Gold investors are going to need all their patience this year

For many years, gold performed outstandingly, rising up to 20% a year. But the tide turned. Now the price is meandering frustratingly. Dominic Frisby asks where it will go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today I amfinally writing a long overdue articleon gold.The metal that was once so beloved now inspires apathy in all who consider it. As my Italian brothers would say, "Nobody gives a fig".

What happened?

The good old days

"Gold is undervalued", you began the decade by saying. "Silver too even more so. Gordon Brown is a fool to have sold at these prices. There is only one way this market can go and that's higher."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

"Gold? Silver?" people would say with a slightly confused expression on their faces. "Why would I buy them? Why would anybody buy them? And how do you buy them? Do I just go and buy ingots or something?"

"Yes", you would say. And they thought you were even more barking.

But then the gold price rose. Silver too. By 15% one year, by 20% the next. You might have been potty, but, fair play, you'd called the market. Anyway, it's moved now. Too late.

"No, you don't understand", you would say by about 2005. "It's not too late. There are new ways to buy now. Exchange-traded funds, online bullion dealers, you name it. You really should buy some. You want to have some of your wealth outside of the system."

You may as well have been howling at the moon. Yet every year the price would rise by another 10%, 15% or 20%. Sometimes by even more. When they called you batty, you just shrugged and pointed to the ticker. There's no arguing with the ticker.

House prices got more and more inflated. Stock prices did too. Fine art and other collectibles reached stupidity pitch.

"The monetary system's broken", you warned. "There's too much debt. There's too much leverage. It's going to go tits up."

"He's really lost it this time," they would think. "Apparently there's going to be some kind of meltdown. LOL."

And sure enough, 2008 came along.By now, you might not have achieved guru status, but you certainly weren't the crackpot people once thought you were. People quietly came to you for advice out of the earshot of their friends "so how do I go about buying gold?"

And you would tell them. And the bull market went on. Every year another gain. Every year, the S&P 500 was outperformed by gold. Every year a chart showing gold v. other assets since 2000 gold always the winner.

It was all happening just like you said it would.

The turning tides of fashion leave gold stranded

With each decline in price, the arguments of the Noughties have started to look more and more far-fetched. Many have deserted the cause altogether. With each 10% fall, the stockmarket has risen by 10%. When you factor in the opportunity cost, the loss to the gold bug has been enormous.

Then some tech whizz called Satoshi Nakamoto invents something called bitcoin and deliberately models it on gold. It does everything gold was supposed to do. It rises by thousands of percent. A cult of devotees proclaims it spells the end of government currency. People actually use it to buy and sell stuff. The young embrace it and thus the future embraces it. $10,000 bitcoin is coming, they say.

"We used to say the same thing about gold", mutter a few wise, grey-haired men. They shake their heads. They know they were right. But somehow the once and future money was not the right vehicle.

Like an improbable Rocky movie, in 2016 gold somehow staged a comeback. The price rallied. The mining companies rallied by even more. The Brexit vote happened. Sterling plummeted. UK gold owners saw the value of their holding rise by close to 50% at one stage.

"They're losing control again", said the gold bugs, no longer muttering, but gaining in confidence.

But then it all petered out again. By the end of 2016, the gains were OK, but negligible in the context of what had gone earlier. Gold continues to go nowhere in 2017, up for a bit, then down for a bit. The price as I write is $1,245 an ounce same as it was in 2010.

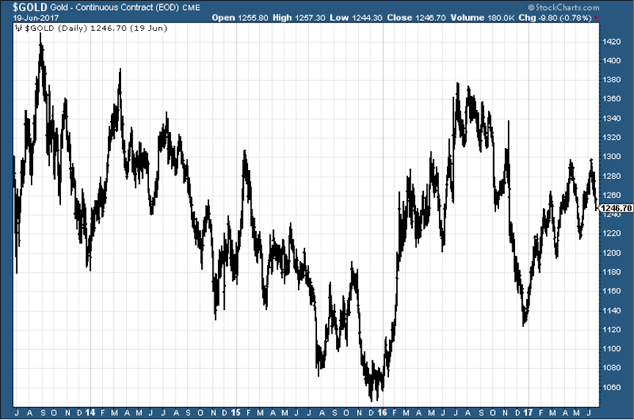

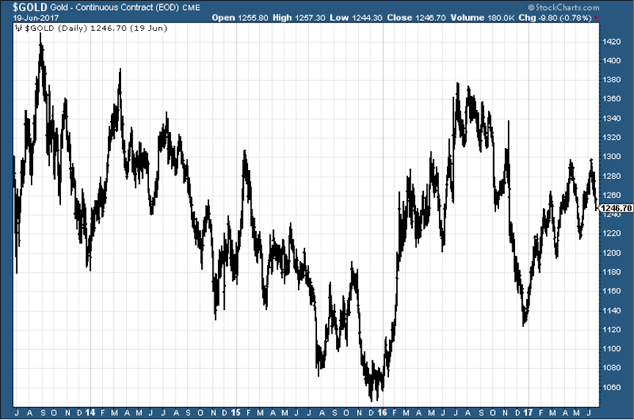

Once upon a time gold charts began in the bottom left and finished on the top right. Now they start in the middle and end in the middle. Below we see the last four years of frustrating meandering. False dawns a plenty but not crashing either. Just a boring nowhere investment, while money is made elsewhere.

In Frisby Towers we survey the lay of the land and we sigh. We know government finances do not pass basic safety standards. We know there's too much debt. We know asset prices are overvalued.

We know that quantitative easing (QE) and zero-interest-rate policy (ZIRP) have breathed life into that which should long be six-feet under. We know rates have to go up eventually. We know that when they do, all hell breaks loose. We know that gold's time will come again, even more so than before.

The problem is we don't think that time is nigh. We hope we're wrong. But that's what we think. We just can't see a major imminent move, nor a change in sentiment.

We note that each low gold makes is higher than the last $1,120, then $1,180, then $1,200, then $1,220. Some might call that an uptrend.

But we also note that this move is unconfirmed by the miners, which have yet again been bleeding investors' capital, as is their wont. For a proper bull market to happen, the two must dance together.

Our outlook is for more frustrating range-trading. As it stands, $1,050 looks like it's the low. Maybe it needs to be re-tested again just as $250 was in 1999 and 2001. Maybe not. The next line of support must be the $1,130-$1,140 zone.

On the upside, $1,300 is a barrier, $1,380 another. There's a long way to go even before we get the almost insurmountably large hurdle that is $1,500.

I'm sorry to say it, but we could be range-trading for a few years yet. But this current state of play won't last forever. Nothing lasts forever.

I take that back.One thing does last forever gold.Gold is, by its very nature, eternal. The current mood of investors is not. There are worse things to own for the long term.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how