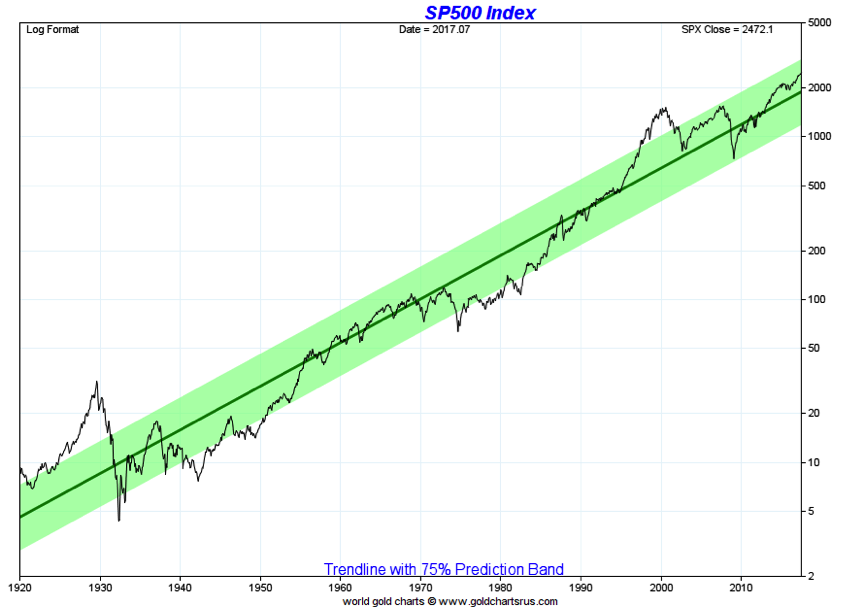

Below, courtesy of Nick Laird, is a long-term chart of the S&P 500 since 1920. Its inexorable rise reflects all the growth, prosperity and progress that the US has seen over the last 100 years.

Nick has drawn a green band around the price and, most of the time, the S&P trades within the range of that band.

Looked at from a distance, all one ever need to do, it seems, is buy America and walk away.

Not so easy.

If you bought the S&P 500 in 1929, it wasn't until the 1950s that you were in the black. If you bought in 1932, of course, you pretty much never had to look back.

If you bought the S&P 500 in the 1950s or 60s, you saw pretty much nothing but gain. But then the market went nowhere in the 70s.

The 80s and 90s look like pure bull market but say that to someone who was trading in 1987. Yet even that momentous crash looks like a blip in retrospect.

The 2000s, too, was another frustrating decade, but if you bought heavily in 2009, let's just say, you can buy the drinks.

I've been making the argument for a while now that this bull market in stocks is mature. It's more than eight years old now. That's unusually long. The end may not be nigh, but it is in sight and if that's the case, we should be looking towards so-called late-cycle assets.

I'm reading a number of other market commentators, far brighter than me, who have been making similar prognostications Jim Puplava over at Financial Sense, and Cam Hui at Humble Student of the Markets, for example.

There are also bears everywhere. These include newsletter nutcases who declare that the Dow is going back to 1,000 (equivalent to the S&P 500 at around 100 its current price is 2,475) to value investors making sensible, rational arguments the likes of Albert Edwards at Societe Generale and Mike Shedlock at MishTalk that valuations are extreme and that this bull market will not end well.

There is also the usual mix of sensible bulls and the nave and over-leveraged, who are convinced this market is headed much higher.

I think I understand most of the arguments and the one I find most persuasive is, as I've suggested, that we are late in the cycle, and that we go a bit higher before a nasty correction.

But before we get too comfortable in our bearishness let me just put another idea into your head.

What if we've just been through a repeat of the 1930s?

In simplistic terms, if the 2000s were a repeat of the 1930s and the 1970s, then shouldn't this decade be equivalent to the 1940s or 1980s, perhaps? In other words, we can expect another ten to 15 years of strong market before the next major downturn.

With everything that's going on politically, it's hard to believe such a thing is possible, but from a trend point of view it certainly is.

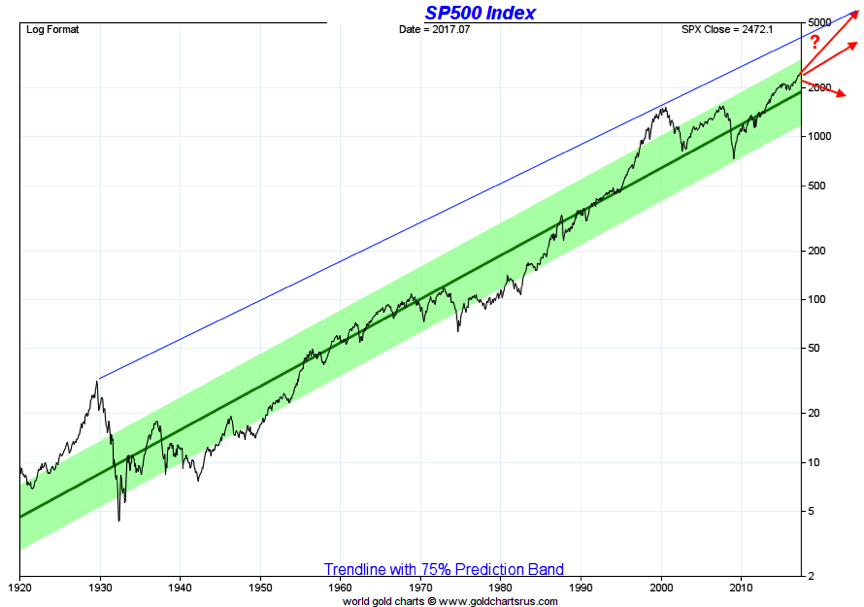

Let's consider once again that long-term chart of the S&P 500. Nick Laird has drawn a green prediction band around the price. For 75% of the time, the S&P has stayed within that band. There are periods when it has slid below and when it has slid above, but for the bulk of the time it has remained within.

You could expand that band only a fraction so that the price only escapes it at times of real extremity the 1929 peak, the 1932 crash low and so on.

If we are following a similar trajectory to the 1940s or the 1980s, then the current trajectory is destined to end around 2030. We might get some kind of blow-off top beyond that green band, as in 1929 and 2000, or a more sober version such as we saw in the late 1960s.

In any case case we'd be looking at a bull market peak perhaps even beyond the 5,000 mark.

The arrows I've drawn on the chart show three possibilities, all within that green band.

I'm not saying the S&P 500 is going to go to 5,000. I am, however, saying that it could quite easily go to 5,000 by 2030 and, if it did, then in historical terms, it would not be such an absurd aberration. So don't rule out the possibility.

By the way, before you get too bullish, it's also worth noting that if you buy this idea that we are in a similar scenario (stockmarket-price-wise) to the 1940s and the 1980s both 1947 and 1987 were horrible years for the stockmarket.

So maybe don't go in all guns blazing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.