Polish stocks are poised to soar

Fears over the impact of Poland’s current government are overdone – and that spells opportunity for patient investors to buy some good firms cheaply, says Frederic Guirinec

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Fears over the impact of Poland's current government are overdone and that spells opportunity for patient investors to buy some good firms cheaply, says Frederic Guirinec.

Winston Churchill famously said that "the soul of Poland is indestructible" that the country is "like a rock which may for a spell be submerged by a tidal wave but which remains a rock". It is an apt metaphor for a state that has three times disappeared from the map, only to reappear again when the tide of history turns.

In 1795, the then Polish-Lithuanian Commonwealth was divided up between the empires of Russia, Austria and Prussia. Desperate for a return of statehood, the people of Poland welcomed the arrival of one of the early architects of a unified Europe, Napoleon Bonaparte, who created the small, semi-autonomous Duchy of Warsaw. Napoleon's vision of Europe proved even more controversial than those of today's eurocrats and the Duchy was short-lived, but Poland eventually re-emerged once again in the form of the Second Polish Republic in 1918. It was invaded by Nazi Germany in 1939, then had to live through communism from 1945 to 1989 in the form of the Polish People's Republic, before being reborn once again as the Third Polish Republic. Poland's history is an astonishing tale of resilience and strong identity. The national bird is a white eagle (see cover) but a phoenix would be an equally appropriate choice.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Today, Poland is the largest of the former communist economies that make up central and eastern Europe (CEE): it accounts for 35% of regional GDP. Since joining the European Union in 2004, it has benefited extensively from EU membership, both through access to the European single market and through EU subsidies. GDP has doubled to $548bn since 2004, making it the seventh-largest economy in Europe. Annual growth remains well above the eurozone's current growth of 1.5%, even though it has slowed down from 3.5% in 2015 to 2.7% last quarter. Nonetheless, the Polish economy is still only on a par with Belgium, a country with only one-third the population, so there is still plenty of catching up to do (GDP per capita is around $14,000, compared with $41,000 for Germany). Productivity gains and sustained growth should still be relatively easy to achieve. Even in terms of purchasing power parity (PPP), which allows for the difference in the costs of goods and services between countries, GDP per capita is just $27,000, reflecting the weakness of the zloty.

Of course, that currency weakness is an asset for exporters. The growth of the Polish economy and Polish companies has been propelled by exports, which have tripled in nominal terms from €60bn in 2004 to €180bn at the end of 2016. Poland's position in central Europe, which sets the country at many crossroads between Russia and Germany, between the Carpathians and the Baltic has been the source of historical tragedies, but is now an economic benefit. The port of Gdansk, once a member of the Hanseatic League, now offers convenient maritime trading routes with northern Europe. Hence Poland is becoming a manufacturing hub of Europe, helped by its skilled, cheap workforce: the minimum monthly wage stands at 2,000 zloty (£400), while the average salary is 4,000 zloty.

An industrial powerhouse

Poland's main industries include food and beverage processing, shipbuilding, machinery, iron and steel products, chemicals, glass and textiles. However, Poland is also a large importer of goods to serve a large and growing middle class of eager consumers. As disposable incomes rose, Polonez and Trabant cars left Polish roads, initially for beat-up, secondhand German cars and more recently for new, often-leased Skodas. Major European retailers such as France's E.Leclerc, Carrefour and Leroy Merlin chains have expanded throughout the country. The growing middle class is also driving growth in sectors such as healthcare, retail, financial services and telecommunications.

Lest this sound like Poland is a land of milk and honey, there are also a number of negatives. These explain why many fund managers have lately been cutting exposure to the country, even though the Polish stockmarket offers relatively low valuations and clear long-term potential at a time when this combination is increasingly hard to find. Poland's first weakness is, of course, its dependence on Europe and in particular on Germany, with which it does 27% of its trade, for export demand. Risks for Europe remain high, especially political risks, with the French and German elections coming and Brexit under way, and that means risks for Poland.

Poland must also still work harder to improve its competitiveness. The World Economic Forum ranks it only 41st in terms of competitiveness, behind the UK (10th) and France (22nd), mainly due to a lack of innovation. This problem is slowly but noticeably changing: research and development investment relative to GDP doubled over the last three years to 0.9% but that's still well below the 2% average for the rest of Europe. Agriculture also remains a drag on growth. Traditional farming methods, as seen in the classic 1967 comedy Sami Swoi about quarrelling rural families, are long gone, but old Ursus and Zetor tractors are still to be seen ploughing Polish land at their own slow pace, barely disturbing storks, wild bison and wolves in the fields. Agriculture employs 12.7% of the workforce but contributes only 3.8% to GDP, reflecting relatively low productivity. More than 80% of farms consist of less than 10 ha (25 acres) and are nowhere near the scale needed for a modern agricultural economy.

