How cash flows move markets

Investors fret over valuations and geopolitics, but there are bigger forces at work that weigh on prices. CrossBorder Capital’s Michael J Howell explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investors fret over valuations and geopolitics, but there are bigger forces at work that weigh on prices. CrossBorder Capital's Michael J Howell explains.

Central banks across the world have injected nearly $10trn into global asset markets via quantitative easing (QE) over the past eight years. The prices of shares, property and bonds have soared, amply demonstrating just how much liquidity matters to investors. In short, money moves markets. But it's not just about central banks. Savings flows, bank credit, company cash flows, and cross-border capital inflows (the vast pool of Chinese money in particular) all affect global liquidity too. Indeed, their contributions are often even bigger and faster-moving than those of central banks. It's these swings in global liquidity, not valuations or geopolitics or anything else, that ultimately drive asset markets.

Peaks in the global liquidity cycle typically precede asset-market peaks, while lows often indicate that banking problems and possibly recession lie ahead. It also seems clear that as global asset markets grow larger and more intertwined, they're becoming more vulnerable to disruption. Banking or credit crises now hit roughly every eight to ten years: 1966 (when a credit crunch in the US sent the S&P 500 down by more than 20%); 1974 (a global bear market with contributing factors ranging from the oil crisis to the end of the Bretton Woods currency regime); 1982 (the Latin American sovereign debt crisis); 1990 (the Japanese bubble); 1997/1998 (the Asian financial crisis); and, of course, the crisis of 2007/2008. (The tech bubble of 2000 broke the pattern somewhat, but still proves the rule it was pumped up by central-bank cash and loose monetary policy.)

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Is another crisis looming?

It's now more than eight years since the last financial crisis began. Meanwhile, central banks are signalling that it's time to taper or unwind QE, and to raise interest rates. Are we nearing another inflection point, one with far-reaching consequences? It seems possible. So it makes sense to monitor where money flows are going, and where they are drying up. By our calculations, the pool of global liquidity totals $115trn roughly 50% bigger than global GDP. China, with $30trn, and the US, at $28trn, dominate the People's Bank of China is now the largest central bank in the world by balance-sheet size (partly because China has kept its currency weak in order to build up US dollar reserves). Growing global liquidity and credit expansion in particular results in vulnerabilities building up within the financial system, in the form of overinflated asset prices, risky borrowing and lending, and maturity or funding mismatches (which brought UK bank Northern Rock down, for example).

Cross-border flows are fast-moving, footloose pools of capital, often seeking to dodge on-shore regulations, and always seeking out the highest short-term returns. As a result, it's these flows rather than central-bank QE that frequently provide the marginal source of financing in the run-up to crises. Over the last three years alone, some $3trn has switched back and forth between the US, China and the eurozone. This roller-coaster heightens currency-market volatility, which then often spreads into share prices. Our Global Liquidity Indices (GLIs) are monthly measures of money flows. The goal is to provide an advance warning of "financial stress", and its impact on markets and the "real" economy, by tracking data on credit spreads (the gap between the yields on various types of debt), available funding, cross-border capital flows, and central-bank interventions across 80 countries.

Predicting where markets are going

The GLIs use flow-of-funds statistics we focus on the sources and uses of funds, rather than on the economic spending categories used in traditional economics. The latter approach isn't wrong, just less insightful. We extract two types of data: information on flows of new liquidity; and data on the investors' risk appetite, as implied by their asset allocation (ie, are they chasing risky assets or fleeing for safe havens?). We also drill into the data to emphasise, if necessary, critical details such as the size of cross-border flows or the impact of central-bank QE.

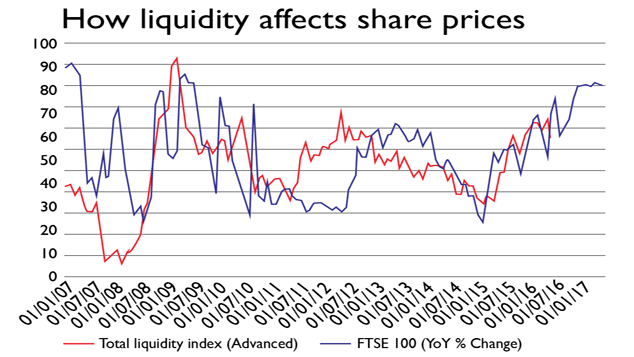

We've found that the GLIs typically lead markets and economies by six to 12 months. Take last year's European Union (EU) referendum. Before the vote, several respectable sources warned of immediate and damaging consequences for the UK economy. But regardless of your view on the rights and wrongs of Brexit, our indicators told us that the outcome wouldn't harm the UK in the short term. Liquidity was high, and foreign reserves at the Bank of England were at record levels. The chart below left shows our GLI indicator for the UK (in blue) advanced 12 months against the year-on-year change in the FTSE 100 index (in red). As you can see, the two measures track fairly closely when we see rising liquidity, it tends to be reflected in a rising stockmarket within a year, while falling liquidity is a bad sign. As the chart shows, UK liquidity remains high we don't expect a crash anytime soon.

Other examples include the final quarter of 2015, when emerging-market equities were suffering along with commodity prices. Yet liquidity indicators suggested the availability of funds was rising. Since then emerging markets have risen by roughly 30% (as measured by the MSCI Emerging Markets index) and they're still climbing. Similarly, we warned at the end of last quarter that the US dollar was set to fall by 5%-10%, which has since happened.

Why the US looks vulnerable

What do our indicators suggest now? The biggest topic on the market's mind is the unwinding of QE particularly in the US and what that will mean for stocks and bonds. You might expect the end of QE to drive the yield on US government bonds (Treasuries) higher (and prices lower), as demand from the central bank, the Fed, falls. Yet the evidence of the last ten years shows that QE did not suppress yields it drove them higher. While the Fed was printing money to buy bonds, other investors were selling. After all, why own a "safe" US Treasury if you believe the Fed is acting as a backstop for the whole financial system? So the end of QE should in fact push Treasury yields lower, all else being equal.

But all else is not equal there's an even bigger factor offsetting this move. In all, we reckon central banks will remove roughly $1trn to $2trn from markets in the next three to five years. However, since 2011, roughly $3.5trn has fled China and the eurozone (partly as a spillover from European Central Bank QE) and gone to the US. Much of that money went into Treasuries, pushing yields down. But now, with Europe looking more attractive to investors, and China cracking down on capital flight, the money is starting to return home.

So on the one side, you've got the Fed tightening monetary policy by ending QE, which should push Treasury yields lower (and the dollar higher). But on the other, cross-border capital is flowing out of Treasuries and back to where it came from. And this latter force is much bigger than the former. So we expect US Treasury yields to rise we see the ten-year Treasury hitting 3.5% in the medium term and the US dollar to continue lower from here, particularly against the euro. As for equities, the US looks expensive and vulnerable to falling liquidity, but the liquidity backdrop for both the eurozone and the UK remains particularly favourable.

Michael J Howell is founder and CEO of CrossBorder Capital (@crossbordercap).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Michael J Howell is founder and CEO of CrossBorder Capital (@crossbordercap).

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how