Where to find the world’s cheapest stocks

With investors in US stocks facing some of the worst returns in history, where should they turn for value?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Starting valuations determine your long-term returns. Investors in US stocks "currently face some of the worst returns in history", says Jesse Felder on TheFelderReport.com. The cyclically adjusted price-earnings ratio of the S&P 500 is now 29, the third-highest reading after the bubbles of 2000 and 1929.

The average since the 1880s has been 17. There are plenty of other signs of froth on Wall Street, as MoneyWeek contributor Time Price notes in his Price Value Partners report. A valuation of $28bn for Snapchat, a profitless web business, recalls the dotcom era.

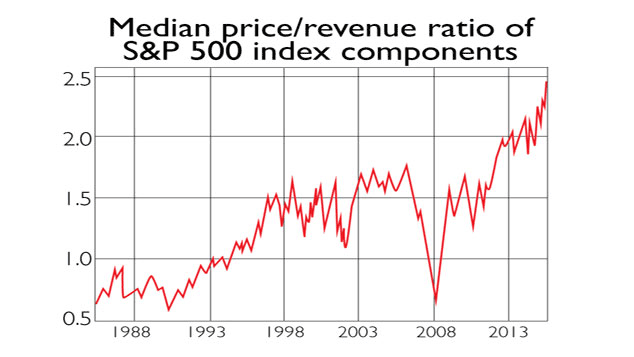

Broader indicators also suggest the US is absurdly overpriced. John Hussman on HussmanFunds.com notes that the median price/sales ratio in the S&P 500 has shot up to a record 2.5. This is "the most broadly overvalued moment in market history". In the dotcom era, a few large-caps skewed the picture. Meanwhile, the US ratio of stockmarket capitalisation to national income is around 1.3. It has only been higher for a few months during the dotcom mania.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Europe is certainly enticing compared with America, though it is not at bargain-basement levels compared with its own history. The wider UK, Spanish and French markets are on price-earnings (p/e) ratios of around 21, while Germany's is only slightly lower at 18.7, according to figures from Capital Economics. Europe's book value is far below Wall Street's. Japan is the only market whose p/e, 18.2, is currently below its ten-year average. What's more, as we noted last week, 40% of its equities are trading below book value. It is the only major market left that can be considered cheap.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how