While farms attract low-skilled, low-wage workers from Ukraine, many Poles have emigrated in search of higher pay creating its own problem by shrinking the pool of skilled workers. Indeed, massive emigration has long been a drag for Poland and has led to a sizeable Polish diaspora, dubbed "Polonia". Persuading some of these recent emigrants to return home to work or set up their own businesses would be helpful. However, "biurokracja", or red tape, remains another unfortunate characteristic of Poland. Creating a new business as an entrepreneur takes a long time and understanding the tax system is as difficult as mastering the famously tricky Polish grammar.

What to make of the government?

These are long-standing problems, but the development that has made headlines more recently and has concerned many foreign investors is the new conservative government of the Law and Justice Party. Policymaking under this government has been erratic. Measures to reduce the state pension age and to pay families for having more children are highly controversial and suggest a reckless approach to the public finances. Curbs on the media, efforts to neutralise the constitutional court and the appointment of those loyal to the party to important positions in the public sector have raised concerns about the strength of Poland's democracy. Hence ratings agency Standard & Poor's last year downgraded Poland's credit rating, regional fund managers began to reduce their exposure to Poland and the European Commission has been threatening Poland with sanctions.

However, it is important to note that the electoral success of the Law and Justice Party comes both from conservative voters and those who feel they haven't benefited enough from Poland's growth. Core support for Law and Justice's policies is narrower than this and while the opposition parties remain divided, the public has shown a willingness to protest effectively if the government oversteps its mandate earlier this year, street protests forced it to abandon plans to ban abortion.

So fears over the long-term impact of the current government are overdone. In the meantime, this has created a small window for opportunistic investors to invest in a country with cheap, skilled labour, improving infrastructure and strong potential. Indeed, the WIG20 index of major firms has rallied 25% since the end of November. Despite the recent political turmoil, listed companies in Poland are not exceptionally cheap, although the weak zloty makes the market more appealing for foreign investors.

The WIG20 trades on a forecast price/earnings (p/e) ratio of 12.3, which compares with 14.8 for the FTSE 100 and 14 for Germany's DAX. The cyclically adjusted p/e (Cape) ratio, which uses average inflation-adjusted earnings over the past ten years in an attempt to even out the impact of the economic cycle, stands at ten, compared with 15 for the UK or 19 for Germany. However, the Polish stockmarket indices are skewed by their composition. Major components include financials (45%), energy (13%) and utilities (9%), which are sectors that tend to trade at low valuations and valuation discrepancies between sectors are very large. For example, CCC and LPP, two major retailers, had extremely strong results in 2016. But on an enterprise value to earnings before interest, tax, depreciation and amortisation (EV/Ebitda) multiple of 22, these shares look fully priced. Conversely, consider Orlen, the largest oil distributor in central Europe. This firm focuses on refining and retailing, and hence it benefits from low oil prices. Its current valuation looks relatively attractive, with an appealing dividend yield. Indeed, both Orlen and Lotos, an oil producer and refiner, are valued favourably in comparison with most oil companies in other markets, on an EV/Ebitda ratio of four.

Due both to the global environment and the unpredictable monetary and fiscal policies of the government, I recommend avoiding the banks, which dominate the Polish market and the Polish investments of most funds. Investors should consider which sectors offer the best opportunities for growth. For example, since joining the EU, Poland has attracted significant foreign direct investment. One notable success has been the car industry, with large investments from Volkswagen, Mercedes and GM (this plant is now owned by France's PSA, following GM's decision to exit Europe). The car industry represents 11% of Poland's exports with an annual production of 575,000 cars, nearly a third of French production. Local automotive suppliers such as Boryszew can profit from this.

A more surprising opportunity may be for Poland's services sector to become a beneficiary of Brexit. Banks have already outsourced part of their back-office operations to Poland. Credit Suisse employs 4,000 employees in Wroclaw, UBS 2,500 in Krakow and Wroclow, Citi 3,500 in Warsaw and Lodz. Other multinationals such as IBM, Capgemini, HP and Shell are also large employers and some could choose to move more of their operations from the UK to Poland. I look at one company that could benefit in the box below.

Investing in Poland will not be a quiet, low-risk option, but the country has compelling long-term potential and some stocks present interesting value for a patient investor with a long-term horizon. With the market rallying, it's unclear how long they will remain cheap. As the Polish proverb goes, okazja na nikogo nie czekaj "wait too long and the opportunity is sure to vanish".

