How to invest your kids’ pocket money

Dominic Frisby picks the best place to lock away some cash for his children’s future.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Today we attempt to answer a question which, no doubt, has been burning away at your insides for many a year.

How to invest your children's pocket money?

How to cut your unpaid pocket money bills

At some stage when they were younger, I hit upon the not particularly original idea of giving them a pound per week pocket money for each year they have spent on this good earth. So when they were six, they would get £6; when they were seven, £7, and so on.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The system was fine in theory, except it broke down in practice. Either I would forget to give them their pocket money or they, worryingly, would forget to ask for it.

After several months of non-payment, my daughter, who is the biggest spender of the two, would occasionally realise that her contract had not been honoured and demand back-payments of moneys owed. Sometimes several months had gone by. In fact, in one case over a year had passed.

Such is the power of compounding, I would find myself feeling the considerable pain and injustice of owing three-figure sums. I would then sit them down at the negotiating table and attempt to come to some kind of compromise. I know at one stage that pound became 50p.

Things got worse when my son, seeing the pay-offs his sister had negotiated, would demand similar bungs. In fact, he wanted more, given his two years' superiority.

Finally, I hit upon the novel idea of opening a bank account for each of them and paying their pocket money by standing order.

But I did something rather sneaky. I opened two accounts a current account and a savings account. 50p per week per year on this earth went into each.

My son, of whom Einstein, with his love of compounding, would be proud, has never touched either account. The letter containing his hole-in-the-wall card was never opened, nor were any of his statements. The envelopes were left in a pile gathering dust on one of my many shelves.

He has no need of such base necessities of money. Like John the Baptist in the Wilderness, he'd rather live an uncomplicated existence and go without unless, that is, somebody else is offering.

My daughter, on the other hand has a love of knick-nacks. She has a love of clothes. She has a love of shoes. She has a love of shopping. There is no greater way of spending an afternoon than in some hellhole of a shopping centre. Westfield, Canary Wharf, the Glades, Oxford Street no matter. It's all Olympus to her.

In short, my daughter has "enjoyed" most of her dough the stuff in the current account, at least. My son hasn't spent a penny. What a pity we live in an age of low interest rates, otherwise he really would have something to show for his frugality. No matter, he has still built up a sizable pot. My daughter's isn't bad either, due to the unknown savings account.

So this weekend we decided that the time has come to invest the pot.

The question now is, where should we put the money.

Where should you invest for the long run?

Gold is a no-no. There's enough of that in the family already, and this is about growing their capital rather than preserving it.

Bitcoins and other digital assets are a possibility, but I'd rather they made those investments through choice and a working knowledge of the tech. Also, a bit like Patsy and daughter in Absolutely Fabulous, my kids are more conventional than I am.

Trading costs and the time demands of monitoring a portfolio mean that too much diversification is not really an option.

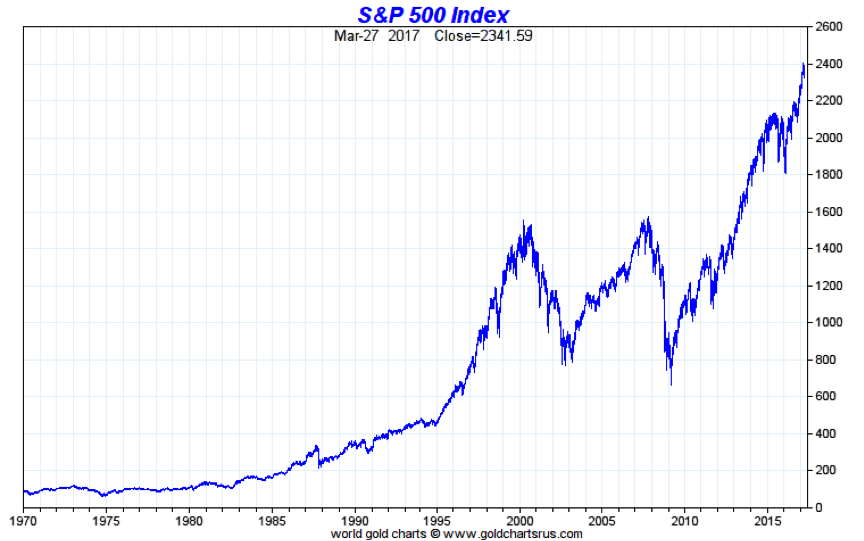

All in all, some kind of tracker is best. I wish we had the S&P 500 here in the UK because its record is excellent. Here you can see it since 1970.

The noughties were a duff decade but, apart from that, it's done very well. Most years see growth of some kind, which is what you want.

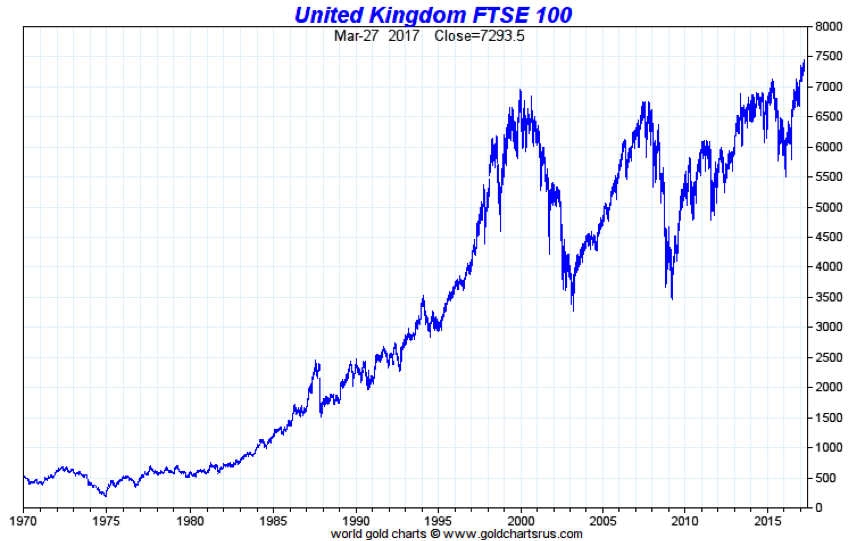

The FTSE 100 our own headline' index over the last half generation, hasn't done nearly as well.

We're only a few points higher than we were in 1999!

Of course, I'm being unfair on the FTSE 100. It's only made up of 100 companies. The S&P, made up of 500, is far more dynamic. The FTSE 100 is further limited by the fact that so many of its companies are multi-national natural resource based operations, which are a market unto themselves. (If that's your focus, you may as well just buy BHP).

We don't have the Russell 2000 either to track small caps. Instead we have Aim. And that is not a habit I want to get my children into. You can get UK small cap trackers based on other indices, but it's a bit of fiddle trying to stay on top of what's in them, and I'd rather stick with well-known indices that are easy to keep an eye on for now.

I don't want to get them into the complexities of currency fluctuations just yet either, and the pound is so absurdly cheap anyway, that for the UK investor, US stocks look rather dear to me.

So a FTSE 250 tracker looks like the best bet and that's the closest equivalent we have to the S&P 500. Here it is since 1999 rather better than the FTSE.

This is the decision we/I've come to. The tracker, a bit of BHP, plus they will also choose a company of their choice my daughter wants Apple, my son likes Google but to know the final decision they make, you'll have to subscribe to their newsletter.

Have I got this right? Or should I be pushing them into some speculative junior miner, do you think?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices