Macron’s victory has opened a can of euro worms

Emmanuel Macron’s victory in the French election could make things a lot more interesting than markets might think, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's been another long week in politics, but the market hasn't really paid that much attention.

First of all, Emmanuel Macron comfortably won the French election. The market was resoundingly unsurprised by this. Investors had priced in his victory to the extent that both the euro and eurozone markets had a pretty mediocre week.

It helped that ECB boss Mario Draghi made it pretty clear that while he's a bit more upbeat on the eurozone economy, he has no intention of tapering' the money printing if he can help it at all.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So that's it. The eurozone is saved again and nasty Marine Le Pen will have to go away and lick her wounds with all the other horrid populists.

Well maybe. It's not quite that simple. Having had a bit more time to digest it and look at the commentary, Macron is going to be interesting.

You see, he's one of the rare pro-eurozone politicians who's actually quite honest about the euro and the eurozone. He is calling openly for a much closer Europe. He reckons that Europe needs a common budget, a common banking system effectively, a full-blown United States of Europe.

And let's be clear here he's right. If you want to share a currency, then it makes sense to share an over-arching political and taxation structure too. A federal model, basically. It's a model we seem to be approaching with the UK, only from the opposite direction.

Obviously, the European Union (EU) as an entity loves him. Trouble is, the other great power in Europe Germany isn't so keen. The Germans don't want to end up being sugar daddies for the rest of Europe (or at least, that's how they see it). The post-victory headline from Bild Germany's rough equivalent of The Sun said it all: "How expensive will Macron be for us?"

So far, German chancellor Angela Merkel has been able to use the excuse of France being a basket case to avoid grappling with questions of Franco-German led further integration.

Every time a French leader brings it up, she can say: "Away and fix your own economy first before you start criticizing German economic policies." Trouble is, if he can get the support and it looks as though he might Macron may just do that. And that'll put Angela on the spot in front of a far more eurosceptic electorate.

What makes it even more interesting is that Merkel's political opponent German Social Democrat leader Martin Schulz, a former EU Parliament president is backing Macron. German voters admittedly seem unlikely to back Schulz.

But it's somewhat ironic that just as the biggest immediate continental threat to the eurozone and the EU has apparently been overcome, the old divisions between the French and German visions for Europe seem likely to erupt back into public view. That's when the fundamental contradictions in the eurozone will need to be tackled, one way or another.

To be clear, I have no political drum to bang here. I don't want the UK to be part of further European integration, or a United States of Europe, but it's not going to be. And if the people are behind the idea, it makes a lot of sense for Europe to seriously consider further integration if it wants to stick with the euro.

But convincing those pesky voters is the sticky issue, as always.

Trump has a funny way of drawing attention from a story

Elsewhere, Donald Trump fired the head of the FBI, just as he was asking lots of tricky questions about Trump's Russia connections.

On the one hand, I can see why Trump might want to fire James Comey, given his somewhat clumsy handling of the pre-election email scandals. On the other, the timing looks bad, to put it lightly. And if Trump wanted to kill this Russia story well, he must have know this wasn't the way to do it.

Oh, and it was eye-catching and grimly amusing to see Ray Dalio the founder of hedge fund Bridgewater, which by all accounts, has one of the most challenging workplace cultures on the planet tweeting along the lines that Comey's sacking could have been handled with more tact. (Dalio had worked with Comey in the past).

As Dealbreaker put it, this is coming from "the guy who built the most potent asset management firm in the history of mankind by openly subjecting his minions to constant surveillance and making it socially acceptable to tell your co-workers that their ideas are dumb."

Labour's leak

Finally, the Labour manifesto leaked. It wasn't that surprising.

Nationalise stuff (railways, the Royal Mail); tax the rich (anyone earning over £80,000 just a bit more than an MP earns, conveniently enough); and spend more.

You'd be disappointed to read anything else from Jeremy Corbyn. It's the sort of thing that will appeal to Corbyn's backers, and it may well have wider appeal to those sitting on the fence. A lot of people think that renationalizing the railways is a good idea, for example. I suspect that it isn't, but given the unsatisfactory state of trains in the UK in general, I'm not surprised people think a different system might be worth a shot.

But I still very much doubt that it's an election winner. The real intrigue for me is what the Conservatives will come out with next week.

Firstly, they're the ones who are most likely to be in a position to put their policies into action. But secondly, they're throwing out plenty of odd ideas of their own.

Fox hunting. Put bluntly, who cares? Sorry, I know it fires some people up but I don't see why we should waste any more time on the topic in parliament. A cap on energy prices (also proposed by Labour). Ed Miliband rightly got slated for this idea, and yet the Tories have decided it's a smart campaign promise.

Many of the ideas have their hearts in the right place dealing with ridiculous executive pay packages and at least reconsidering our approach to nurturing future big British companies. But there's a big difference between identifying problems (easy) and implementing policies that will actually solve them (hard).

It'll be fascinating to see whether Theresa May can deliver. So far she's done a good job of keeping things calm at a potentially very politically unstable period.

But at the same time, she hasn't exactly had much of a challenge from the opposition. So it's hard to judge her effectiveness. Assuming she wins the election and wins it as resoundingly as expected, then she'll be under pressure to deliver. Let's hope she doesn't disappoint.

The six charts that matter

So what's been happening in the markets? Below are the six charts we like to follow every week, to give us a sense of what investors are thinking.

Right now, there's a mild flavour of risk on' (ie people don't want to be in safe' assets), but it's mixed with some skepticism about reflation and China (commodities are struggling).

My gut feeling is that it'll take a sense that fears over China are overdone to make that go away. But that might well happen China is so opaque to most investors that sentiment can turn on a sixpence on the basis of very little news.

Gold

Gold had another tough week, although it appears to be stabilizing for the moment. It ended last week at around $1,228, and fell below $1,220 at one point this week, before clawing its way higher towards the end of the week.

Copper

Copper had a similar week to gold. It ended last week at $2.51, and after continuing to struggle this week, has ended where it started.

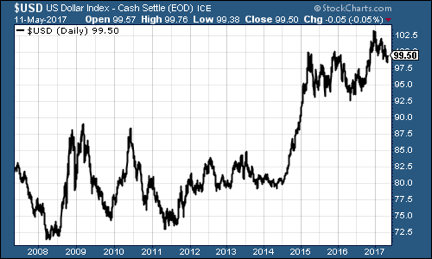

US dollar

The US dollar has picked up this week it's still below the 100 mark, but with the ECB showing no signs of budging on its monetary policies, and the market having already enjoyed a Macron victory lap before he'd even won the second round, euro weakness helped to bolster the US currency.

US Treasury bonds

Meanwhile, yields on ten-year US Treasury bonds continued to pick up as investor fears over another deflationary spasm relax a little. Investors are also starting to believe that the Federal Reserve will be able to continue raising interest rates this year, what with US employment figures remaining strong.

Bitcoin

Source: bitcoincharts.com

Bitcoin had another extraordinary week. My colleague Charlie Morris recently put a $1,700 target on bitcoin. It's already hit it and gone beyond.

US jobless claim

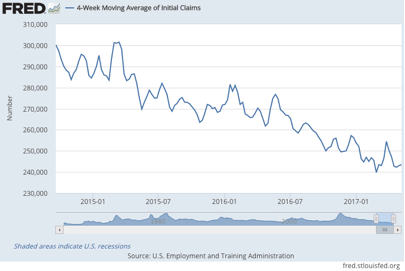

Finally, the US jobless claims data. To recap, David Rosenberg of Gluskin Sheff sees this is a valuable leading indicator. When the figure hits a "cyclical trough" (as measured by the four week moving average), a stock market peak is not far behind, and a recession follows about a year later.

As the short-term chart below shows, it looked as though jobless claims troughed at just under 240,000 at the end of February. So we'd be looking at the market (the S&P 500) peaking around the end of May.

Yet, the latest weekly data showed that claims fell to 236,000. Following a 238,000 reading last week, it looks as though the four-week moving average may well hit a fresh trough in the weeks to come.

This is one to watch. A further trough in the jobless claims data could suggest that we have a wage inflation spike to come before anything spoils the party.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how