Four promising plays on Poland

Many fund managers include Poland as part of their emerging Europe strategy. In practice, this means their portfolio is barely exposed to Poland or other economies such as the Czech Republic, and is mainly invested in Russia. There are two exchange-traded funds (ETFs), the iShares MSCI Poland Capped ETF (LSE: IPOL) and the VanEck Vectors Poland ETF (NYSE: PLND), but as these track the Polish stockmarket indices, they are overweight in financials (45%) and energy (20%). Hence investors will have most of their money in sectors that have limited prospects or are in long-term decline, such as coal miners (coal, including highly polluting lignite coal, still produces 85% of electricity in Poland).

Consequently, to apply the themes outlined above, investors will need to look at individual stocks. Investing in Poland is a bit of a challenge for the individual investor, but Saxo Capital Markets offers access to the Warsaw exchange. Some Polish companies are also listed in the UK or in Germany, although liquidity in these foreign listings is often limited. One example of a London-listed firm is Stock Spirits (LSE: STCK), a drinks company. It generates 50% of its revenue in Poland and 25% in the Czech Republic. It has faced a tough competitive environment, and has had to restructure its operations and change some of the management. Despite flat revenues, it has managed to improve its Ebitda margin to 20% and generate strong cash flows. It trades on a p/e ratio of 15 and has a dividend yield of 3.5%.

Ciech (Warsaw: CIE) is the leader in the Polish chemical industry generating PLN3.36bn of annual revenues. It produces ash soda, salt, resin and silicates used by various industries. Despite price pressure in the sector, it has focused on profitability, increasing Ebitda margin to 15% while maintaining revenues at PLN3.2bn. A weak zloty has also helped exports. Solvency ratios have improved. Its valuation, on a p/e ratio of 6.8, looks attractive even given the cyclicality of the industry. Ciech is dual-listed in Frankfurt since August, although liquidity there is weak compared with the Warsaw stock exchange.

Grupa Azoty (Warsaw: ATT), a fertiliser producer, is well positioned to benefit from modernisation of Polish agriculture. Fertiliser prices have bottomed out and lower gas prices have also helped it to maintain its 15% Ebitda margin. Major shareholders include the European Bank for Reconstruction and Development, the Polish government and Russian fertiliser producer Acron. It trades on a p/e of 17.5.

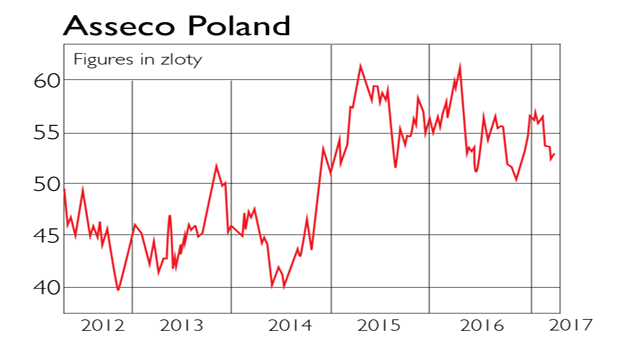

Asseco Poland (Warsaw: ACP) is Poland's largest technology firm and provides computer software to the banking and finance industry. It generated a modest Ebitda margin of 13.5% off the back of PLN7.9 revenues in 2016, but with banks outsourcing their back-office operations to Poland, it's well paced to grow. It trades on a p/e ratio of 15 and has a 5.5% dividend yield.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Frederic is an investment analyst. He started his career at JP Morgan in Paris. He has more than ten years of experience investing in private equity and also worked with the 3i debt management team investing in private debt. He is an ACCA member and a CFA charterholder. He graduated from Edhec Business School.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Europe’s new single stock market is no panacea

Europe’s new single stock market is no panaceaOpinion It is hard to see how a single European stock exchange will fix anything. Friedrich Merz is trying his hand at a failed strategy, says Matthew Lynn

-

The stockmarket has overlooked British small caps with huge potential

The stockmarket has overlooked British small caps with huge potentialAdrian Gosden, Investment Director and Manager of the UK Equity Income Fund, at GAM Investments

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

European stocks are ignored and cheap – but possibly not for long

European stocks are ignored and cheap – but possibly not for longNews European stocks are out of favour, with some analysts predicting their worst year since 2008. But the worst of the sell-off could be over, and European value shares in particular look appealing.

-

Macron has failed France – but there is still plenty to invest in

Macron has failed France – but there is still plenty to invest inCover Story Emmanuel Macron won a convincing victory in France's presidential election, but he has no clear vision for halting the country’s decline. Frédéric Guirinec looks at the state of France and picks 20 French stocks to buy.

-

The best markets in Asia and how to invest in them

The best markets in Asia and how to invest in themCover Story China and Indonesia should do well over the next year, while India and Vietnam have exceptional long-term prospects. From tech giants to banks, there are plenty of cheap stocks, says Rupert Foster

-

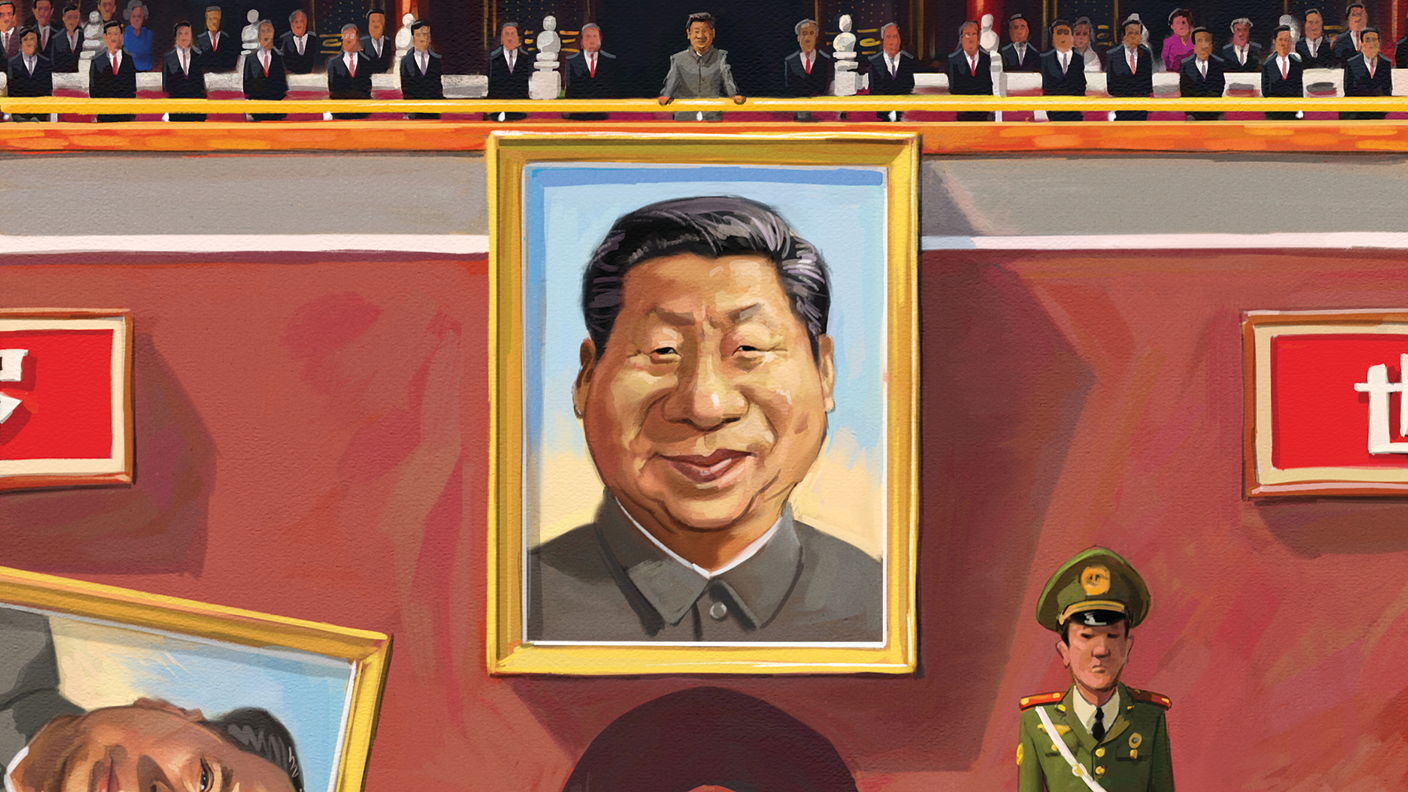

The three key risks for investors in China, and how to tackle them

The three key risks for investors in China, and how to tackle themCover Story Xi Jinping’s vision for the future of China is very different to the past. Stricter social control and the slow struggle to tackle problems in the economy may not be good news for markets, says Cris Sholto Heaton.

-

Has Italy’s economy turned the corner?

Has Italy’s economy turned the corner?News Italy’s FTSE MIB stockmarket index has returned 23% so far this year, more than double the FTSE 100’s performance over the same period.